“Let’s simply be certain that going ahead, all of the invoices are forwarded to Mr. X for validation earlier than processing.”

If solely bill validation have been that easy.

In actuality, it requires systematic checks and balances, not only one particular person’s oversight. Research present that 25% of bill errors slip by accounts payable processes undetected regardless of inner correction efforts.

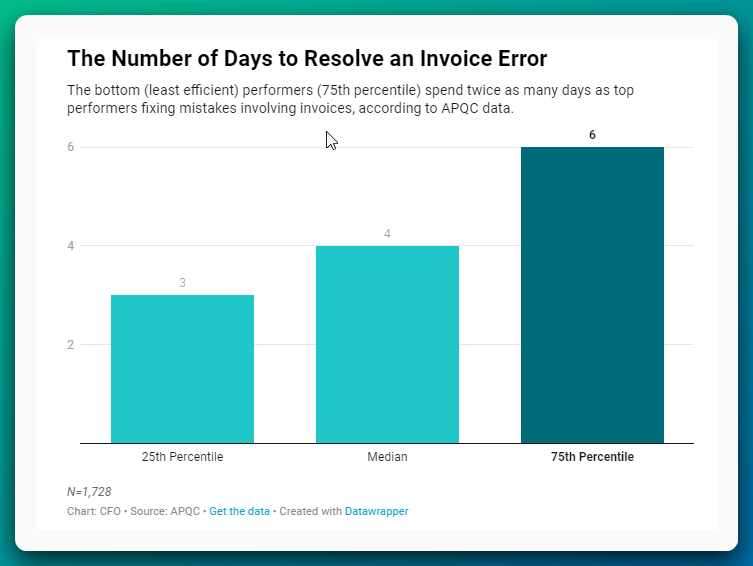

Even top-performing firms take 3 days to resolve bill errors, whereas others take twice as lengthy. This results in cost delays and strained vendor relationships.

How can we break this cycle? That’s what we’ll discover on this publish. We’ll stroll you thru the bill validation course of, discover widespread challenges confronted by AP groups, and supply sensible methods to streamline your workflow. We’ll additionally delve into how automation will help you progress nearer to that 3-day benchmark.

The bill validation course of

Bill validation is the method of verifying and authenticating vendor data, bill quantity, due date, items billed, tax utility, costs, portions, and different fields of an bill.

It sometimes includes checking these fields, matching them towards supporting paperwork like buy orders, vendor contracts, and receiving studies.

The intention is to make sure accuracy and stop errors or fraud earlier than cost processing. It’s essential for:

⁍ Making certain the corporate pays just for items and providers really acquired

⁍ Stopping unauthorized, duplicate, or inflated funds

⁍ Sustaining correct monetary information

⁍ Adhering to tax rules by verifying appropriate tax purposes

⁍ Making certain correct documentation for audit trails

⁍ Following industry-specific rules (e.g., GAAP, IFRS)

⁍ Catching and resolving discrepancies earlier than they impression money movement

⁍ Figuring out and stopping potential fraudulent actions

Usually, it’s the AP clerks or specialists who deal with nearly all of the validation duties. By the method, they take care of the buying division to confirm buy orders, the receiving division to substantiate receipts of products, and the finance division to approve funds. And, in fact, distributors who present invoices within the first place. They might be contacted for clarifications, too.

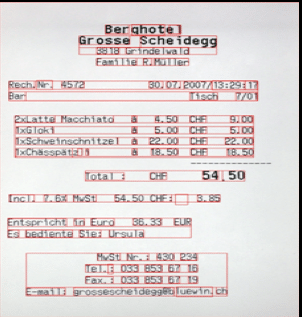

1. Bill: The first doc detailing the quantity owed and for what

2. Buy Order (PO): Confirms what was ordered by the corporate

3. Receiving Report: Verifies that items or providers have been delivered as anticipated

4. Vendor Contracts: Present agreed-upon phrases and pricing

5. Firm Insurance policies: Information inner procedures for bill processing

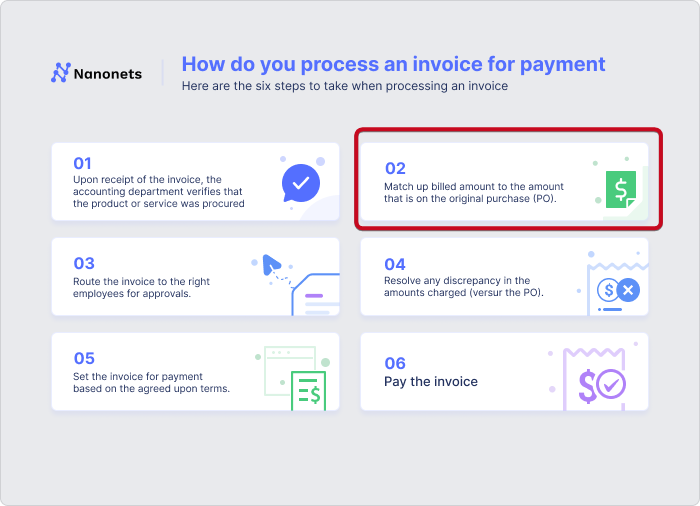

Now, let’s put all of them collectively to grasp the validation course of:

1. Receipt and preliminary assessment

Invoices are acquired by numerous channels — e-mail, mail, or bodily paperwork. Then, AP specialists start by checking for completeness of important data within the incoming bill.

They search for vendor title and speak to particulars, bill quantity and date, due date, merchandise descriptions, portions, unit costs, whole quantity due, and tax breakdown (if relevant). If any data is lacking, they sometimes contact the seller for the lacking particulars and maintain the bill in a pending standing.

2. Three-way matching

This important step includes evaluating the bill towards the acquisition order (PO) and receiving report. AP specialists will examine merchandise descriptions and half numbers, portions ordered vs. acquired vs. billed, unit costs and prolonged quantities, cost phrases, and supply dates. Any discrepancies discovered listed here are flagged for additional investigation.

3. Compliance examine

AP specialists confirm adherence to firm insurance policies and regulatory necessities. This contains checking buy approval limits, most well-liked vendor lists, contract phrases (e.g., agreed reductions, cost schedules), appropriate tax charges, documentation wanted for particular industries, or compliance with worldwide commerce rules for international distributors.

4. Approval routing

Primarily based on predefined guidelines, invoices are routed to the suitable approver(s). This routing sometimes considers bill quantity (e.g., invoices over $10,000 require senior administration approval), division (e.g., IT purchases accepted by IT supervisor), or venture codes (e.g., particular venture managers approve associated bills).

5. Discrepancy decision

Say the order portions within the bill do not match the receiving report. Then AP specialist would possibly assessment the packing slips or delivery paperwork to confirm the precise portions acquired and likewise to find out the precise supply of the error.

To resolve the state of affairs, they might want to barter with the seller for a credit score notice or revised bill.

6. Remaining verification

AP specialists guarantee all approvals are in place, and examine that any discrepancies have been resolved. The bill is then entered into the accounting system with correct coding for normal ledger accounts, price facilities, and venture codes.

The expense is acknowledged, sometimes by debiting the suitable expense account and crediting accounts payable.

Lastly, the cost is scheduled in response to phrases, with the suitable cost methodology (e.g., examine, ACH, wire switch) chosen. The bill is then filed for future reference or audits, finishing the validation course of.

➡️

Now, on paper, this course of appears easy. Nevertheless, in observe, it is usually riddled with challenges that may decelerate operations and result in errors.

The challenges that AP groups usually face with bill validation

Based on a current {industry} report, roughly one in 5 invoices is tagged as an exception at the moment. These exceptions can considerably cut back the proportion of invoices processed straight-through. This results in a rise in the associated fee and time to course of a single bill.

Bill validation is a fancy course of that may be hindered by numerous challenges. These embody:

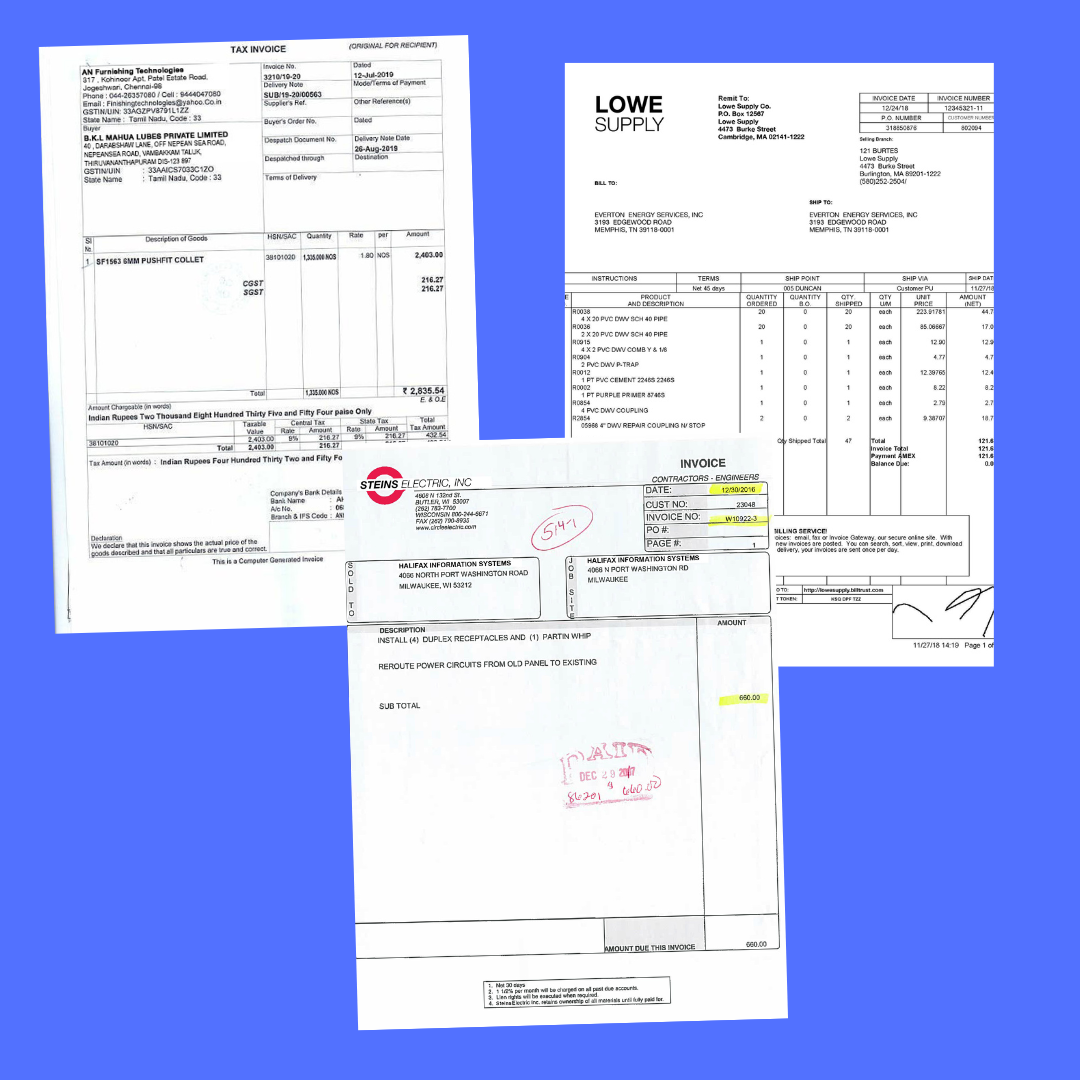

1. Handbook receiving of invoices

Practically 49.7% of invoices are acquired manually. This implies AP groups manually type, categorize, and enter knowledge from paper invoices or PDFs into their programs. This introduces the danger of human error. It might be typos, improper decimal placements, or misinterpret data.

💭

AP Specialist: “Certain, I am pulling it up now… You are proper. Should have transposed the numbers on one of many line objects. It ought to be $1,823.50, not $1,283.50.”

Your AP crew finally ends up spending extra time on validation and error correction, lowering total effectivity. Handbook knowledge entry additionally slows the method, doubtlessly resulting in late funds and strained vendor relationships.

2. Inconsistent bill layouts

The bill construction and structure can range between distributors. As an example, some might embody detailed merchandise descriptions, whereas others present minimal data. Finding key particulars every time manually will grow to be a big time sink over time.

💡

Instance: A world manufacturing firm receives invoices from 500+ suppliers, every with a singular format. The AP crew spends a median of 5 additional minutes per bill simply finding fields like PO numbers, tax quantities, and cost phrases.

This inconsistency not solely slows down processing but additionally will increase the probability of errors. AP groups should always adapt to completely different layouts, which may be mentally taxing and time-consuming.

3. Disconnected programs and knowledge silos

Many organizations use a number of programs for buying, receiving, and accounts payable. So, on the time of validation, wanting up matching data throughout these programs may be difficult and time-consuming.

➡️

Instance: An AP specialist switches between the ERP and the procurement system to confirm PO particulars after which checks a separate stock administration system for receiving data. Within the course of, they overlook a discrepancy within the acquired amount. This results in an overpayment, which is barely found in the course of the subsequent audit cycle.

Such disconnected programs improve the danger of errors and make it tough to take care of a complete audit path. Additionally they hinder real-time visibility into the bill standing, making it difficult to answer vendor inquiries promptly.

4. Advanced and unclear approval hierarchies

Convoluted approval processes with a number of layers and unclear duties usually trigger bottlenecks within the validation workflow.

➡️

Instance: An bill requires approval from three completely different departments. It sits within the second approver’s inbox for per week as a result of they’re not sure if they’ve the authority to approve, inflicting a delay in validation and cost.

These complicated hierarchies result in delays in validation, pissed off distributors, and missed alternatives for early cost reductions. Additionally they make it tough to trace the standing of invoices and determine bottlenecks within the course of.

5. Insufficient exception administration processes

Some AP employees might not know or have the mandatory authority to deal with exceptions successfully. This occurs because of an absence of clear pointers or coaching.

📊

Poor exception administration results in backlogs, delayed funds, and elevated processing prices. It additionally will increase the danger of errors as AP employees might rush to clear exceptions with out completely investigating the basis causes.

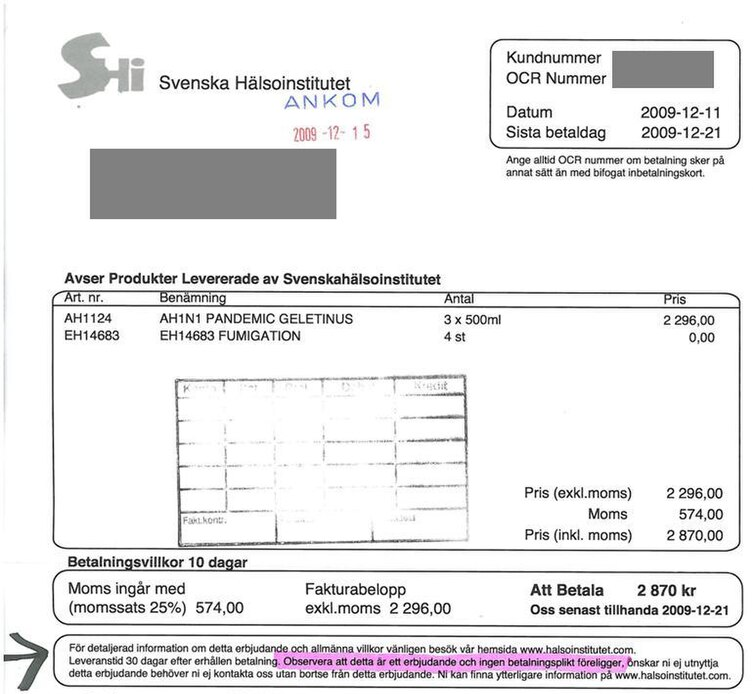

6. Problem in validating tax compliance

Every nation and jurisdiction has its personal tax rules. And so they change usually. So, handbook processing requires your AP employees to remain up to date on these complicated and ever-changing guidelines. In any other case, they might fail to determine incorrect tax charges or miss required tax documentation.

💭

AP Specialist: “Oh, I did not replace the current price modifications. I will must assessment all of the Japanese invoices once more to make sure compliance.”

If these exceptions should not recognized on time, it might result in compliance points and potential penalties. Moreover, forex conversions and fluctuating alternate charges add one other layer of complexity to bill validation. AP groups should be certain that the proper alternate charges are utilized and that any currency-related charges are precisely calculated and accounted for.

7. Detecting refined fraud schemes

As bill fraud schemes grow to be extra refined, recognizing pink flags in the course of the validation course of turns into more and more tough. Handbook validation processes usually lack the systematic checks wanted to determine refined indicators of fraud.

➡️

Instance: An AP crew fails to note that the provider checking account has modified barely from earlier invoices. This minor alteration goes undetected, leading to a big cost being diverted to a fraudulent account. The scheme is barely uncovered weeks later throughout a routine audit.

Handbook validation processes might miss these refined modifications, particularly when coping with excessive volumes of invoices. This oversight can result in vital monetary losses and injury the corporate’s fame. Moreover, handbook processes usually lack the power to cross-reference historic knowledge and patterns, which might assist determine potential fraud indicators.

8. Dealing with excessive bill volumes and scalability

Handbook validation processes usually buckle underneath strain when bill volumes surge because of enterprise progress, seasonal peaks, or acquisitions. They do not scale simply, forcing AP departments to rent extra employees or borrow sources from different groups.

➡️

Instance: An AP division sometimes validates 500 invoices per 30 days with a crew of three specialists. After a significant acquisition, their bill quantity abruptly triples. Their handbook validation course of, which is reliant on spreadsheets and e-mail approvals, cannot sustain. Validation time will increase from 3 to six days. Distributors name every day for cost updates, tying up much more AP sources.

This incapability to scale bill validation effectively can result in elevated error charges, late cost penalties, misplaced early cost reductions, and strained vendor relationships. The shortage of money movement visibility because of delayed processing may hinder strategic monetary decision-making.

Furthermore, the elevated workload and stress on AP employees can result in burnout and better turnover charges, additional exacerbating the issue.

As you may see, validating invoices is not so simple as it might sound. There are many hurdles that may journey up even probably the most diligent AP groups. So, what may be finished about it? Let us take a look at some sensible methods to deal with these challenges and make bill validation much less of a headache.

The right way to enhance your bill validation workflow

The excellent news is there are a number of methods to streamline your bill validation course of. Whether or not you are coping with a handful of invoices or 1000’s, these approaches will help you save time, cut back errors, and maintain your distributors blissful.

Let’s discover a few of them.

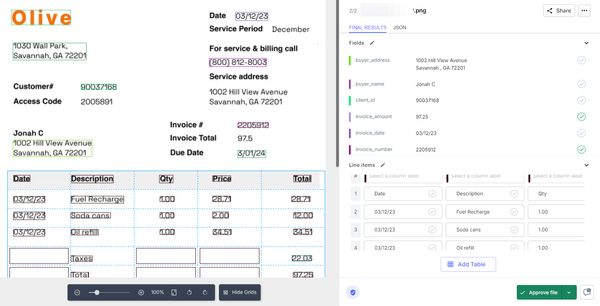

1. Use AI to seize and extract bill knowledge

With an AI-powered clever doc processing (IDP) resolution, you may robotically extract knowledge from invoices in any format – PDF, scanned photographs, and even pictures of paper invoices. This eliminates the necessity for handbook knowledge entry or tedious file conversions.

These programs use superior OCR and AI to precisely seize all essential bill data from a single supply. They’ll deal with invoices with completely different layouts and buildings, together with customary invoices, worldwide codecs and languages, and even handwritten notes.

The AI adapts to numerous bill buildings while not having pre-set templates. It might determine and extract key fields like bill numbers, dates, line objects, taxes, and totals, even when their positions change between invoices.

You’ll be able to pull out important data from scanned invoices, together with vendor particulars, merchandise descriptions, portions, and costs. The system then exports this as structured knowledge appropriate along with your accounting software program or ERP system.

This know-how considerably hastens the preliminary levels of bill validation. It reduces errors from handbook knowledge entry and frees up your AP crew to deal with extra complicated validation duties.

2. Automate three-way matching

An AI-powered doc processing system can carry out computerized three-way matching between invoices, buy orders, and receiving paperwork. This course of is quicker and extra correct than handbook matching.

The system compares key particulars like merchandise descriptions, portions, costs, whole quantities, dates, and supply data throughout all three paperwork.

When all the things matches, the bill may be robotically accepted for cost. If there are discrepancies, the system flags them for assessment, declaring precisely the place the mismatch happens.

This automation hastens the validation course of, permitting you to course of extra invoices straight by. It reduces errors and frees up your AP crew to deal with resolving exceptions and different high-value duties.

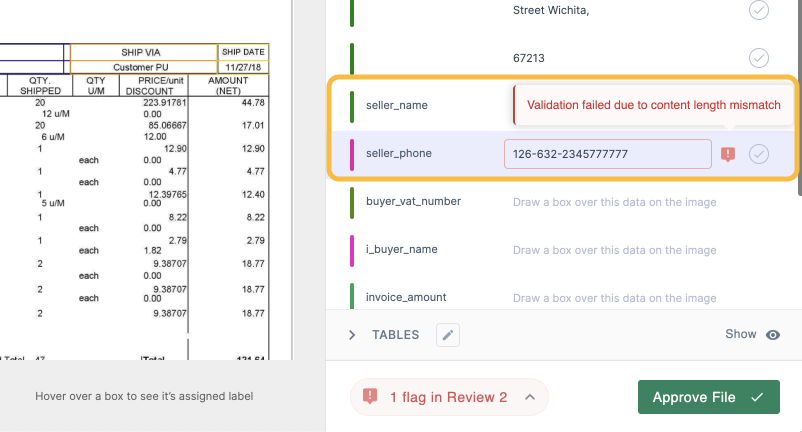

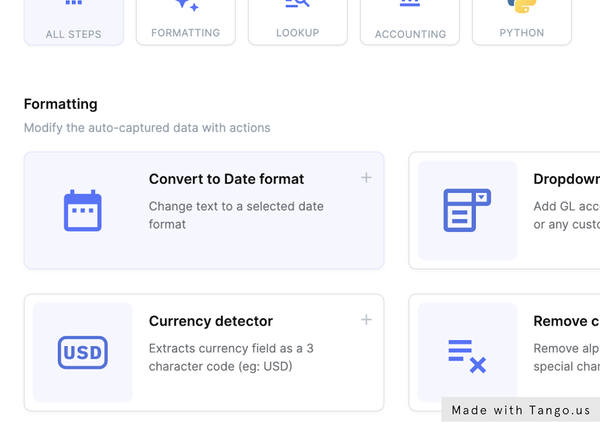

3. Arrange automated validation guidelines

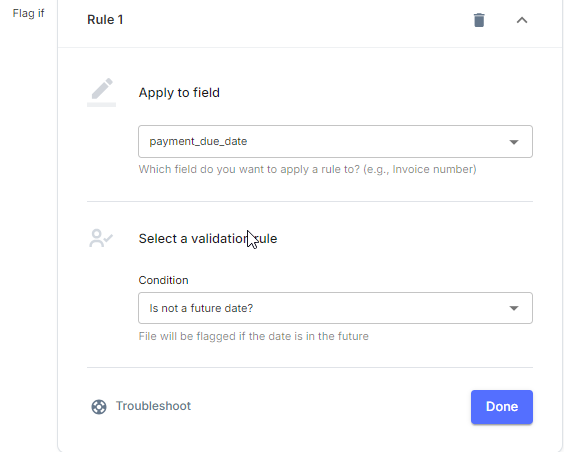

Clever doc processing options let you configure predefined validation guidelines. These can embody checks for lacking fields, mismatched quantities, duplicate invoices, incorrect tax calculations, and invalid vendor data.

These automated checks catch the most typical errors earlier than they attain human reviewers. The flagged invoices are then routed to the suitable crew members for assessment and backbone. This streamlines the validation course of, making certain that solely real exceptions require human intervention.

With these validation guidelines, your crew received’t be losing time on primary math checks anymore. You’ll be able to even confirm and doubtlessly appropriate tax calculations primarily based on subtotals and recognized tax charges.

The system catches these errors, and so they can deal with the trickier points that want experience. It additionally helps guarantee consistency in how invoices are validated throughout your AP crew.

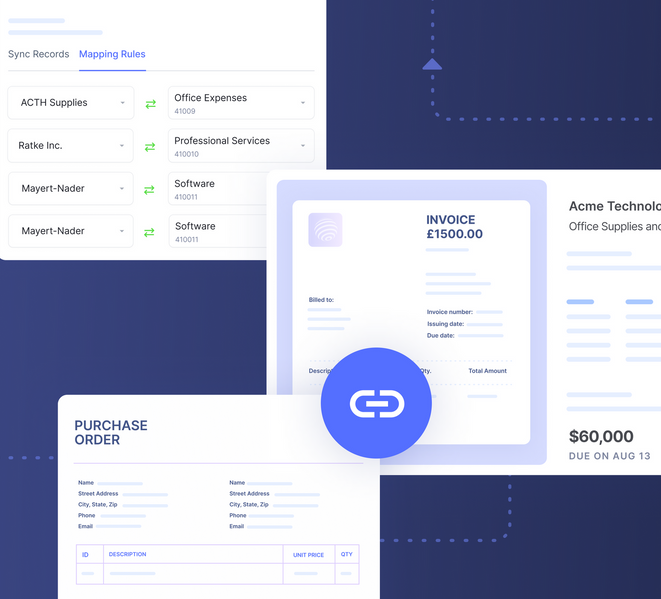

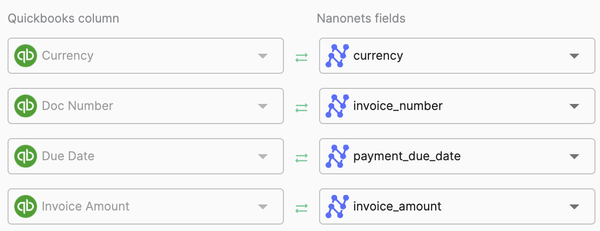

4. Combine programs for seamless knowledge movement

Join your bill processing resolution along with your ERP, accounting software program, and different enterprise programs. This integration permits real-time knowledge sync and reduces handbook knowledge switch.

It ensures computerized updates of bill standing throughout all programs. This eliminates double knowledge entry and reduces errors. Furthermore, you may simply entry buy orders and receipt data for matching. You don’t need to manually contact completely different departments or dig by a number of programs for data.

Moreover, it ensures improved accuracy in vendor knowledge and cost data, permitting for higher money movement administration and reporting. Finance groups could make extra knowledgeable choices about when to pay distributors.

5. Use AI to detect fraud

IDP instruments can analyze bill patterns and flag potential fraudulent exercise. This provides an additional layer of safety to your validation course of.

AI can spot refined patterns people would possibly miss, comparable to invoices slightly below approval thresholds, slight modifications in vendor financial institution particulars, uncommon spikes in bill frequency or quantities, and duplicate invoices with minor alterations.

It protects your organization from monetary losses and strengthens your total management surroundings. It permits your crew to deal with strategic duties whereas the AI constantly displays for potential dangers.

6. Implement a provider portal

Arrange a self-service portal the place suppliers can submit invoices electronically and examine cost standing. It will cut back handbook knowledge entry and assist catch errors on the supply.

It encourages digital bill submission. Suppliers can add invoices immediately, lowering errors and making certain knowledge accuracy. In case of exceptions, the system will alert suppliers, permitting them to shortly deal with points, rushing up decision occasions.

Furthermore, it ensures transparency as a result of they will monitor bill standing and cost data with out contacting your AP crew. This reduces inquiries and frees up your employees’s time. Additionally results in higher provider relationships.

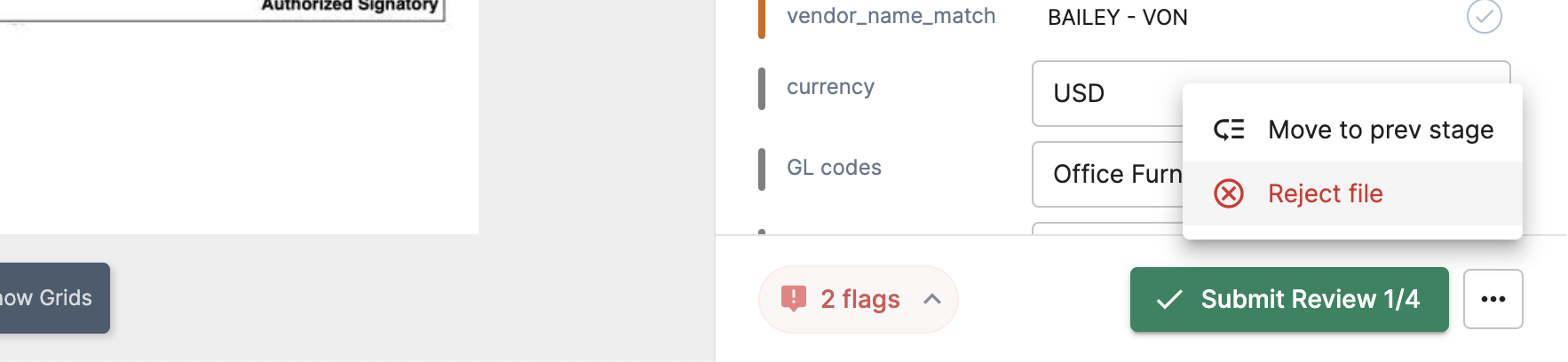

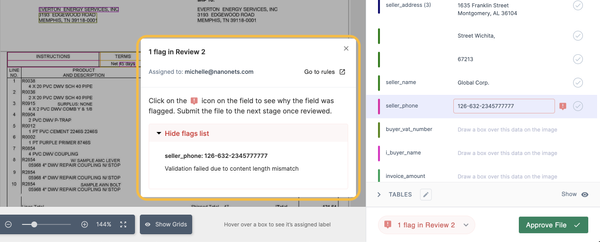

7. Implement exception-handling workflows

Arrange automated workflows in your IDP instrument to handle invoices that fail preliminary validation checks. As an example, a mismatch in pricing might set off a notification to the buying division for assessment. This context-based routing ensures that exceptions are dealt with effectively by the precise individuals.

Plus, when exception varieties are clearly categorized (e.g., worth mismatch, amount discrepancy), it turns into simpler to trace and analyze widespread points. This knowledge can be utilized to determine recurring issues and implement preventive measures.

When your AP crew is aware of precisely which points they should deal with, and so they can simply collaborate with different departments to resolve them shortly. You received’t be taking weeks or months to resolve exceptions anymore. This streamlined course of reduces bill processing time and improves total effectivity.

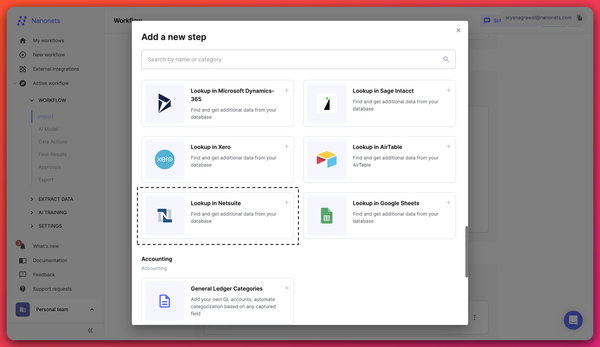

8. Enriching bill knowledge from exterior sources

Lacking or incomplete bill knowledge usually prevents them from being validated shortly. IDPs will help overcome this problem by enriching bill knowledge from exterior sources.

These instruments let you lookup vendor data from databases or out of your Netsuite, Xero, QuickBooks, or different accounting programs. This ensures that crucial data like tax IDs, cost phrases, and addresses are correct and up-to-date. You’ll be able to robotically fill in lacking particulars, cut back the handbook back-and-forth

Furthermore, IDPs can cross-reference bill line objects with product catalogs or tariffs to confirm pricing accuracy. This function is especially helpful for organizations with complicated pricing buildings or frequent worth modifications.

9. Simplify worldwide bill validation

Think about with the ability to apply country-specific validation guidelines (e.g., VAT calculations for European invoices) robotically. Many of those IDP instruments include multi-language assist, forex detection and conversion, and built-in compliance checks for various areas. This eliminates the necessity for handbook intervention at so many various ranges.

Moreover, these instruments can standardize numerous date and quantity codecs. So, when you’re coping with invoices from completely different nations, the system can robotically convert them to a standardized format for simpler processing.

There’s so much you are able to do to streamline your bill validation course of. Nevertheless, it is necessary that you just don’t disrupt your current workflows whereas implementing these modifications.

A current Forrester examine discovered that the Threat of disruption to present processes is the best barrier to adopting new bill processing applied sciences. So, you could prioritize know-how that may seamlessly combine along with your legacy programs and workflows.

That is the place IDP options shine. Not like normal AI instruments like LLMs, IDP platforms are constructed particularly for duties like doc processing, providing a extra predictable and correct method. They’re designed to deal with all varieties of invoices — from easy to complicated, typed to handwritten – with excessive accuracy.

What units IDP options aside is their capacity to ship constant outcomes time after time, whatever the bill format or complexity. They work methodically, following set guidelines and patterns whereas additionally studying from every doc they course of. This implies they will adapt to new bill codecs over time, however in a managed, predictable method.

Furthermore, they will work along with your current programs seamlessly, be it conventional options like NetSuite or SAP or trendy cloud-based platforms like Xero or QuickBooks. This integration functionality ensures that your current workflows stay intact whereas benefiting from enhanced automation. This ensures a clean transition and minimal disruption to your present processes.

Nanonets stands out as an {industry} chief within the IDP area, addressing each AP problem you face. It gives a complete resolution for bill validation:

- Clever doc sorting

- Automated line merchandise and discipline validation

- Sensible three-way matching

- Database matching

- Multi-stage approval workflows

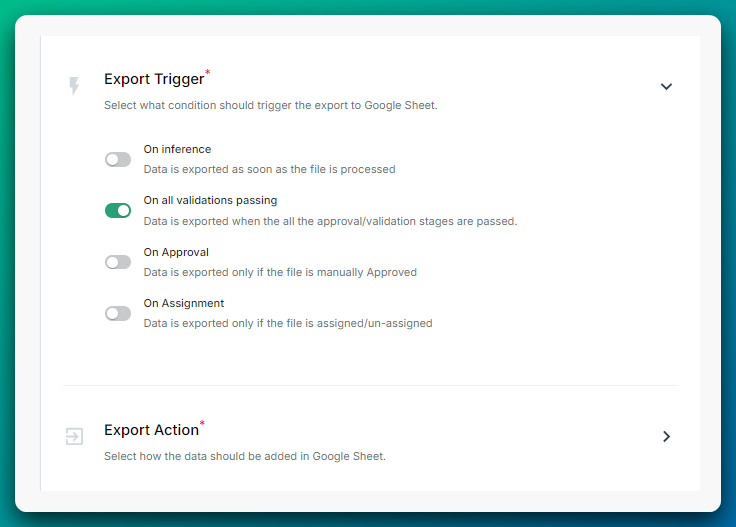

- Automated import and export workflows

- Multi-language assist and forex detection

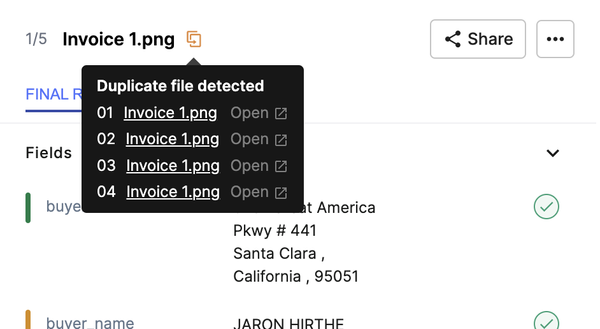

- Duplicate detection, tax verification, and far more

With Nanonets, you get the effectivity of full automation with out the effort of complicated setup or upkeep. It is designed to streamline your whole bill validation course of, from when an bill is acquired to its closing approval and cost.