[ad_1]

Bill coding includes categorizing bills and assigning them to particular accounts. It appears easy, which is why it is usually missed in AP effectivity discussions. However this is the kicker: it might be costing you greater than you suppose.

Corporations with out automation spend $6.30 per bill, whereas automated counterparts pay simply $1.45. That is proper— automation may prevent almost 77% per bill! It offers you an thought of the potential financial savings at stake. However it’s past simply value. Correct bill coding is essential for monetary reporting, budgeting, and decision-making. Errors can result in compliance points and skewed monetary information.

Need to know the way precisely does it work? And how will you implement bill in your group? You are in the appropriate place. This information will stroll you thru the method of bill coding, how you can automate it, and the perfect practices.

Let’s begin with the fundamentals.

What’s bill coding?

Bill coding is the method of assigning particular identifiers to every line merchandise on an bill. These codes, usually known as Basic Ledger (GL) codes, categorize bills for accounting functions. Consider it as giving every expense its personal ‘tackle’ in your monetary data.

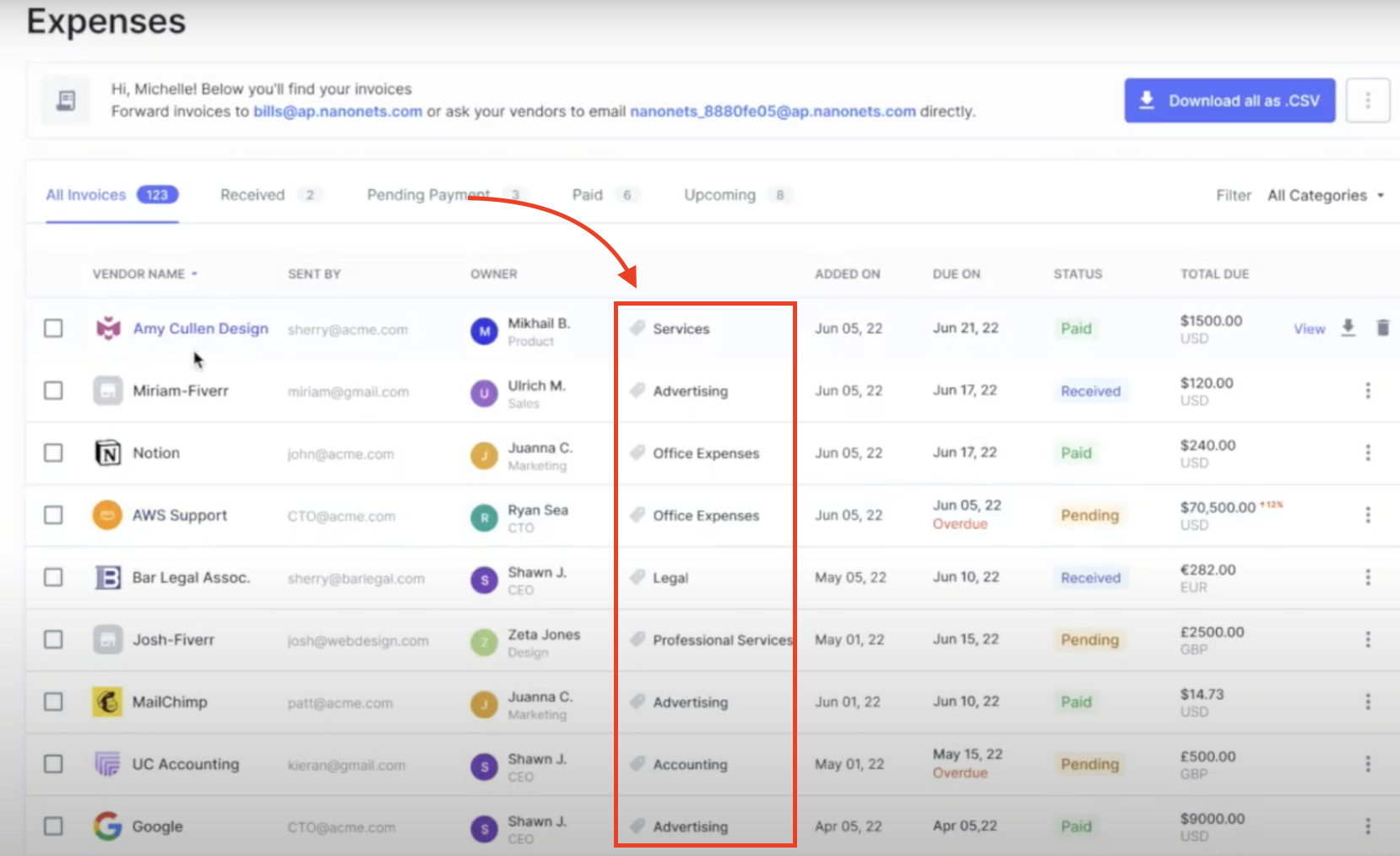

A appropriately coded bill ought to embrace a singular vendor ID (like OFF001 for OfficeMax), a selected GL code (resembling 6100 for Workplace Bills), a division code (MKT for Advertising and marketing), a price heart (MKTG-01), and a mission code (Q2CAM for Q2 Marketing campaign).

This detailed coding allows correct funds monitoring, simpler reporting, quicker approvals, and higher monetary evaluation. For example, you possibly can rapidly generate studies on all Q2 marketing campaign bills or whole OfficeMax purchases, mechanically route invoices to the appropriate approvers, and analyze spending patterns throughout departments, tasks, or distributors.

Historically, AP employees needed to manually assessment every bill, decide the appropriate codes, and painstakingly enter them into the accounting system. This course of, whereas thorough, is time-consuming and vulnerable to errors.

Fashionable AP automation software program makes use of AI, ML, OCR, and workflow automation to streamline this course of. It could actually:

💡

The bill coding course of

Your AP employees might already be utilizing some type of bill coding. It might contain manually assigning classes to invoices in spreadsheets, or maybe you are utilizing your ERP’s built-in coding options. No matter your present technique, understanding the usual bill coding course of will help you determine areas for enchancment.

Usually, bill coding follows these steps:

- Bill receipt: You might obtain invoices by way of e-mail, net portals, provider platforms, and even as paper paperwork. Step one is to assemble and digitize them if obligatory.

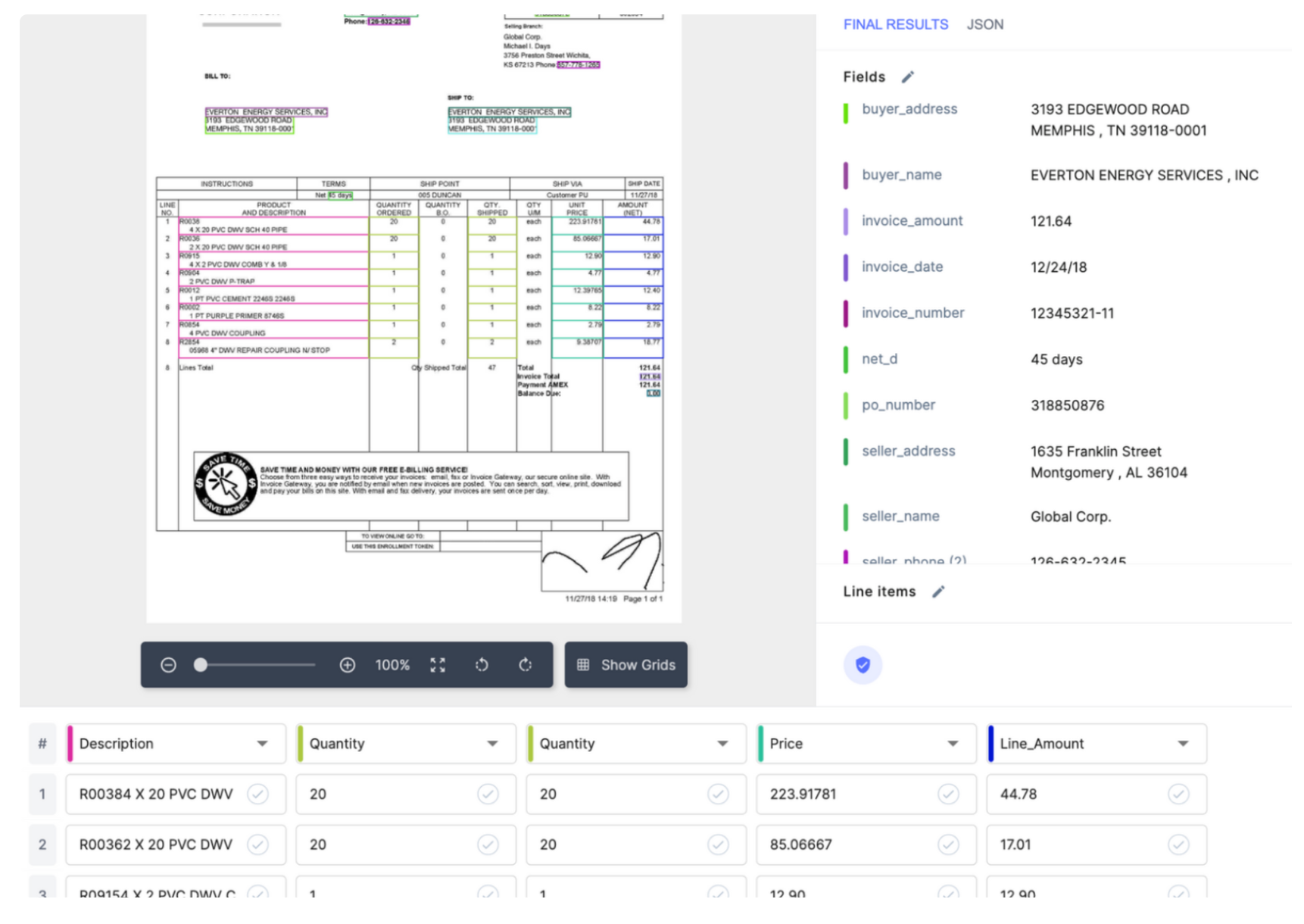

- Knowledge seize: That is the place your staff extracts key data from the bill. In guide techniques, this implies keying in particulars by hand. Extra superior setups would possibly use OCR know-how to automate this step.

- Code project: This is the place the precise ‘coding’ occurs. Your staff assigns every line merchandise a GL code based mostly in your chart of accounts. This step requires a deep understanding of your monetary construction.

- Validation and matching: Subsequent, the bill is checked in opposition to buy orders and receiving paperwork. This helps catch discrepancies early.

- Approval routing: The coded bill then strikes by your approval chain. This would possibly contain bodily handoffs, emails, or digital workflows, relying in your present system.

- Posting to the accounting system: Lastly, the authorised and coded bill information is entered into your accounting software program or ERP.

💡

Professional tip: When implementing automation, begin with high-volume, low-complexity invoices for fast wins.

How does your present course of examine to this commonplace circulation? If you happen to’re nonetheless counting on guide strategies, you are seemingly dealing with challenges like:

- Time drain: AP employees should manually key in every bill element, usually cross-referencing with different paperwork. This tedious course of can take hours, particularly for complicated invoices.

- Error charges: Human errors in information entry or code project can ripple by your monetary studies. A misplaced decimal or incorrect GL code can considerably skew your monetary information.

- Late funds: Bodily routing of invoices or e-mail chains can result in bottlenecks. Invoices would possibly sit on somebody’s desk or get misplaced in an inbox, leading to missed cost deadlines and potential late charges.

- Poor visibility: With no centralized system, it is difficult to know the place an bill is within the approval course of. This results in time wasted on standing inquiries and potential duplicate funds.

- Incorrect cashflow place: Handbook processes usually imply delayed information entry, making it arduous to get an correct, real-time image of your monetary place.

- Coding inconsistencies: Completely different staff members would possibly interpret coding pointers in another way, resulting in inconsistencies in monetary reporting.

- Scaling issues: As your small business grows and bill quantity will increase, guide processes grow to be more and more unsustainable.

These challenges aren’t simply inconveniences—they’re costing you cash. Bear in mind, guide processes can value as much as $6.30 per bill, in comparison with simply $1.45 with automation.

Make invoices payment-ready quicker!

Routinely seize and validate crucial bill information, resembling PO numbers, line objects, and cost phrases, in opposition to your current data. This ensures your invoices are correct, full, and prepared for cost processing, saving your AP staff worthwhile effort and time.

Methods to automate bill coding

Organising automation could be scary. You have to discover the appropriate software program, persuade finance to take a position, practice your staff, and combine the system. However when you get previous these hurdles, you will surprise why you did not do it sooner.

This is how you can get began:

1. Select the appropriate software program:

You would wish an AP automation resolution that seamlessly integrates together with your current ERP system. Search for options like OCR know-how, AI-powered information extraction, automated matching, and customizable approval workflows. Additionally, make sure the software program can deal with your bill quantity.

Nanonets’ pre-trained mannequin can acknowledge widespread bill fields out of the field, saving you time in setup.

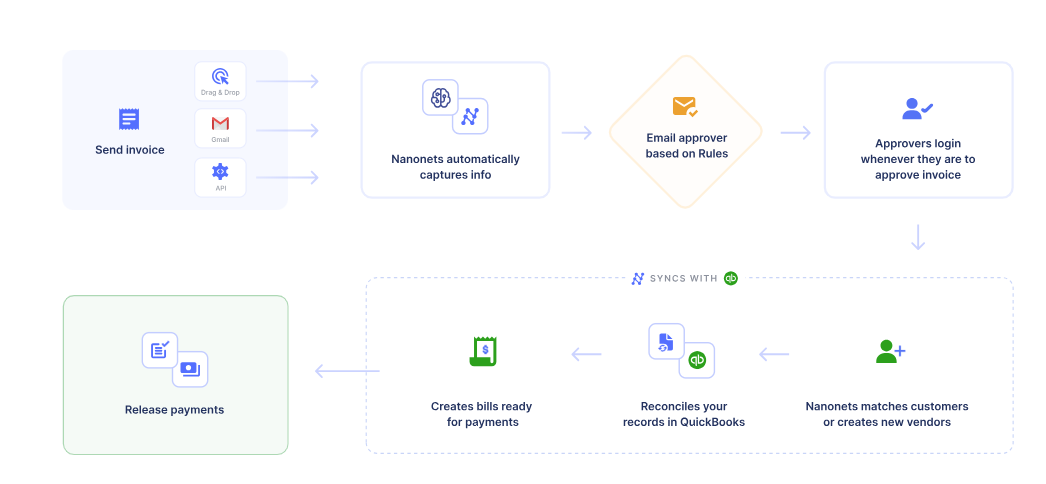

2. Digitize your invoices:

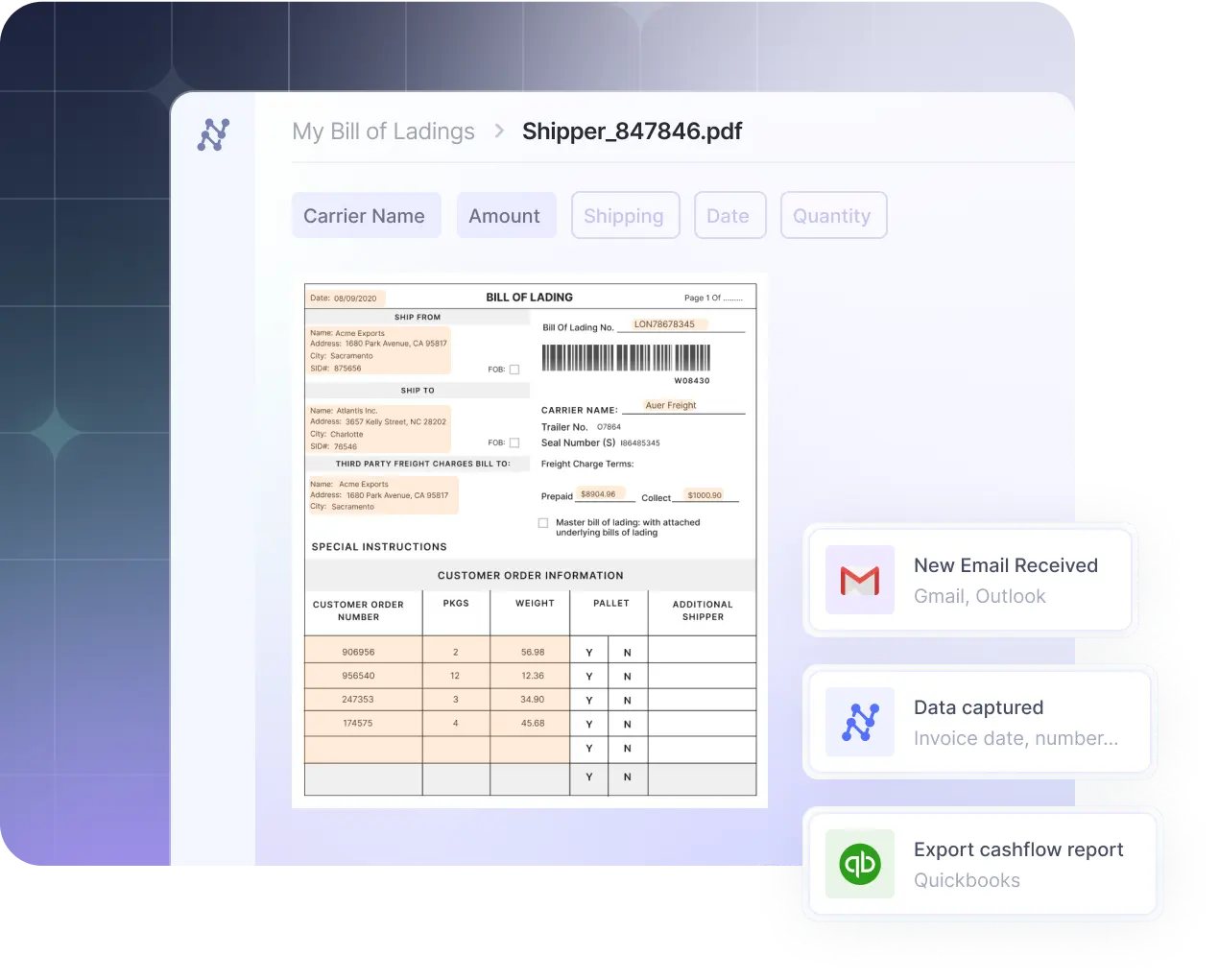

Add your scanned and digital invoices into the system. Many options provide bulk add choices or can mechanically seize invoices from designated e-mail addresses.

With Nanonets, you possibly can arrange e-mail integration to mechanically course of emailed invoices, join cloud storage companies like Google Drive or Dropbox for batch uploads, or use the API for direct integration together with your current techniques. This flexibility ensures you possibly can course of invoices from all of your sources.

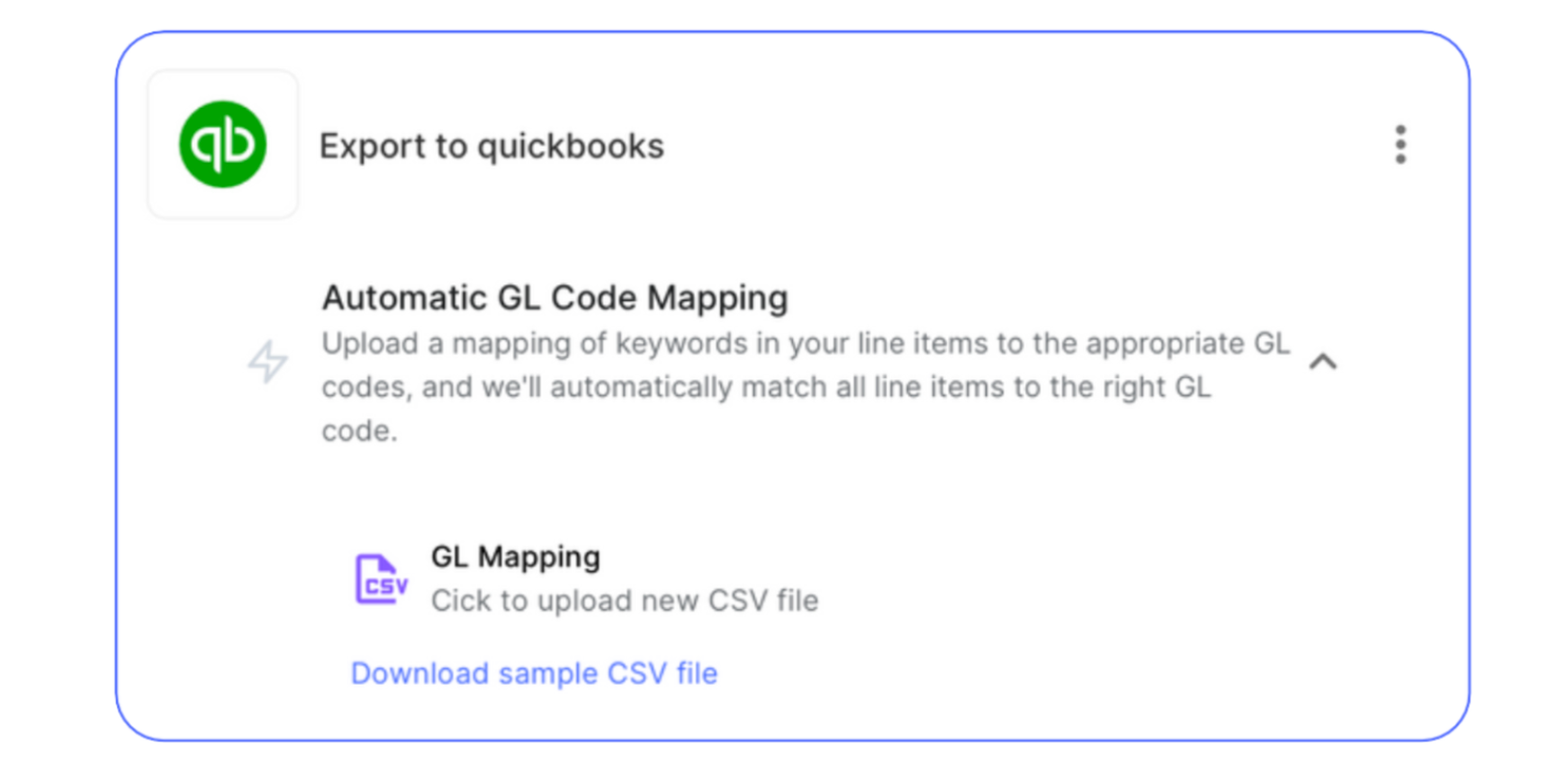

3. Arrange GL code mapping:

Outline clear pointers for assigning GL codes. Create a complete chart of accounts. You should utilize historic information to coach the system in your coding patterns. Many automation options permit you to create guidelines for automated code project based mostly on vendor, merchandise description, or different bill fields.

Nanonets, you possibly can create customized fields for each bit of knowledge it is advisable to extract, like ‘GL Code’ or ‘Value Heart’. Then, practice the mannequin by importing pattern invoices and manually labeling these fields. As soon as you’ve got labeled sufficient samples, the AI will study to acknowledge and extract these fields mechanically. You can even arrange guidelines to assign GL codes based mostly on particular standards, resembling vendor title or merchandise description.

5. Arrange validation and matching:

Configure your system to mechanically match invoices with buy orders and receiving paperwork. Arrange guidelines for flagging discrepancies, resembling value variances or amount mismatches. This step ensures accuracy and helps forestall overpayments or duplicate funds.

With Nanonets, you possibly can automate 3-way matching by establishing database matching as a part of your validation guidelines. This lets you mechanically examine bill information in opposition to your buy orders and receiving paperwork. You possibly can create conditional blocks to flag invoices for assessment if there are discrepancies in portions, costs, or totals.

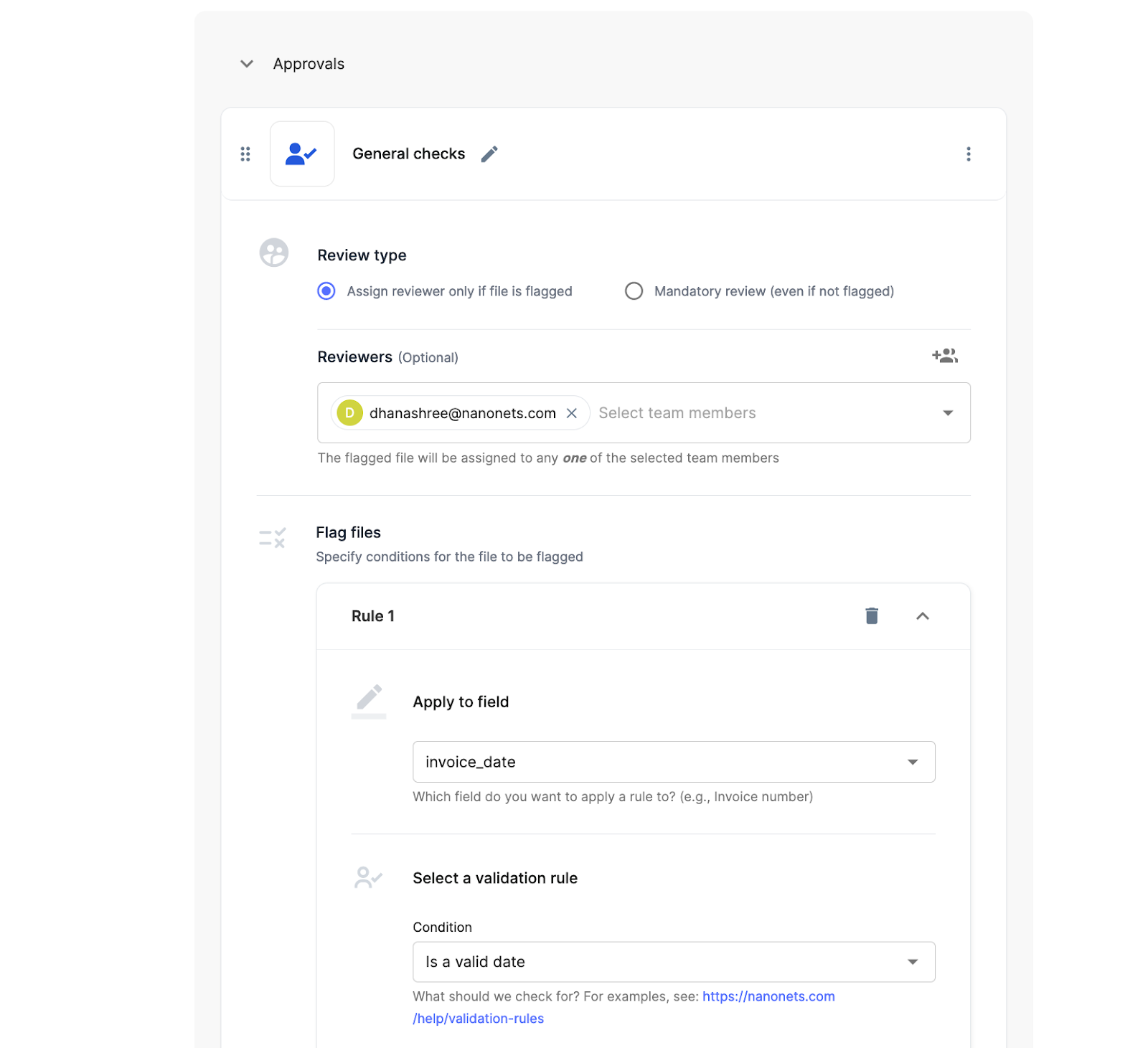

6. Set up approval workflows:

Design approval workflows that align together with your group’s insurance policies. Decide who must assessment and approve invoices based mostly on elements like quantity, division, or vendor. Automated routing can considerably pace up the approval course of.

Nanonets provides highly effective approval workflow options. You possibly can arrange a number of assessment levels with totally different guidelines for every stage. For instance, you would possibly create a rule to route invoices over a certain quantity to a senior finance supervisor, whereas commonplace invoices go to the AP staff. You can even arrange obligatory critiques or assign reviewers provided that sure circumstances are met.

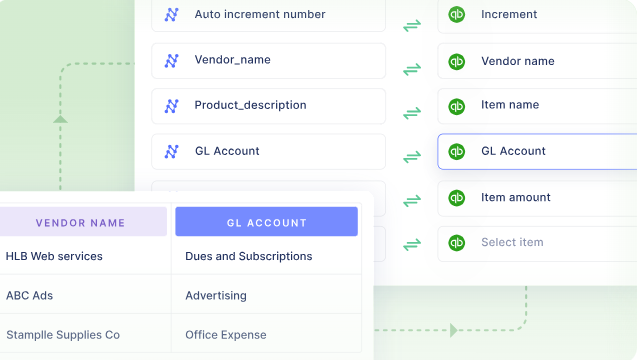

7. Combine with your small business techniques:

Arrange automated information export and syncing together with your ERP or accounting software program. This ensures that authorised and coded bill information flows seamlessly into your monetary techniques, eliminating the necessity for guide information entry. Additionally, contemplate connecting your AP automation resolution with different related techniques like contract administration or procurement platforms. This holistic method can present even higher visibility and management over your monetary processes.

With Nanonets, you possibly can arrange direct connections to in style ERP and accounting techniques like QuickBooks, Xero, and Salesforce. For different techniques, you need to use Nanonets’ API, the Zapier integration, or webhook options to push information mechanically. This ensures that your coded and authorised bill information flows easily into your monetary techniques with out guide intervention.

As soon as your system is ready up, give attention to profitable implementation and ongoing enchancment. Practice your AP staff totally, emphasizing exception dealing with and correction procedures. Begin with a pilot run utilizing a subset of invoices, steadily rising quantity as you achieve confidence.

Leverage analytics to observe efficiency metrics like processing time and accuracy charges. Frequently assessment these insights and consumer suggestions to refine your automation guidelines and workflows. Bear in mind, automation is an evolving course of – be ready to make changes as your small business wants change.

With Nanonets’ user-friendly interface, you possibly can simply retrain your mannequin, replace GL codes, or modify approval workflows with out IT intervention. This flexibility ensures your bill coding automation stays environment friendly and aligned with your small business processes over time.

Closing ideas

Embracing bill coding automation is not nearly maintaining with know-how—it is about remodeling your AP division right into a strategic asset. By streamlining processes, lowering errors, and liberating up your staff’s time, you are paving the best way for higher monetary decision-making and improved money circulation administration.

By streamlining processes, slashing errors, and liberating up your staff’s time, you are setting the stage for smarter monetary selections and smoother money circulation administration. However this is the factor: automation is not a one-and-done deal. It is a journey.

Begin small, study as you go, and maintain refining your processes. With the appropriate method and instruments like Nanonets, you possibly can flip bill coding from a tedious chore into a robust driver of effectivity and accuracy.

[ad_2]