[ad_1]

Keep in mind the final time you made a enterprise expense?

Who did you attain out to for reimbursement? How many individuals needed to approve your expense? What did you want for approval? How lengthy did it take the cash to achieve your checking account?

This technique of looking for approvals is a vital step within the expense administration course of.

Welcome to the messy world of expense approvals!

Why do corporations want to trace worker bills?

Monitoring all worker bills is important for a enterprise. A well-defined expense monitoring and approval course of for such bills is vital to:

- Monitor firm spending patterns

- Detect expense fraud and mitigate monetary danger

- Save prices and enhance the underside line

- Get higher money movement visibility and management

- Environment friendly useful resource allocation and improved budgeting

- Quick expense reimbursements

- A great worker expertise

How do expense approvals work?

All corporations have or want an expense approval course of in place.

All expense approvals require prior authorization or approval after the expense has been incurred or a mixture of each.

Pre-authorized expense course of

Usually used when an expense is larger than regular, like an costly enterprise journey to a different nation, corporations ask staff to hunt approval prematurely.

The worker seeks authorization from the supervisor prematurely and may spend on the go.

The advantages of such a pre-approved course of are:

- Elevated policy-compliance

- Decreased danger of non-reimbursements

- Smoother worker expertise

- Higher monetary management

Any unplanned bills that aren’t pre-authorized should be authorized and processed for reimbursement individually.

Put up-expense approval course of

In a typical post-expense approval course of, an worker incurs an expense first and will get the approval later.

That is what the method normally seems to be like:

- Expense submission: The worker must first report the expense utilizing an expense declare kind or file an expense report.

- Expense reporting: The expense report should then be authorized by the supervisor and verified by the finance division.

The worker should submit all the required proof or paperwork, similar to receipts or invoices, for a coverage compliance verify and auditing functions.

- Verification and approval: As soon as the expense is verified, the finance group approves the expense declare and initiates the reimbursement if required.

This complete course of can take wherever from per week to a month. In corporations with no well-defined approval course of, it could take longer and even months.

What’s an expense report and the best way to create one on excel? | Nanonets

An expense report is an in depth record of enterprise bills incurred by an worker on behalf of the corporate. Examine the best way to create expense stories in Excel and the best way to automate the expense reporting course of.

Totally different strategies of expense monitoring and approvals

Relying on the corporate’s tips, staff file expense claims utilizing completely different strategies:

Receipt assortment

The standard expense approval course of requires staff to gather receipts. The finance division then verifies these expense receipts.

Monitoring all such receipts is tedious for workers and finance groups each.

Receipt scanner cell apps are changing such previous paper receipt assortment processes. These apps enable staff to immediately add receipts by scanning or clicking a photograph and file expense claims.

Built-in expense software program instruments additionally enable staff to find direct invoices or receipts from on a regular basis instruments like Gmail, Uber, and Credit score Card transactions to create hassle-free reimbursement claims.

Expense reimbursement and the expense reimbursement course of

Right here’s every part it’s worthwhile to learn about expense reimbursements, the expense reimbursement course of, and the methods to deal with challenges with automation in 2024.

Per diem allowance

In some corporations, staff are given a per diem allowance. The per diem price is supposed to cowl every part and removes the necessity for receipt verification. If the worker breaches the expense cap, it should come out of their pocket.

By capping completely different expense classes, such allowances additionally enhance coverage compliance and assist corporations save prices for sudden bills.

Pay as you go playing cards

Whereas many corporations go for cashless reimbursements, pay as you go playing cards have emerged as a wonderful possibility for pre-authorized expense processing.

Pay as you go playing cards are simple to load, observe, and spend. Additionally they have built-in compliance controls, and managers can customise spending limits for particular person group members. These bank cards can be utilized for worker expense administration, buying, and recurring vendor funds.

💡

Pay as you go playing cards are an modern different to per diem allowances, as corporations can train higher management over them in real-time.

Company bank cards

Enterprises and corporations present company bank cards for workers who must spend extra. With customizable limits and controls, these firm bank cards present real-time spending visibility and empower staff with extra monetary freedom.

Complete Information to Credit score Card Reconciliation

Simplify what you are promoting transactions with efficient bank card reconciliation. Study greatest practices and instruments for higher accuracy.

10 largest challenges within the expense approval course of and their options

The standard post-expense approval course of could be lengthy and tedious. Let’s take a look at the widespread challenges and the steps to resolve them.

1. Limitless delays in approvals

As a number of stakeholders must authorize the expense declare, delays are widespread in expense approvals.

The managers wait till the tip of the month to get an total thought of the group’s spending and approve all bills.

The finance group is overwhelmed with expense claims and has to chase down staff for required proof and documentation. In the meantime, staff are left hanging, operating for supervisor approval or ready endlessly for reimbursements.

Options:

- Automate your approval workflow so that everybody is routinely despatched well timed reminders, notifications, or alerts to hurry up the method.

- Even should you comply with handbook expense approvals, set correct timelines for all approvers – staff, managers, and the finance group.

2. Inaccurate expense reporting

Workers submit incorrect expense claims or expense stories with out correct documentation, set processes, and correct tips. Misplaced, illegible, or broken receipts are the commonest culprits in Excel-based.

Some corporations comply with Excel-based expense reporting that includes handbook knowledge entry. This creates a library of spreadsheets which can be liable to errors and result in delays in expense report approvals.

Options:

- Go paperless and guarantee environment friendly expense reporting with an OCR-enabled receipt scanning app that permits staff to seize and submit bills.

- Guarantee knowledge extraction from the invoices/receipts is seamless to make sure the declare quantity matches the expense.

- Practice your staff with on-line assets that information them to report bills and file claims precisely.

10 Finest Receipt Scanner Apps in 2024

We’ve discovered 10 receipt scanner apps that enable you to digitize receipts, extract related data, create expense stories and handle all of your expenditure from one single app.

3. Handbook expense verification

One in 5 expense stories submitted by staff incorporates errors that the finance group must appropriate manually. Already overwhelmed finance groups should sift by way of every report line by line.

Such handbook processes can price companies closely.

Options:

- Use a device that provides real-time visibility of expense claims filed by staff so the finance group doesn’t have to attend until the tip of the month.

- Go for an OCR-based expense verification device that precisely captures, verifies, flags, or approves expense claims.

4. Lengthy reimbursement cycles

Workers shouldn’t have to attend for weeks and months to get reimbursed.

Even when the supervisor approves the declare, the processing and reimbursement are additional delayed, and months go by earlier than the reimbursement hits the checking account.

Options:

- Make pre-approvals a typical norm by asking managers to authorize the spend prematurely with a tailor-made price range.

- Set well-defined timelines for every division and approver, and guarantee they’re adopted meticulously for everybody.

- Equip staff with company bank cards or pay as you go playing cards to scale back the necessity for reimbursements.

5. Fraudulent claims

Expense claims are essentially the most prone to fraud. The enterprise suffers when the handbook auditing fails to flag inflated claims or detect duplicate receipts.

Options:

- Have a exact expense categorization and implement strict compliance with a well-defined expense coverage.

- Preserve a tab on recurring consumer items or client-related reimbursement claims.

- Evaluate spending patterns throughout people, groups, and departments. Have strict spending limits and per diem allowances in place for various classes.

- Verify anomalies associated up to now, receipt ID, and worth in receipts. Adopting an OCR-enabled expense device can flag such situations early on.

- Don’t wait till the tip of the 12 months; carry out shock audits every now and then to catch and stop fraud.

6. Rare expense claims

When staff ship expense stories too late, it hampers the auditing course of. Rare expense claims additionally make it tough for corporations to trace worker spending.

The longer the time between every expense report submission, the longer the approval cycle.

Options:

- Have a fastened periodic expense reporting cycle—ideally biweekly or month-to-month expense reporting with quarterly auditing by the finance division.

7. No real-time expense visibility

Companies depend on a gentle money movement to maintain operations.

An absence of real-time spend visibility hampers the budgeting course of and notably impacts small enterprise house owners.

Options:

- Make pre-approval the norm for some, if not all, expense classes. This may scale back volatility and assist group leads higher handle and make the most of the budgets.

- Use expense software program with an expense dashboard to trace and handle all worker spending in a single place.

8. Lack of compliance

When staff do not perceive the corporate’s reimbursement coverage and tips, they submit incorrect expense claims and expense approvals get delayed.

Such unaware staff make out-of-pocket bills and have their reimbursement claims rejected as a consequence of non-compliance.

Even with a well-defined expense coverage, checking each expense for compliance could be extraordinarily time-consuming and tedious for the finance group.

Options:

- Strictly implement an expense coverage that outlines eligibility, expense classes, spending limits, documentation necessities, and so on., intimately.

- Use built-in controls in your expense device to extend compliance with spend limits or out-of-policy expense classes. For example, your device ought to be capable to add a spend restrict on meal allowances.

- Permit staff to take away or scale back private bills from receipts in expense claims.

For instance, if an expense declare for a resort keep on a enterprise journey contains non-compliant bills like laundry or alcohol for private consumption, staff could be allowed to scale back the equal quantity from the reimbursement declare.

- Guarantee your organization coverage is tax-compliant and up to date periodically.

- Talk your expense coverage often to your staff.

Pattern Worker Enterprise Expense Coverage Template

Use our Worker Enterprise Expense Coverage template to design an excellent expense coverage guaranteeing monetary management and compliance for what you are promoting.

9. Complicated multi-level approval construction

Workers usually want a number of approvals throughout completely different departments for pricey bills or bills that fall beneath a selected class. This could dramatically delay the approval course of.

Options:

- Set up a tradition of accountability to make sure well timed approvals. Guarantee every stakeholder follows correct documentation to have a transparent audit path.

- Have a follow-up mechanism and deviation workflows to make sure your approval course of doesn’t depend on only one or just a few people.

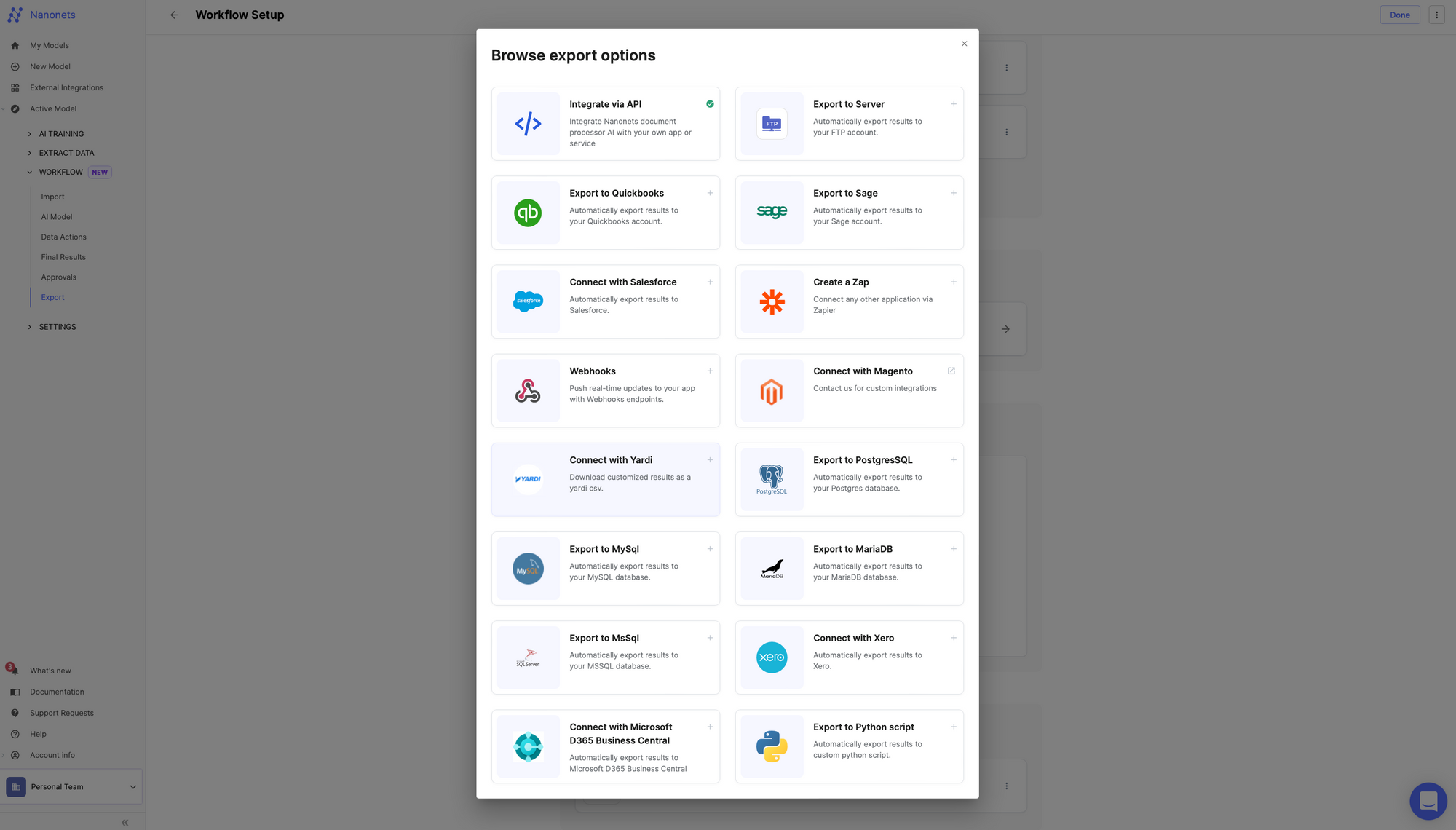

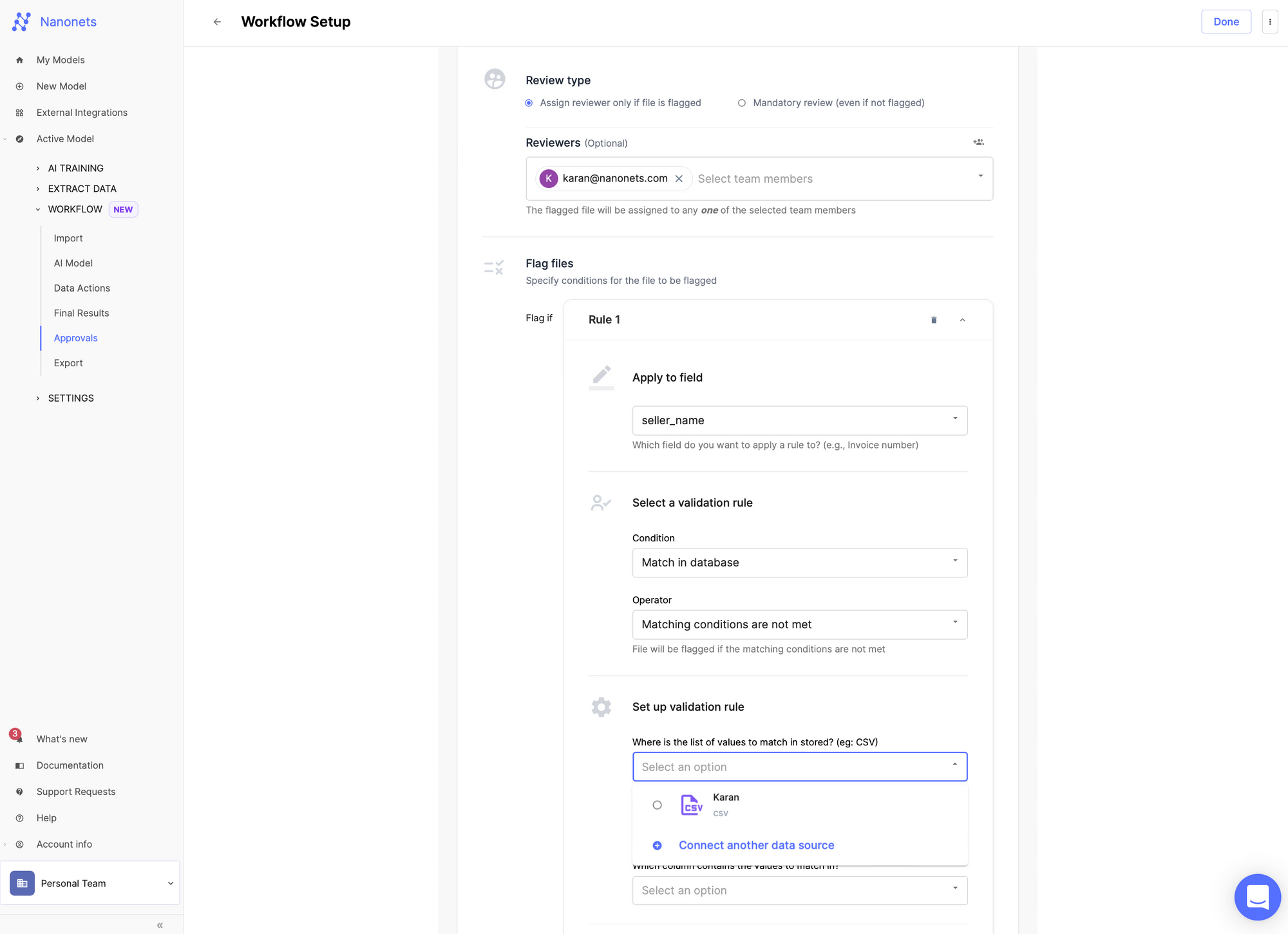

- Automate all multi-level approvals with customizable workflow automation instruments.

10. Lack of integration

Integrating your expense administration instruments with different finance and accounting software program stays difficult for a lot of corporations.

With out correctly implementing integration with all of your pre-existing instruments, automation can create extra points than resolve them and shortly develop into pricey.

Options:

- Guarantee your expense approval system is correctly built-in into your core accounting and ERP software program to work as a unified system.

- Prioritize interoperability and scalability whereas automating any workflow step with a brand new device. The info movement and synchronization should be seamless.

Utilizing AI to streamline expense approval course of

Finance departments have been utilizing synthetic intelligence for a while now, for instance, within the type of OCR-based scanner apps.

Firms are quickly adopting machine studying to coach their fashions to identify fraudulent actions, prepare and adapt to new laws, and develop into compliant.

In expense approvals, the use case for AI/ML is gigantic. Let’s see how you need to use a few of these to streamline your approval course of:

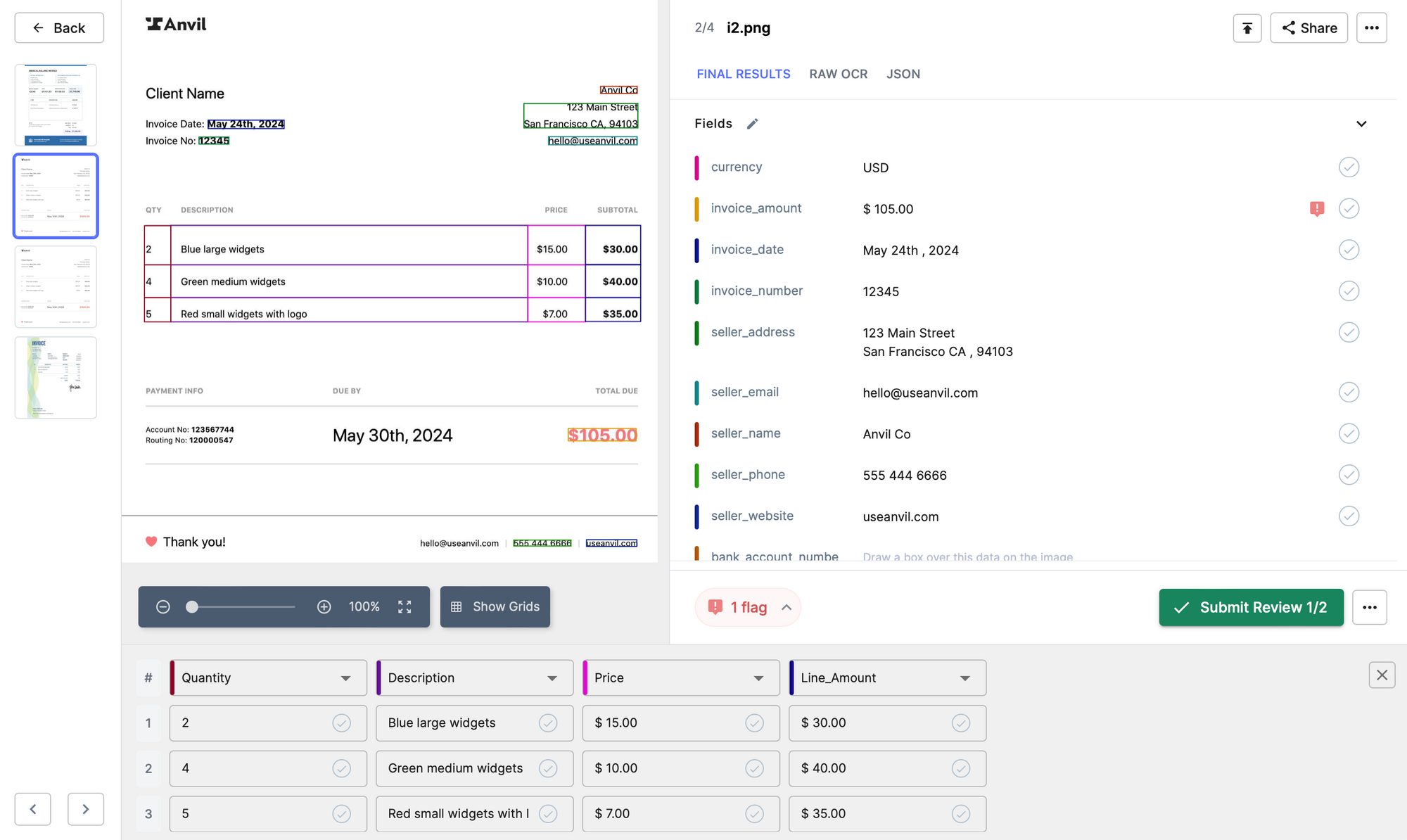

Workers can simply convert receipts and expense claims into readable knowledge utilizing an information extraction device. Such instruments simplify expense submission and verification by populating fields like quantity, date, service provider/vendor knowledge, expense class, and so on.

Utilizing these knowledge extraction instruments, bills could be simply captured from emails, bank card transactions, and even paper receipts utilizing receipt scanner apps.

Approval workflow automation

With automated request submissions and workflows, staff can simply submit and approve spending requests asynchronously. These AI-driven workflows can routinely route and escalate claims to the proper approver primarily based on personalized approval ranges.

Spend administration system

A spend administration system manages worker bills and total firm spending. A platform that utterly integrates with all pre-existing ERP instruments will help you save prices, keep tax and policy-compliant, and handle spending successfully.

Such expense administration software program or spend administration platforms come geared up with functionalities like instantaneous expense stories, customizable dashboards, and real-time analytics that corporations can customise.

Methods to automate expense approval workflows with Nanonets

Nanonets gives an intuitive and user-friendly interface for workers to submit spending requests, connect supporting documentation, and automate your approval course of seamlessly.

Automated receipt seize

Workers snap photographs of their receipts. Nanonets’ OCR know-how immediately captures and digitizes the information.

Generate expense stories simply

The system routinely populates expense stories utilizing the captured knowledge and exports it into your software program of selection.

Arrange personalized approval workflows

Configure your approval workflow and customise deviations as per your expense coverage.

Managers obtain instantaneous notifications, shifting the method alongside on the pace of an e mail. They will evaluate stories extra effectively, aided by AI that flags anomalies or coverage violations.

By implementing Nanonets, corporations remodel their expense approval workflow from a gradual, handbook course of into a quick, automated, and practically easy system.

Ultimate phrase

So there we’ve got it, a whirlwind tour by way of the dynamic world of expense approvals.

Implementing a well-defined expense approval course of is important for corporations to keep up monetary management, mitigate dangers, and guarantee accountable spending practices.

Utilizing the options listed on this article will help you plug within the gaps in your expense administration course of and set up a strong framework for managing approvals.

Incessantly Requested Questions (FAQs)

Q. Which bills require approvals?

A. Usually all enterprise bills incurred by staff should be authorized by their supervisor and the finance division. These bills are normally categorized into journey, meals and leisure, workplace provides, and miscellaneous bills.

Right here’s a complete record of expense classes to make use of.

Q. Who approves bills in an organization?

A. Relying in your firm’s expense coverage, the bills should be authorized by related approvers. Normally these embody your supervisor and the finance division. Relying on different components like sure expense classes or the quantity of expense, the expense approvers can change and contain different individuals.

Q. What’s the technique of expense authorization?

A. The widespread technique of expense authorization requires staff to avoid wasting receipts or related proof of bills and get them authorized by managers and the finance division. In sure circumstances, managers additionally pre-approve bills, and corporations present allowances or pay as you go playing cards to incur bills straight.

Q. How lengthy ought to expense approval take?

A. Expense approvals can take wherever from just a few days to a number of weeks. If the method includes reimbursing the worker, the finance division will confirm and approve the declare. This complete reimbursement course of can take longer and normally goes upto a month.

Firms normally use AI instruments to hurry up the approval course of and slash the approval cycle to some days as an alternative of weeks.

[ad_2]