Monetary doc automation isn’t just altering the sport – it is rewriting the principles.

From multinational banks and massive accounting corporations to native insurance coverage companies and small healthcare suppliers, companies of all sizes course of a whole bunch and 1000’s of economic paperwork day by day. The sheer quantity of paperwork could be overwhelming, time-consuming, and liable to errors.

Enter monetary doc automation, a game-changing resolution revolutionizing how corporations deal with their paperwork, no matter measurement or {industry}.

On this article, you’ll discover ways to arrange environment friendly doc workflows that save time and scale back error, methods to deal with frequent challenges, and automatic instruments for various use circumstances throughout industries.

Monetary doc automation

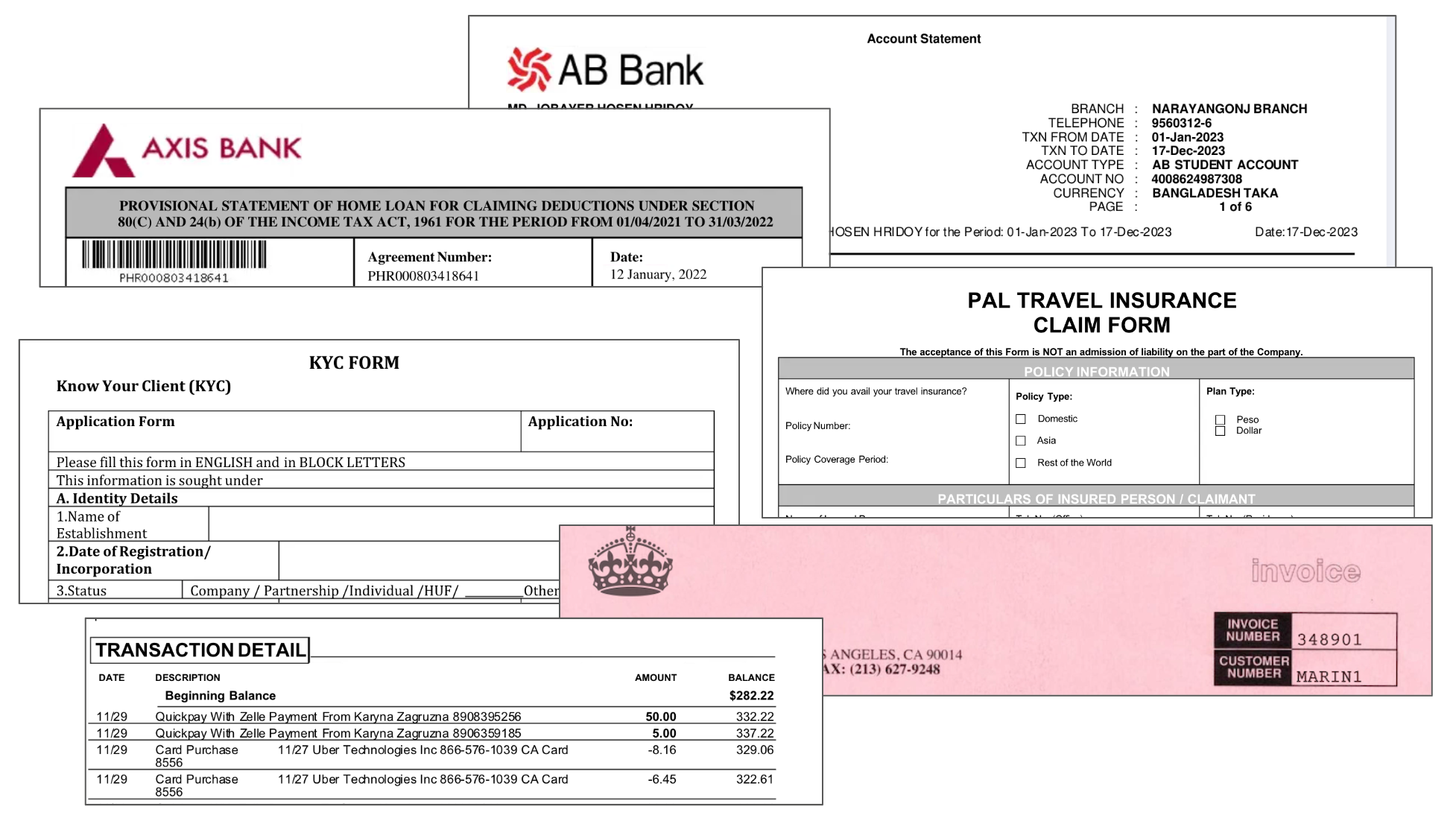

Each firm, no matter its major enterprise focus, offers with finance-related actions. These actions generate many paperwork containing essential monetary knowledge, comparable to invoices, payments, payslips, kinds, KYC paperwork, financial institution statements, asset statements, loans, and tax paperwork.

These paperwork include delicate info, together with personally identifiable info (PII) comparable to shopper and vendor names, addresses, identification numbers, and beneficiary particulars.

For giant corporations with quite a few day by day operations, manually managing this knowledge turns into more and more difficult, time-consuming, and error-prone.

Monetary doc automation is the answer to all these challenges

💡

Doc automation instruments, various in sophistication, can carry out completely different features to streamline accounting and monetary workflows.

How does monetary doc automation work?

To grasp monetary doc automation, let’s take a look at a typical Accounts Payable (AP) course of:

- AP group points a buy order (PO)

- The seller delivers and sends an bill

- AP matches the bill with the PO and supply receipt

- If matched, fee is processed

This guide course of is manageable for small corporations. Nevertheless, as corporations develop, the amount of paperwork will increase exponentially, making guide processing inefficient and error-prone.

Monetary doc automation makes use of applied sciences like superior Optical Character Recognition (OCR), Synthetic Intelligence (AI), and Machine Studying (ML) to streamline these processes.

Guide vs Automation

Let’s evaluate guide vs. automated AP processes:

| Step | Guide Course of | Automated AP Course of |

|---|---|---|

| Bill receipt | PDF in E mail | Any format (PDF, picture) from any supply (Slack, Cloud) |

| Knowledge entry | Guide enter into accounting system | AI-powered automated extraction |

| PO matching | Guide retrieval and comparability | Computerized 2-way, 3-way & 4-way matching |

| Error checking | Guide evaluate | AI-powered validation with flagging for human evaluate |

| Approval routing | Emails with a number of follow-ups | Computerized routing primarily based on predefined guidelines |

| Fee scheduling | Guide entry into fee system | Computerized scheduling primarily based on phrases |

| Doc storage | Bodily submitting or primary digital storage | Clever digital storage with audit path |

Now, let’s perceive the outcomes and RoI in each guide and automatic doc extraction for the above AP course of:

| Metric | Guide course of | Automated extraction with AI |

|---|---|---|

| Processing Time | 1-3 days per bill | 5-10 minutes per bill |

| Error charge | ~4% attributable to guide knowledge entry | <1% with AI validation |

| Value per bill | ~ $10-$15 | ~$2-$3 |

| Scalability | Restricted by human assets | Extremely scalable (1000’s of paperwork) |

| Vendor administration | Reactive, primarily based on points | Proactive, primarily based on knowledge insights |

| Worker focus | Knowledge entry and doc dealing with | Strategic monetary evaluation and vendor relationships |

| Money move visibility | Delayed, primarily based on guide reviews | Actual-time, with predictive analytics |

Easy methods to automate monetary doc workflows

Right here’s how one can arrange and automate any monetary doc workflow utilizing Nanonets:

Step 1: Create an account on Nanonets

Step 2: For widespread monetary paperwork comparable to invoices, receipts, POs, financial institution statements, select a pre-built extractor workflow.

If you wish to arrange a brand new workflow from scratch, select Create your individual workflow and add a brand new doc.

When you doc is getting processed, you possibly can rapidly configure your import and export settings relying on the supply of your paperwork.

Step 3: As soon as the workflow is about up and the doc is processed, evaluate the extracted fields within the doc and approve it as soon as prepared.

Step 4: You can even customise the workflow with completely different actions comparable to:

- Including completely different formatting steps comparable to foreign money detection, change date codecs, scan barcode and QR code, parse URL, LLM knowledge actions, and many others

- Lookup new fields from exterior sources comparable to Accounting software program, database, ERP instruments and

- Organising rule-based approvals by including a number of reviewers, situations for flags and validation guidelines

- Arrange notifications to make sure your group receives well timed reminders by way of Slack and E mail

- Customise import and export from 30+ sources

This lets you arrange custom-made finance doc automation workflow for banking, monetary providers, or any finance processes.

Overcoming considerations and challenges in doc automation

Whereas doc automation comes with compelling advantages, corporations typically face a number of challenges and considerations when implementing these programs. Let’s tackle these points and discover some sensible options:

Accuracy and reliability of economic knowledge

Concern: Monetary knowledge requires 100% accuracy. Even small errors can result in vital monetary discrepancies or compliance points. Whereas automation can deal with customary doc, we encounter distinctive circumstances often which are time-consuming to deal with and likewise increase points.

Options:

- Implement multi-layer verification processes

- Design automation workflows with rule-based paths for exceptions

- Use superior deep studying fashions which are skilled on industry-specific knowledge

- Incorporate human-in-the-loop programs for advanced or high-value transactions

💡

Design your automation workflow with rule-based clear paths for exception dealing with. This not solely improves accuracy but in addition helps in steady enchancment of the system.

Dealing with advanced and various doc codecs

Concern: Monetary paperwork are available a number of codecs, languages, and constructions, making constant knowledge extraction difficult.

Options:

- Make the most of superior OCR and NLP applied sciences that work on advanced paperwork (scanned photos, PDFs with tables, handwritten paperwork)

- Practice fashions on a various set of doc samples

- Implement adaptive studying algorithms that enhance over time

- For template-based automated resolution, present choices for guide template creation

Safety and compliance

Concern: Monetary knowledge is extremely delicate, elevating considerations about knowledge breaches and sustaining compliance with laws.

Options:

- Select a reputed automation instrument that adheres to nationwide and world compliance and regulatory requirements comparable to GDPR, HIPAA, SOC2, ISO 27001, FedRAMP (within the U.S.)

- Implement end-to-end encryption for knowledge in transit and at relaxation

- Use role-based entry management (RBAC) for delicate knowledge

- Commonly conduct safety audits and penetration testing

- Limit unauthorized viewing of confidential paperwork

- Implement strict pointers to guard shopper privateness

- Think about on-premise deployment for extremely delicate knowledge.

Integration with current programs

Concern: Now we have legacy programs (like SAP) and a fancy tech stack, which makes integration difficult.

Options:

- Select an automation resolution with sturdy API capabilities

- Search for pre-built integrations with widespread monetary software program

- Have interaction IT groups early within the implementation course of

- Implement the change progressively, beginning with much less essential processes

- Practice your employees with environment friendly onboarding

💡

There are various middleware options that corporations also can quickly use for advanced integrations.

Use circumstances of economic doc automation

Doc automation within the realm of finance and accounting is utilized in many sectors. Let’s discover potential use circumstances and advantages in several industries:

Banking and monetary providers

This sector offers extensively with monetary issues and handles an infinite quantity of finance-related paperwork pertaining to clients, organizations, and inner processes.

Monetary doc automation is essential to ease worker stress, enhance customer support, scale back turnaround instances, and improve regulatory compliance.

Insurance coverage {industry}

The insurance coverage sector is one other subject devoted to monetary issues. Automation instruments for dealing with insurance-related paperwork can assist with fast info extraction and validation, elevated underwriting capability, correct danger evaluation, and quicker declare processing, leading to faster payouts for policyholders and extra environment friendly operations.

Accounting and auditing corporations

Accounting corporations and departments in massive companies routinely deal with paperwork with essential monetary knowledge. They’re chargeable for vendor funds, sustaining transaction information, auditing, taxation, and regulatory compliance.

Automating doc processing permits these corporations to rapidly extract monetary knowledge from numerous sources, carry out audits with fewer guide steps, and generate reviews mechanically.

Actual property and property administration

Doc automation can assist actual property corporations course of massive volumes of property knowledge. This makes lease abstraction and property valuation extra environment friendly with quicker lease processing, improved accuracy in key knowledge level extraction, and higher portfolio administration. It additionally permits for faster property value determinations and improved administration of consumers, properties, and monetary information.

Healthcare

Healthcare is a sector that offers with a big number of delicate paperwork, each monetary and non-financial. Aside from affected person knowledge, there’s payroll administration for medical and non-medical employees, infrastructure-related paperwork, and different monetary transactions. Doc automation helps healthcare establishments retailer correct affected person information, course of claims extra rapidly and precisely, and allow quicker affected person onboarding and transitions.

Manufacturing and provide chain

Within the manufacturing and provide chain sector, doc automation can considerably enhance accuracy in stock administration, scale back processing instances for buy orders and invoices streamline operations, streamline high quality management processes and improve traceability within the provide chain.