[ad_1]

What’s the Vendor Reconciliation Course of in Accounts Payable

Vendor reconciliation is a crucial observe in accounts payable to make sure the completeness and accuracy of vendor funds. Earlier than making funds to distributors, it”s important to test that the seller payments the corporate the right amount.

Accounts payable groups should reconcile funds recurrently to keep away from double-processing them. The method entails matching the quantities that your distributors invoice and evaluating them to the corporate’s accounts payable paperwork. By periodically performing vendor reconciliation, accounts payable groups make sure that the quantities recorded by each events match precisely.

We’ll stroll you thru the next on this weblog publish:

- Why is Vendor Reconciliation so necessary?

- Steps Involving Vendor Reconciliation

- Instance of Vendor Reconciliation

- Challenges with Vendor Reconciliation

- Automated Vendor Reconciliation workflow with Nanonets

Able to Expertise Seamless Reconciliation?

Say goodbye to guide errors, time-consuming duties, and monetary discrepancies. With Nanonets, you may automate your vendor reconciliation workflow, guaranteeing accuracy, effectivity, and peace of thoughts.

Why is Vendor Reconciliation so necessary?

Vendor Reconciliation is a crucial observe to make sure the corporate’s balances are appropriately owed to the distributors.

It serves fairly just a few essential functions like:

- Prevents Overpayments: Vendor reconciliation helps detect and deter overpayments to distributors by matching vendor statements with inside cost data, which may save the enterprise 1000’s of {dollars}. Distributors may delete paid entries, and the corporate may course of double funds with out common reconciliation.

- Ensures Accuracy: It verifies the steadiness of vendor accounts on the finish of the interval, guaranteeing that each one transactions are precisely recorded and accounted for.

- Detects Fraud: This course of can assist establish fraudulent actions, equivalent to intentional errors in invoices or statements, and stop monetary losses

- Maintains Good Vendor Relationships: Common vendor reconciliations assist preserve good vendor-client relationships by guaranteeing well timed and correct funds, decreasing the necessity for follow-ups and disputes.

- Offers Higher Budgeting: With correct and up-to-date vendor cost knowledge, companies can create extra knowledgeable budgets and make higher monetary choices.

Steps Involving Vendor Reconciliation

Accounts Payable groups should adhere to the necessary options of correct, common vendor reconciliation. By doing so, they will preserve good vendor relationships, detect fraud, and help audit trails.

They will accomplish that by following these steps:

Collect All of the Paperwork:

Be certain that all of the paperwork related to vendor funds have been gathered. This implies consolidating paperwork like vendor invoices, cost receipts, and financial institution statements.

Study Vendor Invoices:

It’s crucial to look at every vendor’s bill particulars and test for human-made errors. Every bill can comprise errors in vendor names, quantities, and bill numbers. Additionally, make sure that the invoices are recorded within the accounts payable system.

Match Line Objects:

Establish and get rid of line gadgets that match the seller assertion and accounts payable data. Be certain that the seller bill appropriately aligns with the Accounts Payable system for every merchandise. Errors in logging funds appropriately, duplicates, or lacking entries could result in incorrect reporting.

Reconcile Discrepancies:

Spot any variations, equivalent to lacking funds or invoices. Establish which gadgets are current on the seller statements however not within the accounts payable ledgers. These points sometimes occur attributable to timing variations, lacking entries, and so on. Doc the foundation reason behind errors in resolving discrepancies.

Examine Financial institution Statements:

Confirm that each one buy transactions are approved and processed appropriately. Be certain that quantities recorded by the Accounts Payable ledger match the financial institution assertion historical past for the quantities paid.

Allocation of Credit score:

Observe situations the place the provider extends a credit score settlement. On this case, the corporate wants to make sure all credit score notes are related to the seller assertion.

Examine Financial institution Statements:

Confirm that each one buy transactions are approved and processed appropriately. Be certain that quantities recorded by the Accounts Payable ledger match the financial institution assertion historical past for the quantities paid.

The opening steadiness of the Accounts Payable Ledger ought to present a view of the quantity the corporate has spent on accounts payable in line with inside accounting data, which ought to, in flip, coincide with the seller invoices. The crew wants to make sure that this quantity is the same as the financial institution assertion, underlining the precise quantity that was processed through the financial institution.

Due to the difficult three-way matching, disconnected knowledge sources, and consolidation of paperwork, vendor reconciliation proves to be a extremely guide, unscalable course of susceptible to human errors.

Instance of Vendor Reconciliation

An organization, ABC Manufacturing, purchases uncooked supplies from a vendor, XYZ Provides. On the finish of the month, the accounts payable crew of ABC Manufacturing undertakes the exercise of vendor reconciliation to make sure all transactions are precisely recorded and there aren’t any discrepancies.

Here is how the crew approaches the duty manually:

- Gathering All of the Paperwork: The crew gathers all of the associated paperwork, together with buy orders, supply receipts, vendor invoices from XYZ Provides, cost receipts, and financial institution statements.

- Study Vendor Invoices: The crew opinions every of the seller invoices and checks for accuracy throughout the data. They discover an bill of $5000 for a cargo of uncooked supplies.

- Match Line Objects: The crew compares every line merchandise with the accounts payable ledger or inside recording system after guaranteeing that the acquisition order, supply receipt, and bill align appropriately.

- Reconcile Discrepancies: Throughout this step, the crew identifies a discrepancy: an bill for $2,000 from XYZ Provides that’s not recorded of their accounts payable system. After investigating, they found that the bill was misplaced and wanted to be recorded.

- Examine Financial institution Statements: The crew verifies that each one funds made to XYZ Provides are appropriately mirrored within the financial institution statements. They make sure that the funds match the quantities recorded of their accounts payable ledger. As an illustration, they discover that the $5,000 cost is appropriately recorded within the financial institution assertion, matching the bill quantity.

- Confirm Opening Balances: They test the opening steadiness of the accounts payable ledger to make sure it aligns with the seller invoices and financial institution statements. They verify that the quantity the corporate has spent on uncooked supplies matches the full quantity recorded within the financial institution statements for funds to XYZ Provides.

Challenges with Vendor Reconciliation

Vendor Reconciliation could be a daunting process confronted by Accounts Payable groups as a result of following points:

Quantity of Transactions: The guide reconciliation course of is inefficient for companies which have a variety of distributors and invoices to cope with.

Knowledge Entry Errors: Coming into knowledge manually may very well be error-prone and trigger inaccurate reconciliation and monetary reporting.

Discrepancies in knowledge: With out the availability of correct documentation, accounts payable groups face a time-consuming process in figuring out and resolving discrepancies.

Totally different codecs of knowledge: When vendor paperwork are in several codecs, it is time to templatize them right into a given format for efficient reconciliation.

Duplicate Funds: With out common reconciliation actions, there’s at all times a danger related to processing funds twice. Not having the correct documentation and notes can result in this situation.

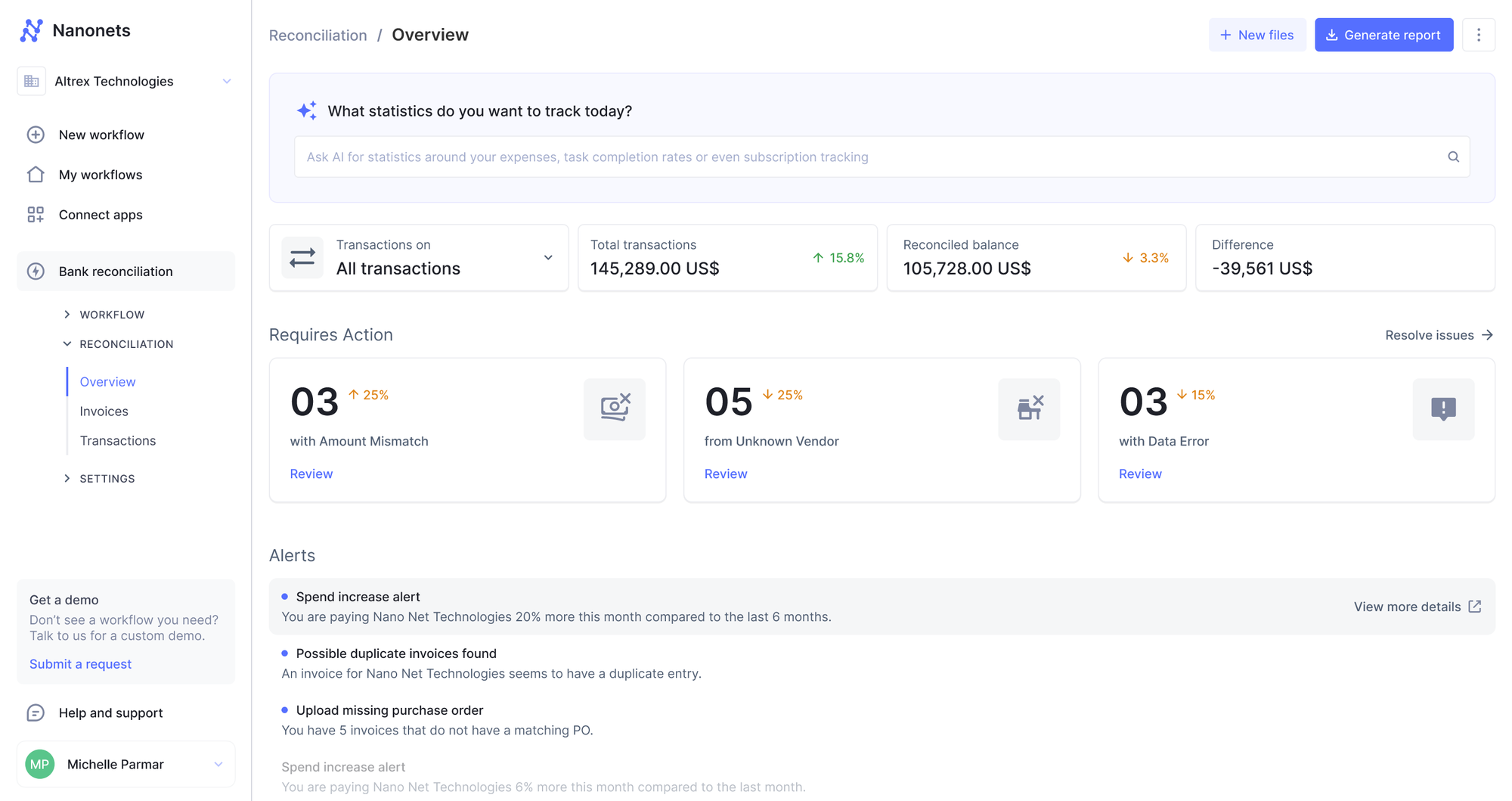

Utilizing software program like Nanonets’ AI Reconciliation can assist profit accounts payable groups within the following methods:

Environment friendly Dealing with of Excessive Transaction Volumes

Handbook reconciliation struggles to maintain tempo with excessive transaction volumes, particularly for companies coping with quite a few distributors and invoices. Nanonets’ automated system effortlessly processes massive datasets, guaranteeing that no transaction is missed. This effectivity saves time and reduces the chance of errors related to guide dealing with.

Fast Decision of Knowledge Discrepancies

Figuring out and resolving discrepancies between firm data and vendor statements might be time-consuming. Nanonets makes use of superior algorithms to detect and spotlight discrepancies immediately. This function permits finance groups to shortly pinpoint the foundation causes of discrepancies, facilitating quicker and extra correct reconciliation.

Elimination of Duplicate Funds

The danger of duplicate funds is a continuing concern in guide reconciliation. Nanonets’ automated system meticulously checks for duplicate entries and flags them for overview, considerably decreasing the possibilities of duplicate funds. This accuracy helps preserve monetary integrity and avoids pointless bills.

Minimization of Knowledge Entry Errors

Handbook knowledge entry is susceptible to errors, resulting in inaccurate reconciliation and monetary reporting. Nanonets automates knowledge seize and entry, drastically decreasing human error. By guaranteeing knowledge accuracy, companies can belief their monetary experiences and make better-informed choices.

Well timed Reconciliation

Delays in vendor reconciliation can have an effect on money move administration and pressure vendor relationships. Nanonets automates the reconciliation course of, guaranteeing that it’s accomplished promptly. Well timed reconciliation helps companies handle money move extra successfully and preserve wholesome relationships with their distributors by guaranteeing on-time funds.

Optimum Useful resource Utilization

Many companies face useful resource limitations concerning employees, expertise, and instruments for environment friendly reconciliation. Nanonets provides a scalable resolution that optimizes useful resource utilization. By automating repetitive duties, your crew can give attention to extra strategic actions, bettering total productiveness with out the necessity for added employees or costly instruments.

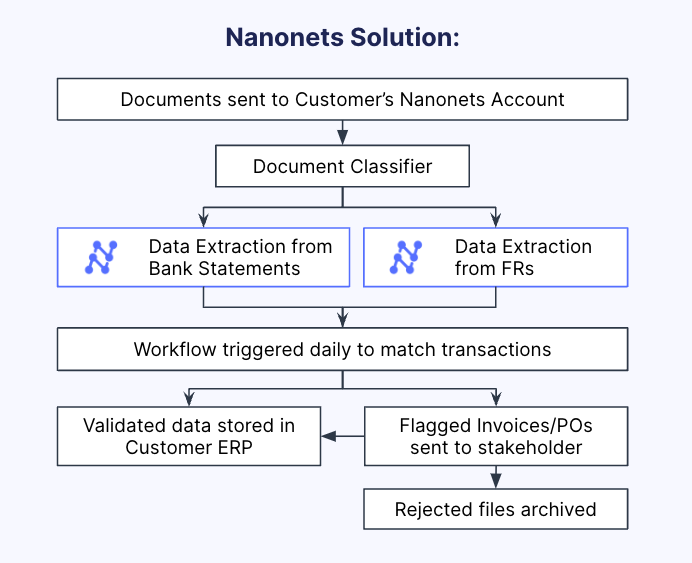

Automated Vendor Reconciliation workflow with Nanonets

Step 1: Gathering Paperwork

Conventional Strategy: Gathering piles of receipts, invoices, and financial institution statements is time-consuming and susceptible to errors.

Nanonets Resolution: With Nanonets, gathering paperwork manually is now not required. All of your sources, together with financial institution statements, vendor invoices, and different related paperwork, might be uploaded in any format or built-in immediately through accounting instruments. This automation eliminates the necessity for guide doc assortment and group.

Step 2: Knowledge Extraction and Standardization

Conventional Strategy: Manually verifying and coming into knowledge from varied paperwork can result in inaccuracies and inconsistencies.

Nanonets Resolution: Nanonets extract knowledge with excessive accuracy utilizing Optical Character Recognition (OCR) expertise and templatize all vendor statements right into a constant format. This ensures that each one knowledge is standardized, making it simpler to match and analyze.

.png)

AI doc processing options for workflow challenges

| Problem | Motion |

|---|---|

| Knowledge Inaccuracy | Eliminates errors by exact machine learning-driven extraction. |

| Excessive Volumes of Knowledge | Quickly digests bulk paperwork, effortlessly scaling with enterprise growth. |

| Compliance Failure | Automates compliance measures, sustaining strict adherence to rules. |

| Unstructured Knowledge | Deciphers and precisely extracts knowledge from various codecs utilizing superior AI. |

| Current Programs Integration | Fluidly integrates and syncs knowledge with current methods, guaranteeing easy transitions. |

| A number of Languages | Breaks language obstacles, processing paperwork in varied languages with ease. |

| Restricted Visibility | Grants real-time monitoring and management for swift situation identification and determination. |

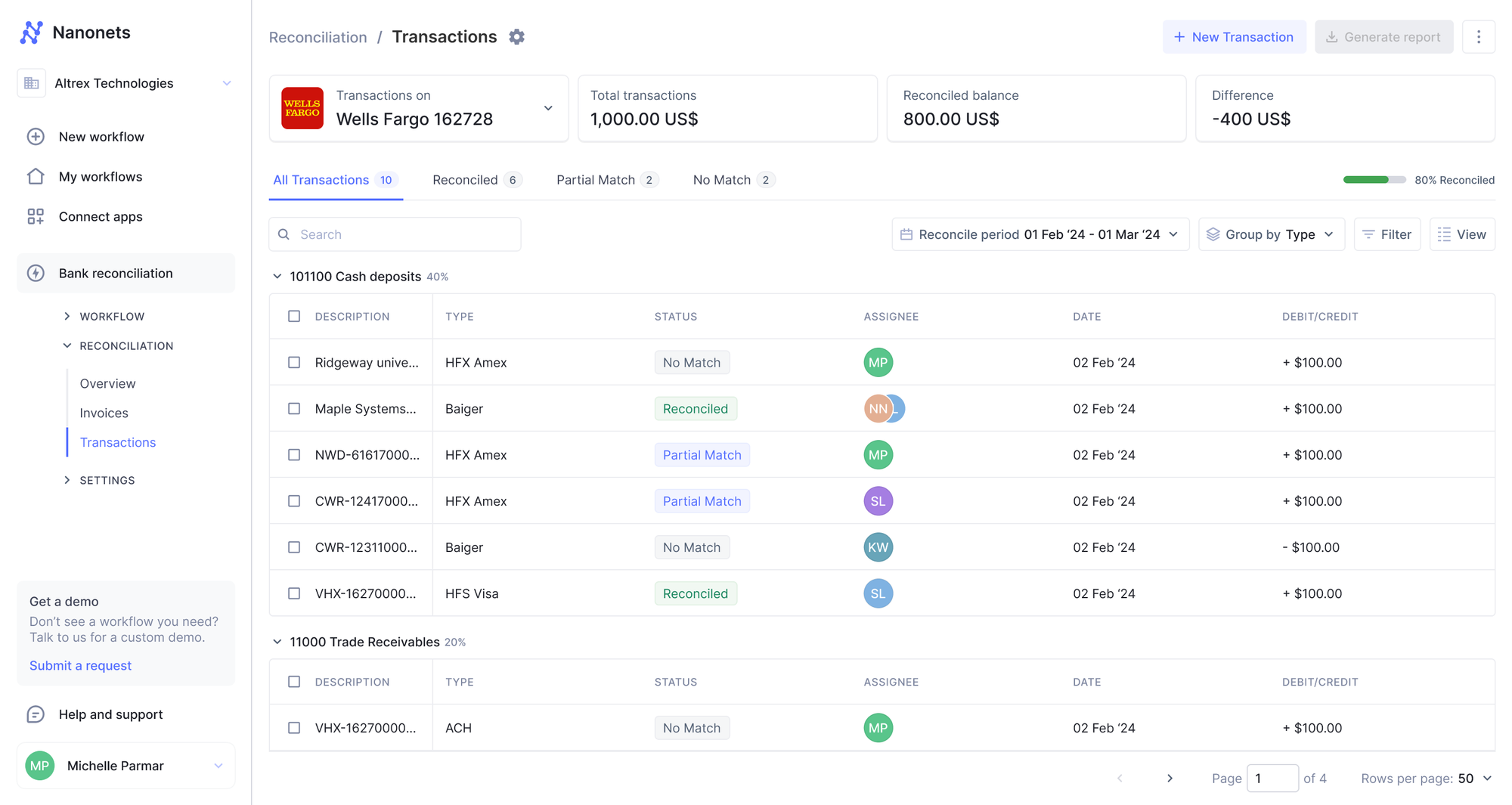

Step 3: Matching Transactions

Conventional Strategy: Matching vendor statements with invoices manually is a tedious process, typically resulting in missed discrepancies and errors.

Nanonets Resolution: Nanonets makes use of Pure Language Processing (NLP) and fuzzy matching methods to mechanically match transactions from vendor invoices to the accounts payable ledger. It constantly checks these in opposition to financial institution statements, flagging any discrepancies for additional overview. This automated matching ensures excessive accuracy and saves important time.

Step 4: Reconciling Inconsistencies

Conventional Strategy: Figuring out and reconciling inconsistencies requires meticulous consideration to element and might be extremely time-consuming.

Nanonets Resolution: Nanonets recurrently reconciles vendor statements, mechanically figuring out and highlighting any inconsistencies. The system learns from guide inputs and adjusts its algorithms to enhance future reconciliation processes. This ensures that discrepancies are shortly and precisely resolved, decreasing the chance of errors and fraud.

Step 5: Stopping Duplicate Funds

Conventional Strategy: Stopping duplicate funds requires cautious monitoring and verification, which is usually error-prone.

Nanonets Resolution: Nanonets’ automated system constantly displays for duplicate funds, guaranteeing that every transaction is exclusive and appropriately processed. This prevents the chance of duplicate funds, sustaining monetary integrity and optimizing money move administration.

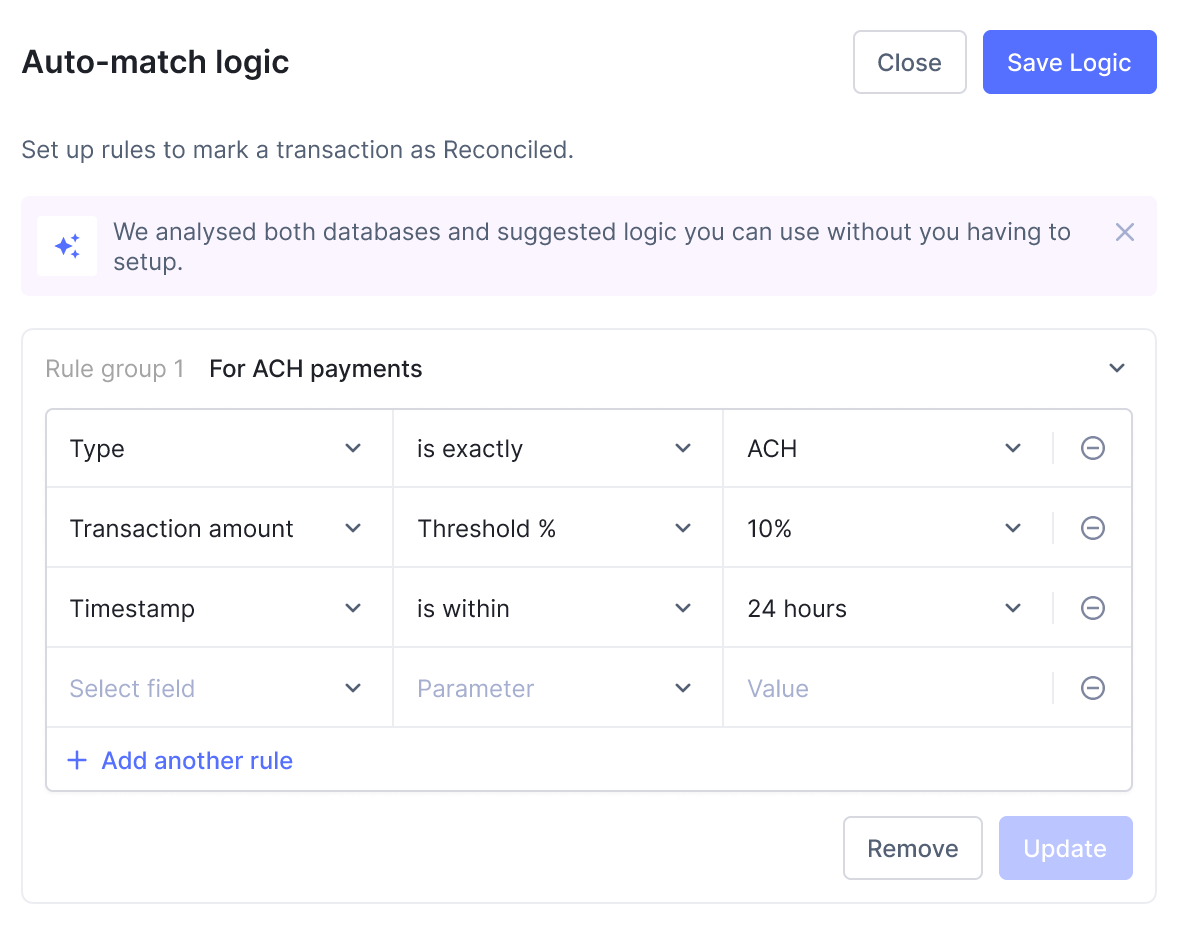

Step 6: Customized and Advanced Rule Matching

Conventional Strategy: Making use of customized guidelines and dealing with advanced eventualities manually might be difficult and resource-intensive.

Nanonets Resolution: Nanonets present customized and sophisticated rule-matching capabilities. The AI engine continually learns from guide inputs, adapting to distinctive enterprise necessities and bettering its accuracy over time. This flexibility permits companies to deal with advanced reconciliation eventualities effortlessly.

Step 7: Reporting

Conventional Strategy: Producing correct and complete experiences manually is a cumbersome course of.

Nanonets Resolution: On the finish of the reconciliation course of, Nanonets generates detailed experiences, together with the opening steadiness, closing steadiness, the quantity spent in line with the accounts payable ledger, and the cash issued through the financial institution, coinciding with vendor invoices. These experiences present a transparent and correct overview of the monetary standing, serving to companies make knowledgeable choices.

Conclusion

Vendor reconciliation is a crucial course of throughout accounts payable groups for correct monetary reporting. It helps within the detection of fraud, overcomes double cost processing, and helps preserve good relationships with distributors. Nevertheless, the method of manually reconciling vendor statements is error-prone, time-consuming, and never one of the best use of time for monetary groups. Automating the seller reconciliation course of through automated reconciliation software program like Nanonets transforms a historically advanced and error-prone course of right into a streamlined and environment friendly operation. By leveraging superior applied sciences Nanonets ensures excessive accuracy, well timed reconciliation, and complete reporting.

[ad_2]