Ever discovered your self spending hours on a single financial institution assertion, questioning if all these numbers add up?

Whether or not you are a mortgage officer reviewing an software or a enterprise proprietor guaranteeing your shoppers’ funds are so as, financial institution assertion verification is integral to making sure monetary accuracy and fraud prevention.

With an automatic financial institution assertion verification course of, it can save you hours of handbook checking, keep away from pricey errors, and enhance your confidence in your monetary information.

Let’s focus on financial institution assertion verification and discover solutions to a few of your largest challenges. Able to crunch these numbers with out the headache?

What’s financial institution assertion verification?

💡

Financial institution assertion verification is the method of confirming that the main points in a financial institution assertion—resembling deposits, withdrawals, and balances—are correct and genuine.

For instance, how do lenders confirm financial institution statements? The applicant submits their financial institution statements as proof of earnings, however how can the lender make sure they haven’t been altered?

Verification ensures the information matches the financial institution’s information, stopping fraud and supplying you with confidence within the applicant’s monetary standing. Many organizations now depend on automated instruments to hurry up this course of, guaranteeing sooner approvals and fewer human errors.

Learn extra: Learn how to use AI in financial institution assertion processing

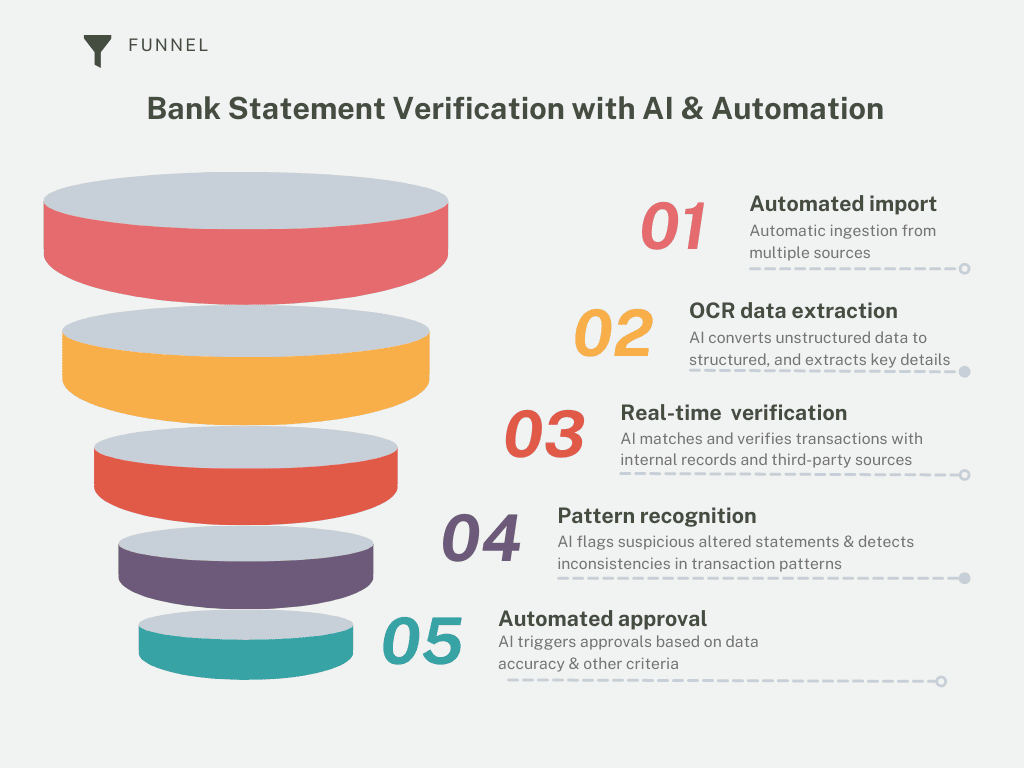

How does the financial institution assertion verification course of work?

The financial institution assertion verification course of entails a number of key steps to make sure the accuracy of the monetary knowledge offered. Right here’s a breakdown of the way it works:

- Doc submission: The applicant or buyer submits their financial institution assertion, both in digital or bodily kind.

- Preliminary evaluate: Fundamental checks and evaluation of statements make sure the doc is full, legible, and covers the required interval.

- Information matching: Key particulars—resembling balances, transactions, and account holder data—are in contrast with inside information or third-party databases.

- Fraud detection: The assertion is analyzed for any indicators of tampering, resembling inconsistent fonts, altered numbers, or formatting points.

- Verification instruments: Automated instruments can cross-verify transactions straight with the financial institution, streamlining the method.

- Remaining approval: As soon as all the pieces checks out, the financial institution assertion is verified, and the method is accomplished.

Applied sciences in financial institution assertion verification

The financial institution assertion verification course of has developed considerably with the assistance of superior applied sciences, making it sooner, extra correct, and safer. Listed here are some key applied sciences now generally used within the course of:

- Optical Character Recognition (OCR): OCR expertise extracts textual content from scanned or image-based financial institution statements, changing unstructured knowledge right into a readable, structured format. This eliminates the necessity for handbook knowledge entry, drastically lowering errors and dashing up the method.

- Synthetic Intelligence (AI) and Machine Studying (ML): AI-powered instruments can detect patterns, spot discrepancies, and flag suspicious transactions that may point out tampering. Machine studying algorithms enhance over time, making the verification course of smarter and extra dependable.

- APIs (Software Programming Interfaces): APIs enable integration between verification platforms and monetary establishments, enabling real-time entry to financial institution knowledge. This ensures that transaction particulars are cross-verified straight with the financial institution’s system, lowering fraud threat.

- Blockchain expertise: Some verification techniques undertake blockchain for safe, tamper-proof record-keeping. Blockchain ensures that when a financial institution assertion is verified, it can’t be altered with out leaving a hint, offering an extra layer of belief.

- Information encryption and safety protocols: Robust encryption strategies safe delicate monetary knowledge through the verification course of, guaranteeing that buyer data stays shielded from unauthorized entry.

Learn extra: Finest LLM APIs for doc extraction

Challenges within the financial institution assertion verification course of

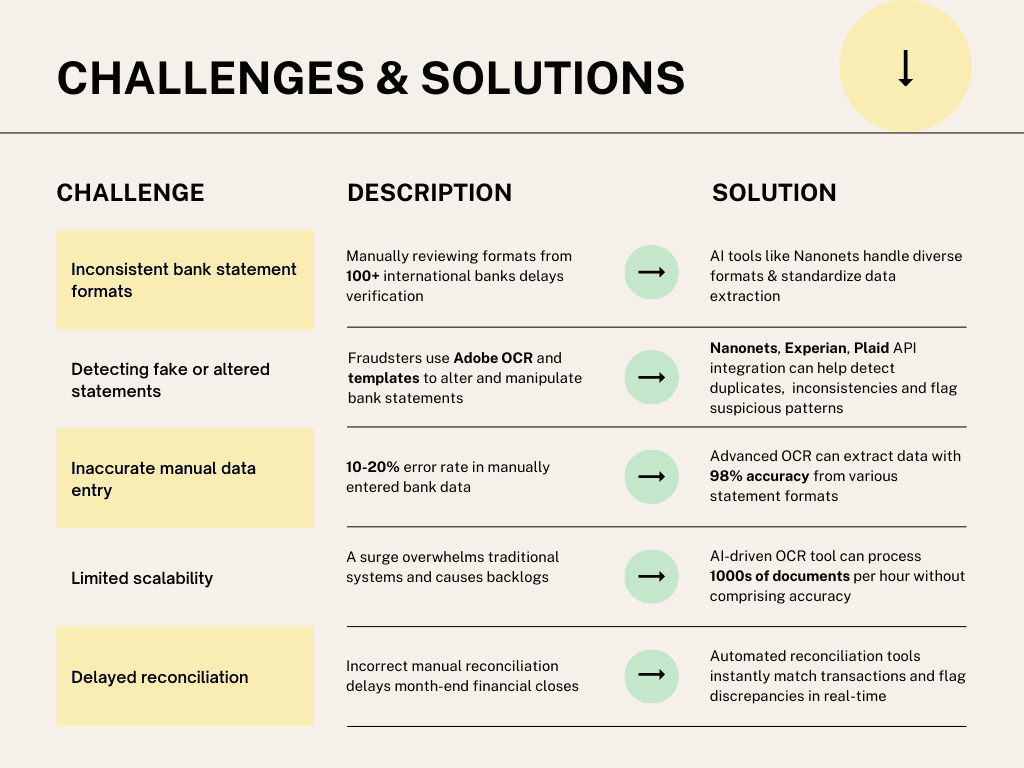

Financial institution assertion verification typically entails a spread of complicated challenges, particularly when coping with various codecs, expertise limitations, and regulatory necessities.

Let’s discover frequent points and the way they are often addressed successfully.

Inconsistent knowledge codecs from a number of banks

💡

Some use commas for decimals; others have totally different date codecs, like DD/MM/YYYY in a UK financial institution assertion or MM/DD/YYYY from a US financial institution. It’s time-consuming to kind via all this and manually confirm all the pieces precisely.

Options:

AI-driven financial institution assertion extraction instruments can automate the studying and processing of knowledge from statements in varied codecs, recognizing currencies, date codecs, and quantity representations.

For instance, skilled on hundreds of world financial institution statements, Nanonets AI financial institution assertion extractor can deal with scanned PDFs, handwritten textual content, and digital paperwork, guaranteeing quick, correct verification. By automating the popularity of cross-border variations, AI ensures sooner, extra exact verification with out handbook intervention.

Automating such knowledge extraction duties with rule-based workflows can save mortgage officers as much as 40% of the time usually spent on handbook verification.

Detecting faux or altered financial institution statements

💡

Fraudsters use superior instruments to change PDFs, altering transaction quantities, dates, and security measures like watermarks. In addition they use AI-powered templates to generate completely new statements practically indistinguishable from real ones.

With a whole bunch of functions to course of, catching these crafted fakes via handbook checks is just about unimaginable, posing important monetary and reputational dangers to our establishment.

Options:

- AI-powered fraud detection: AI instruments scan financial institution statements for delicate inconsistencies in fonts, layouts, and transaction patterns, figuring out tampered paperwork extra precisely than handbook checks.

- Metadata evaluation: Verifying the doc’s metadata—resembling creation date, modification historical past, and software program used—will help flag altered or fraudulent financial institution statements.

- Actual-time cross-verification: Implement APIs to allow instantaneous verification of financial institution statements with totally different sources — the issuing financial institution, all of your databases, and inside software program to make sure that the submitted doc matches official information.

- Third-party integration: Connect with authorities databases and providers like Plaid and Yodlee (US and Europe) to verify reported incomes.

- Credit score bureau cross-checking: Use providers like Experian or Equifax (in India) to validate monetary knowledge in opposition to official information.

- AI-driven sample recognition: Combine instruments like DataRobot or SAS to shortly establish errors or uncommon patterns.

By means of complete options, organizations can improve their verification processes and higher serve their shoppers by addressing the legitimacy of information and the necessity for faster approvals.

Inaccurate handbook knowledge entry

💡

Regardless of their greatest efforts, my group faces a 10-20% error fee, with frequent points with transaction quantities, dates, and account numbers. These errors compromise our verification accuracy and trigger many delays in mortgage selections. We’ve got to double-check our work on a regular basis.

The price of correcting these errors escalates dramatically via our course of – from $1 at entry to $10 throughout validation and as much as $100 throughout remaining evaluation. This has critically impacted our group’s morale and led to a dip in profitability and buyer satisfaction.

Answer:

Automating the information extraction and knowledge entry course of with AI-driven instruments can keep away from such pricey errors by rectifying errors in time. These instruments precisely extract key fields—resembling transaction dates, quantities, and descriptions from financial institution statements.

Human oversight in AI instruments is essential. As an alternative of spending time on knowledge entry, the mortgage officer might have let AI instruments pull the information and confirm it later.

As soon as verified, the correct knowledge could be simply exported into Excel, Google Sheets, a database, or any accounting software program for post-processing. This streamlined workflow minimizes the chance of errors, enhances productiveness, and ensures consistency all through the verification course of.

Restricted scalability

💡

Final month, we skilled a 300% surge, from 100 to 400 functions every day. Our outdated, template-based OCR system crawled to a close to halt, making a backlog of over 200 functions. Processing instances skyrocketed, and accuracy plummeted.

The fallout was quick – missed enterprise alternatives, annoyed shoppers, and a flood of complaints about delayed mortgage approvals. This scalability disaster threatens our fame and skill to capitalize on market development.

Answer:

Implementing an superior AI-driven device like Nanonets can dramatically enhance mortgage software processing capabilities.

In contrast to conventional template-based OCR techniques, these trendy options are designed to deal with sudden spikes in quantity with out compromising velocity or accuracy. With the power to course of 1,000 functions per hour and extract key fields with 98% accuracy, Nanonets can simply handle the surge in your every day functions.

This automation eliminates backlogs and considerably reduces processing instances by enhancing accuracy and straight addressing consumer frustrations and complaints about delays.

The 30% to 40% you’ll be able to obtain via automation could be reinvested in development initiatives to enhance your organization’s market place additional.

Points in reconciliation

💡

My group wasted days manually monitoring these transactions. With our excessive quantity of transactions, foreign money exchanges, and timing variations, these reconciliation points have gotten a recurring nightmare with many errors.

Answer:

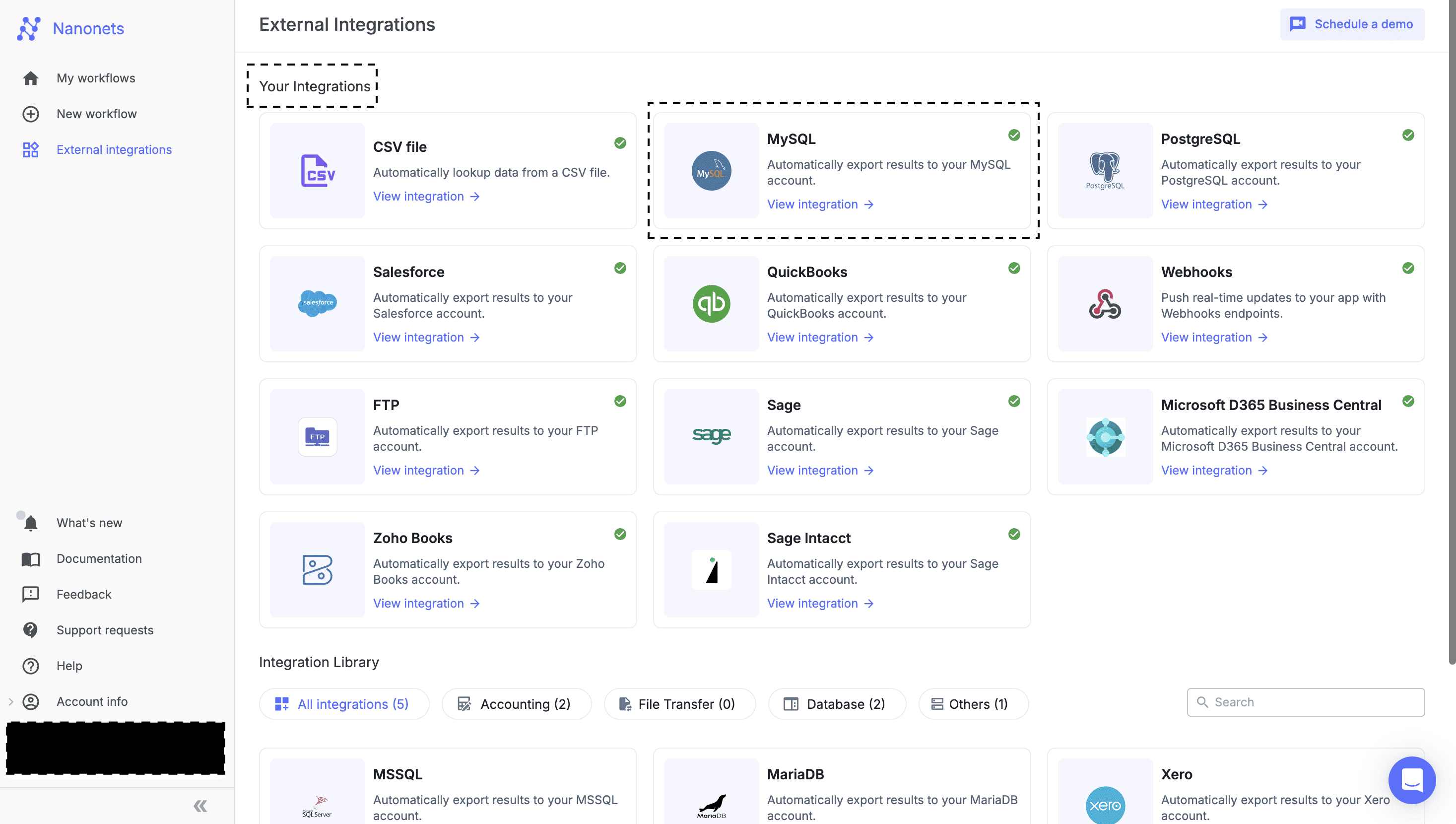

Implementing automated financial institution assertion reconciliation instruments can streamline your course of by integrating with widespread accounting software program, resembling Quickbooks and Xero.

No matter inside instruments you might have, all of them have to have a seamless knowledge stream and be in good sync as a way to catch such errors in time.

The system immediately flags discrepancies such because the $2,000 error you encountered, permitting your group to deal with points promptly with out handbook intervention. By automating this course of, you’ll be able to usually cut back reconciliation time by as much as 50% and obtain 95% accuracy in transaction matching.

This not solely prevents delays in monetary closing but in addition frees your group from the recurring nightmare of handbook reconciliation, permitting them to give attention to extra strategic monetary duties.

Learn how to automate financial institution assertion verification duties with AI

Let’s discover how an AI-powered financial institution assertion doc extraction can automate essential processes in verification, making the method sooner and extra dependable.

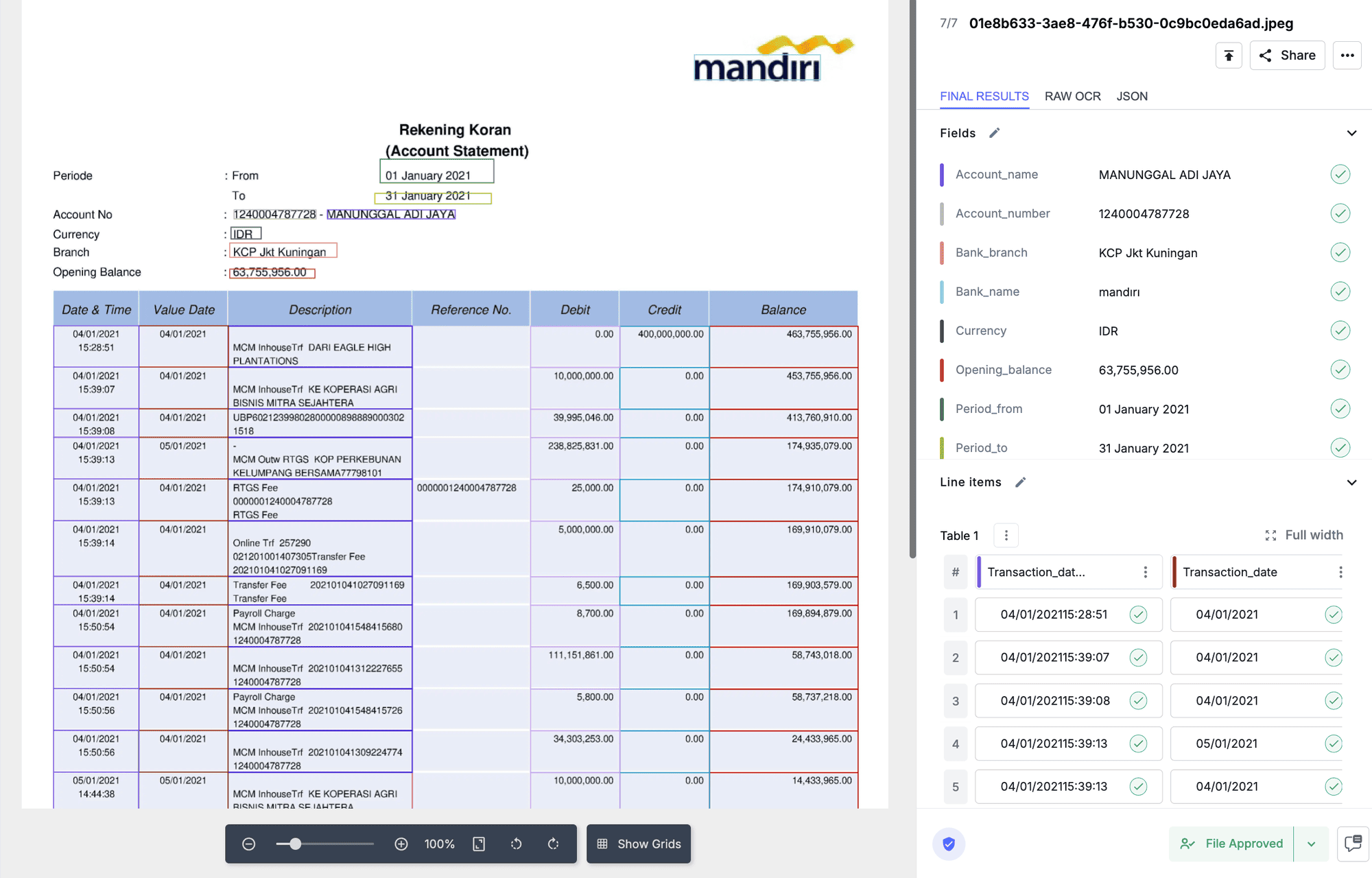

I’m taking Nanonets for example right here. Powered by generative AI, Nanonets presents a pre-trained financial institution assertion extractor and a zero-training extractor that may simplify your verification course of.

With the pre-built financial institution assertion extractor, you’ll be able to simply extract 12+ key fields from financial institution statements, resembling account numbers, addresses, financial institution names, transaction dates, transaction varieties, and balances and arrange much more by customizing the AI mannequin.

The platform acknowledges varied codecs and layouts, guaranteeing constant knowledge extraction from numerous assertion varieties.

Capturing knowledge from cross-border financial institution statements

With Nanonets AI, you’ll be able to seize knowledge from financial institution statements in 40+ languages by coaching the AI mannequin to deal with paperwork in a number of languages.

The system makes use of superior language fashions (LLMs) to interpret and extract data precisely, making it preferrred for corporations with worldwide shoppers or numerous markets.

It could actually additionally standardize financial institution statements with totally different currencies to simplify processing.

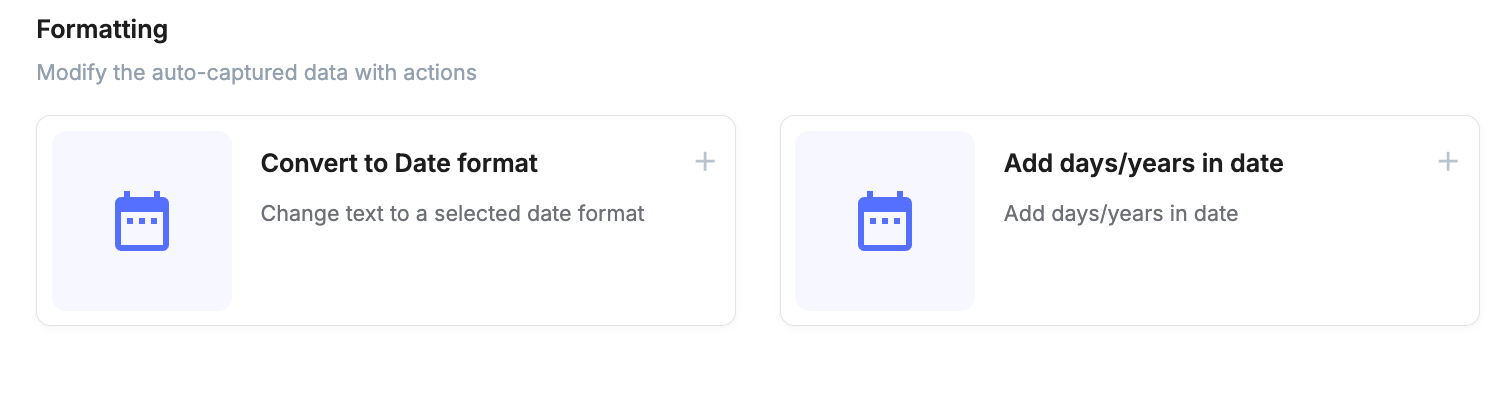

Standardizing date codecs in financial institution statements

As an example, when processing paperwork from varied banks, you would possibly encounter totally different codecs for dates, resembling “12 Could,” “05•12•2022,” or “2022-05-12.”

You’ll be able to standardize these entries utilizing the Convert to Date Format motion in your date fields in financial institution statements.

This course of ensures that every one the date entries are standardized robotically while you obtain financial institution statements from any nation or financial institution, facilitating extra accessible knowledge evaluation and reporting.

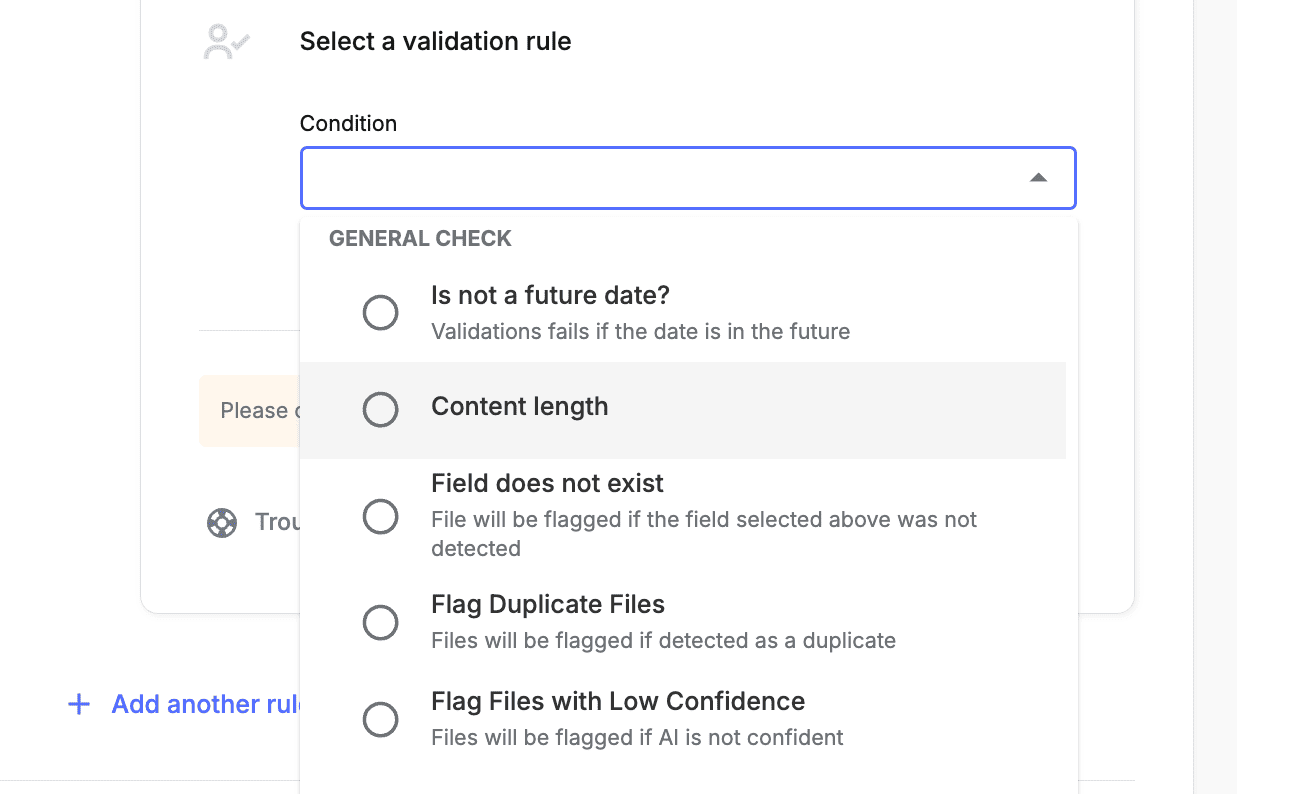

Flag duplicate financial institution statements

You’ll be able to arrange totally different validation guidelines to make sure no duplicate recordsdata.

By flagging recordsdata with low confidence like statements with lacking fields for obligatory evaluate, you’ll be able to stop many points.

Lookup knowledge from inside information

You’ll be able to enrich your financial institution statements by pulling knowledge from totally different third-party sources, spreadsheets, GL accounts, knowledge base, accounting and ERP software program, and extra.

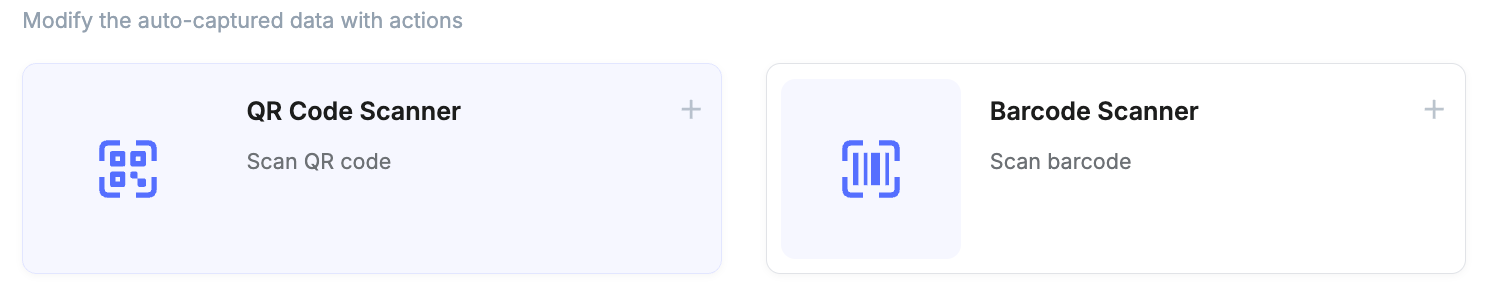

Scan QR codes or bar codes on the financial institution statements

You’ll be able to enrich financial institution extract by incorporating extra data or standardizing codecs.

Actual-time verification and decision-making

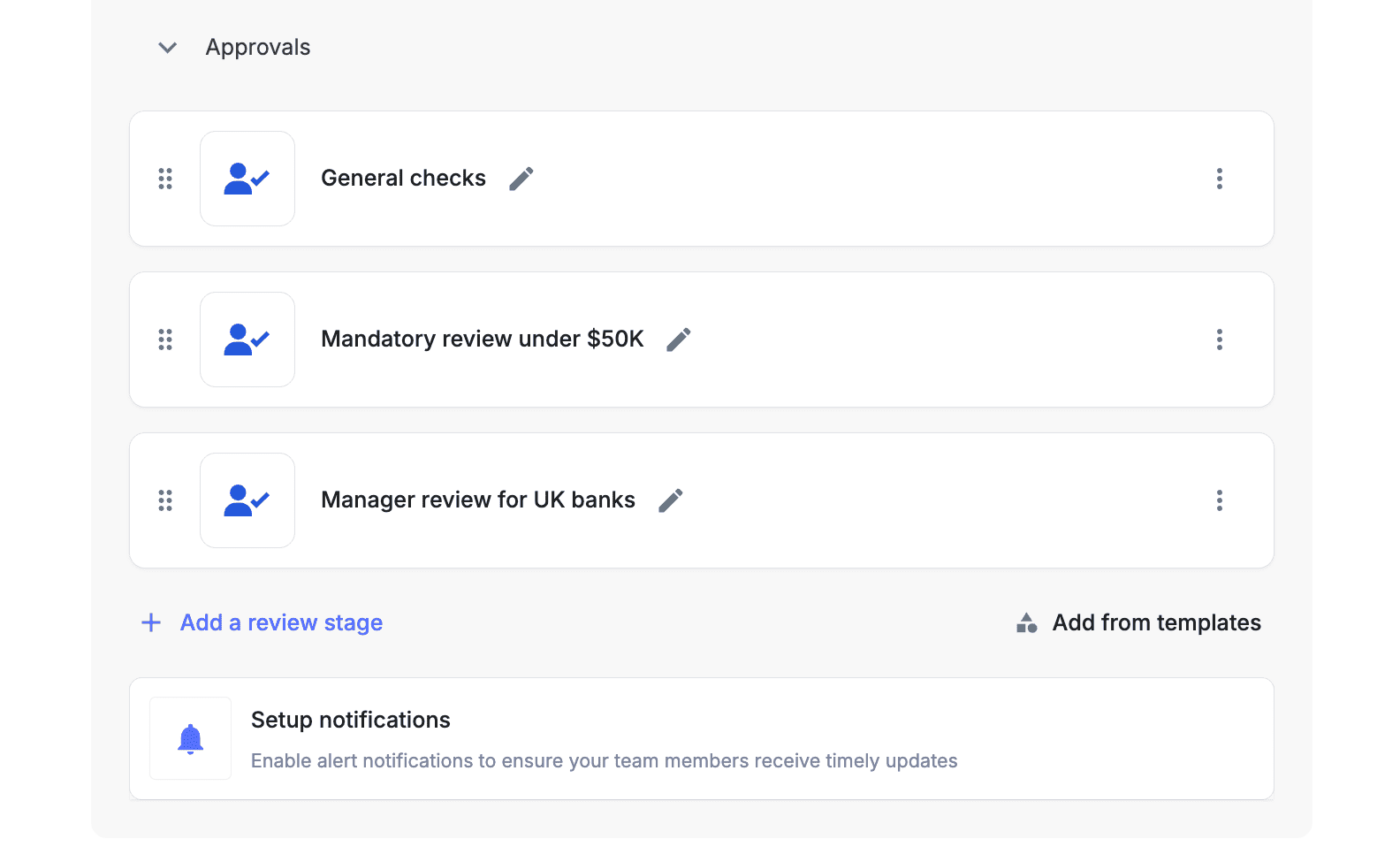

You’ll be able to arrange real-time verification approval by defining totally different standards.

For instance, you’ll be able to arrange automated obligatory approval for mortgage functions with financial institution balances below $50,000 whereas flagging these above the edge for supervisor evaluate.

This ensures that high-value or probably dangerous functions obtain acceptable scrutiny whereas routine circumstances are processed effectively.

Reconciling financial institution statements

With Nanonets, you’ll be able to automate the reconciliation course of by establishing predefined validation guidelines. Listed here are some efficient methods for organising guidelines:

- Transaction categorization: Classify transactions into earnings, bills, refunds to simplify matching and error identification.

- Threshold limits: Outline financial thresholds to give attention to important discrepancies, permitting for extra environment friendly evaluations.

- Date matching: Match transactions inside a particular date vary to reduce errors brought on by timing variations.

- Reference quantity checks: Implement guidelines to confirm distinctive identifiers related to transactions.

- Automated Matching Algorithms: Make the most of software program that robotically matches transactions primarily based on predefined standards, lowering handbook checks.

- Reconciliation frequency: Based mostly on transaction quantity, set up how typically reconciliations ought to happen—weekly, month-to-month, or quarterly.

- Exception reporting: Create guidelines for producing experiences on unmatched transactions, permitting you to give attention to particular points.

You’ll be able to shortly examine transactions between financial institution statements and accounting information utilizing superior algorithms primarily based on NLP methods and fuzzy matching. This considerably reduces the time required for handbook reconciliation from hours to minutes.

Conclusion

So, the following time you end up squinting at a financial institution assertion, bear in mind: you are not simply watching random figures however participating in a high-stakes sport of “Spot the Fraud.”

And with just a little automation magic, you’ll be able to commerce in that tedious handbook checking for a swift, streamlined strategy that may go away you with extra time to rejoice your monetary victories—like treating your self to a pleasant dinner as a substitute of crunching numbers all evening! Pleased verifying!

Continuously Requested Questions (FAQs)

How do lenders confirm financial institution statements?

Lenders confirm financial institution statements by utilizing automated techniques that extract key monetary particulars from the paperwork. These techniques examine for the knowledge’s consistency, authenticity, and accuracy.

Automated AI-powered knowledge extraction options, like Nanonets, can streamline this course of by dealing with unstructured knowledge from a number of banks, permitting lenders to evaluate paperwork in mortgage functions shortly.

Is it protected to share financial institution statements for verification?

Whereas sharing financial institution statements carries some dangers, you’ll be able to guarantee security by following key practices:

- Use safe, encrypted platforms for knowledge transmission

- Share solely essential data and redact delicate particulars

- Confirm the recipient’s compliance with knowledge safety rules like GDPR and PCI DSS

- Perceive the recipient’s knowledge dealing with and retention insurance policies

- Monitor your accounts for any suspicious exercise after sharing.

Keep in mind, respected verification processes prioritize your knowledge safety, however all the time train warning when sharing monetary data.

What’s real-time verification of financial institution statements, and why is it essential?

Actual-time verification permits lenders or monetary establishments to immediately confirm the accuracy and authenticity of financial institution statements with out delays.

That is essential for quick decision-making, particularly in high-volume industries like mortgage processing. AI-based instruments can arrange workflows to robotically confirm statements and set off approvals as wanted.