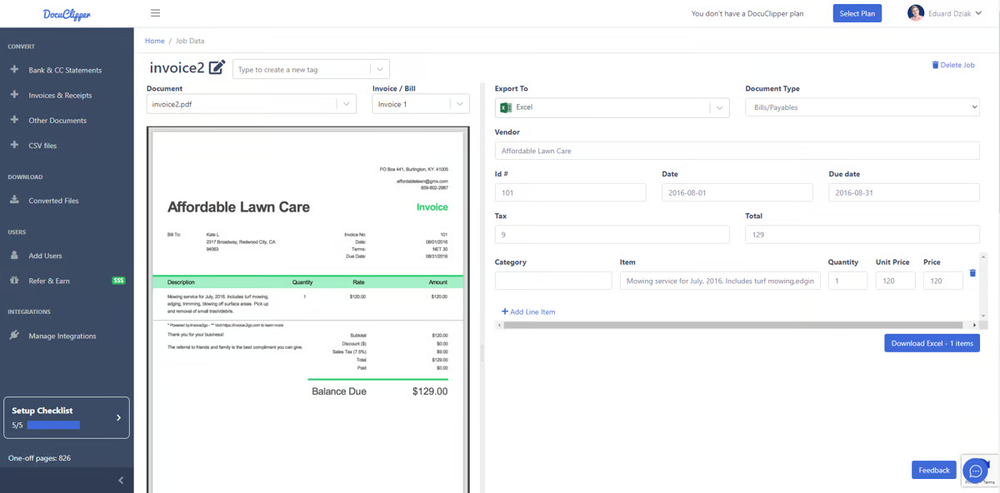

DocuClipper is an OCR-powered financial document processing tool that converts bank statements, credit card statements, invoices, receipts, and brokerage statements into Excel, CSV, or accounting software-ready formats. The software stands out for its ability to handle even poor-quality documents while maintaining high accuracy in data extraction.

DocuClipper helps you:

- Match and check bank transactions

- Organize your transactions into categories

- Makes data entry quick and painless

- Handles poor-quality documents well

- Converts multiple statements in seconds

- Provides accurate data extraction

- Works with most bank formats

- Send data to your accounting software

Current pricing starts at $39/month for 200 pages, with professional plans at $74/month for 500 pages and business plans at $159/month for 2000 pages.

While DocuClipper serves its core purpose, businesses often look for alternatives due to:

- You need better connections with ERP systems

- You want to scan documents with your phone

- You’re processing complex documents

- You need simpler document management

- You need more workflow automation features

- Your industry needs specific features

This comparison examines ten DocuClipper alternatives that might better suit your document processing needs.

DocuClipper competitors: A quick comparison

| Tool | Primary use case | AI-powered learning | Custom document types | Key advantage | Best for | G2 rating (Max 5) |

|---|---|---|---|---|---|---|

| DocuClipper | Financial document conversion for accounting | No | No | Accuracy, speed | SMBs, accountants | 4.8 |

| MoneyThumb | Bank statement conversion & fraud detection | No | No | Fraud detection, reconciliation | Lenders, accountants | NA |

| ProperSoft | Offline transaction file conversion | No | No | Offline use, one-time purchase | Individuals, small businesses | 4.4 |

| AutoEntry | Automated data entry for accounting | No | Yes | Ease of use, accounting integration | SMBs, accounting firms | 3.8 |

| Hubdoc | Automated document fetching & archiving | No | Yes | Automated fetching, Xero integration | Xero/QBO users | 4.3 |

| Nanonets | Automating complex document workflows | Yes | Yes | Automation, versatility, multi-language | Enterprises, high-volume processing | 4.8 |

| Docparser | Custom data extraction from documents | No | Yes | Customizability, flexibility | Tech-savvy users, custom needs | 4.6 |

| Dext Prepare | Receipt & invoice processing | No | Yes | Multiple capture methods, expense management | Businesses, accountants | 4.5 |

| FineReader PDF | Digitizing, OCR, and PDF editing | Yes | Yes | High OCR accuracy, PDF editing | General document needs, multi-language | 4.5 |

| ScanWriter | Forensic accounting & investigations | No | No | Audit trails, security, local storage | Investigators, agencies | NA |

Now, let’s explore each alternative in detail.

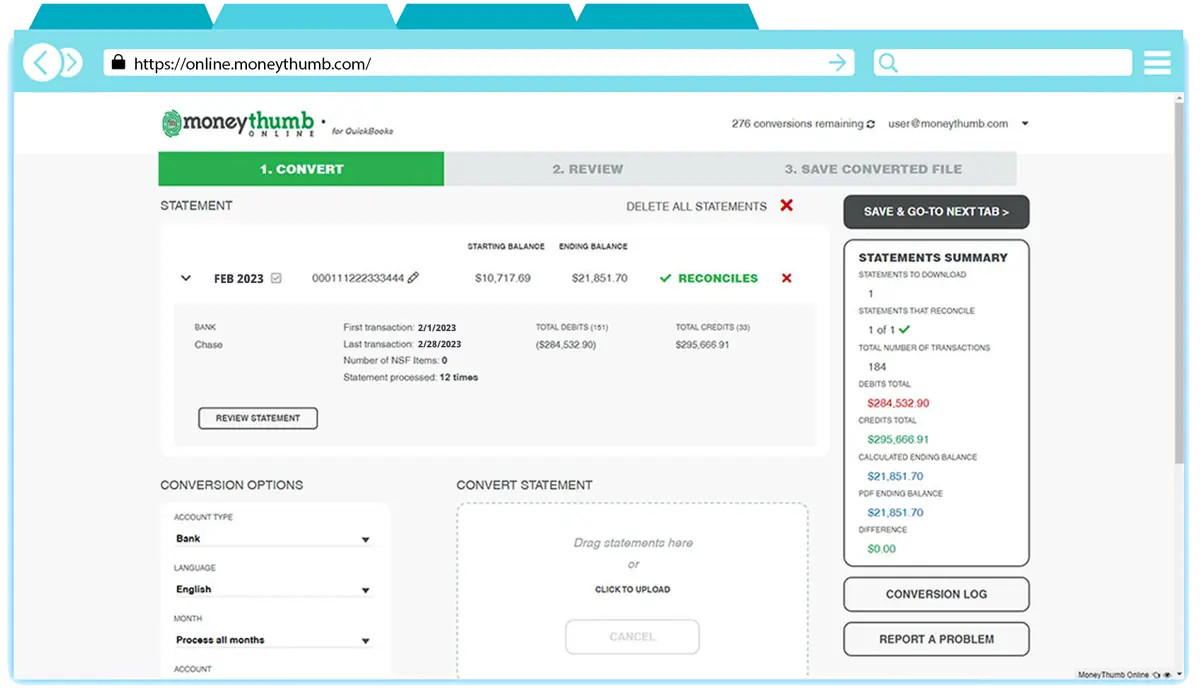

1. MoneyThumb

MoneyThumb offers specialized tools for converting and analyzing financial documents, serving both accounting professionals and financial institutions. It offers specific solutions for different financial workflows, such as determining loan applicant creditworthiness and evaluating PDF authenticity for lending decisions.

Key features:

1. Converts bank statements from PDF to QBO, QFX, OFX, and CSV formats

2. Verifies document authenticity through Thumbprint technology

3. Cleans up and standardizes payee names automatically

4. Reconciles statements to ensure accuracy

5. Handles both text and image-based PDFs

6. Supports multiple financial institutions

Pricing: Individual plan at $24.95/month for 5 conversions, the Standard plan at $49.95/month for 20 conversions, and a Pro plan at $99.95/month for 60 conversions.

| Pros of MoneyThumb | Cons of MoneyThumb |

|---|---|

| Dramatically reduces data entry time | Desktop-based with installation limitations |

| High accuracy in statement conversion | Learning curve for new users |

| Built-in reconciliation checks | Some bank format compatibility issues |

| Works with various statement formats | Annual renewals for certain features |

| Strong fraud detection capabilities | Limited automation options |

| Quick processing of multiple statements |

Best for: Accounting professionals, lenders, and small to medium-sized businesses that regularly process bank statements and need reliable format conversion with fraud detection capabilities.

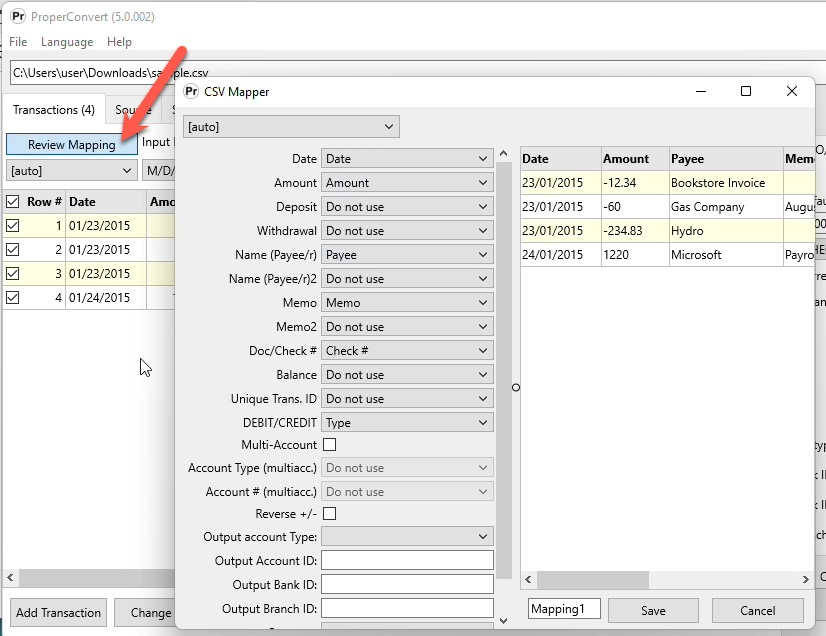

2. ProperSoft

ProperSoft is a desktop-based solution that helps convert financial transaction files between different formats. It works offline, giving users direct control over their data. The focus is specifically on file format conversion for accounting software compatibility.

Key features:

1. Converts bank and credit card statements from multiple formats (CSV, Excel, PDF, QFX, QBO, MT940)

2. Integrates with QuickBooks, Quicken, Xero, and Sage

3. Automatic format detection for dates and numbers

4. Custom payee name rules

5. Offline processing

Pricing: Starts at $19.99 per month for one user, with a free trial available and one-time purchase options also offered. Team plan for 3 users is priced at $49.99/month.

| Pros of ProperSoft | Cons of ProperSoft |

|---|---|

| Works offline without internet dependency | Learning curve for initial setup |

| Responsive customer support | Some accuracy issues with PDF conversions |

| Saves significant time compared to manual entry | Basic interface that needs updating |

| Supports a wide range of file formats | Limited automation options |

| One-time purchase option offers long-term cost saving |

Best for: Individual users, small businesses, and accounting professionals who require offline file conversion, value direct control over their data, and prefer a one-time purchase option for long-term cost savings.

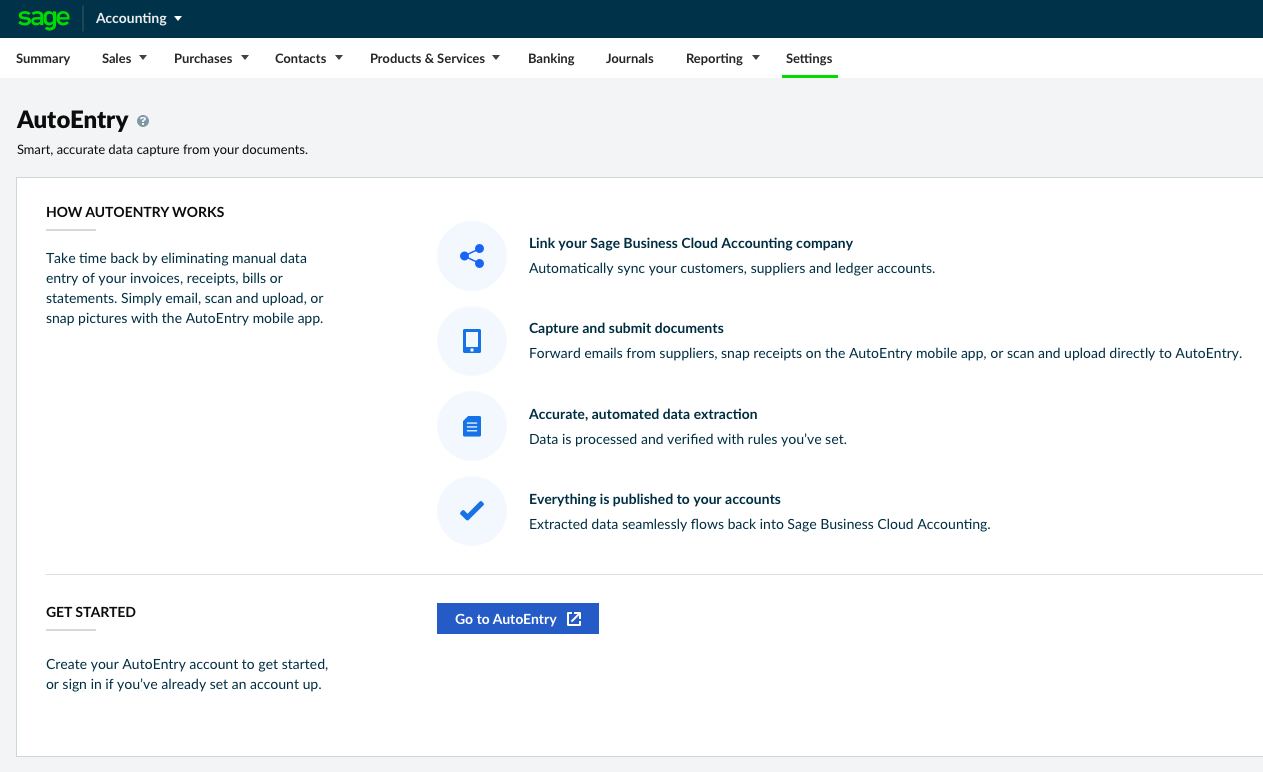

3. AutoEntry by Sage

AutoEntry is a data automation tool that helps businesses extract information from financial documents and sync it with accounting software. It’s particularly popular for its integration with major accounting software and its ability to reduce manual data entry.

Key features:

1. Extracts data from receipts, invoices, and bank statements

2. Mobile app for document scanning

3. Automated data categorization and rules

4. Integration with major accounting software

5. Multi-currency supportLine-item extraction capability

6. Supplier statement reconciliation

Pricing: Credit-based pricing, with plans ranging from Bronze (50 credits for $12/month) to Sapphire (2500 credits for $450/month). The per-credit cost decreases with higher-tier plans. A free trial with 25 credits is also available.

| Pros of AutoEntry | Cons of AutoEntry |

|---|---|

| Significant time savings on data entry | Processing times can be inconsistent |

| High accuracy for standard documents | Sync issues with accounting software |

| Easy integration with accounting software | Learning curve for advanced features |

| Good at remembering recurring transactions | Credits expire if not used |

| Helpful customer support via chat | Mobile app can be unreliable |

| Mobile app for on-the-go scanning | Occasional delays in document processing |

Best for: Accounting firms, bookkeepers, and small to medium-sized businesses (SMBs) looking to automate financial document processing and reduce manual data entry.

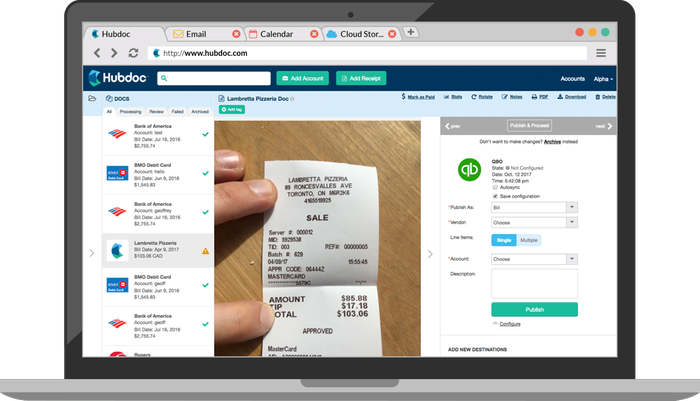

4. Hubdoc from Xero

Hubdoc is a cloud-based document management platform that simplifies data capture and organization. It imports bank statements and other financial documents, automatically extracting key data and syncing it with accounting software such as QuickBooks and Xero.

Key features:

1. Mobile app for document scanning

2. Custom email address for forwarding documents

3. Automatic data extraction using OCR

4. Integration with major accounting software

5. Cloud storage and backupDocument organization and search

6. Multi-user collaboration

Pricing: A single plan for $12 per month after a free trial.

| Pros of Hubdoc | Cons of Hubdoc |

|---|---|

| Easy document upload through multiple methods (email, mobile app, scanner) | OCR accuracy issues with complex documents |

| Strong integration with accounting software like Xero and QuickBooks | Processing delays and sync problems |

| Effective document organization and storage | Mobile app can be unreliable |

| Good for team collaboration | Limited bulk editing capabilities |

| Time-saving automated data extraction | Some users report duplicate document issues |

| Helpful for maintaining audit trails |

Best for: Small to medium-sized businesses and accounting firms that primarily use Xero or QuickBooks Online and need a simple solution for collecting, storing, and managing financial documents.

5. Nanonets

Nanonets is an AI-powered document processing platform designed to automate data extraction and workflow automation. Unlike DocuClipper, which focuses on pre-built models for financial documents, Nanonets allows users to train custom deep learning models and handle a wider variety of document types.

Key features:

1. AI-powered OCR and deep learning models

2. Custom model training and zero-shot learning capabilities

3. Multi-language support (40+ languages)

4. API integration options

5. Workflow automation tools

6. Pre-built templates for common documents

Pricing: The starter plan offers pay-as-you-go pricing with $0.3/page after first 500 free pages. Contact the sales team for the enterprise plans.

| Pros of Nanonets | Cons of Nanonets |

|---|---|

| Reduces manual data entry by up to 90% | Relatively expensive for low-volume needs |

| Strong customer support during implementation | Learning curve for complex use cases |

| Handles complex document types well | Some UI/UX improvements needed |

| Regular platform improvements | |

| Flexible customization options | |

| Suitable for high-volume processing |

Best for: Medium to large enterprises processing high volumes of varied document types and needing highly customizable extraction capabilities through custom model training.

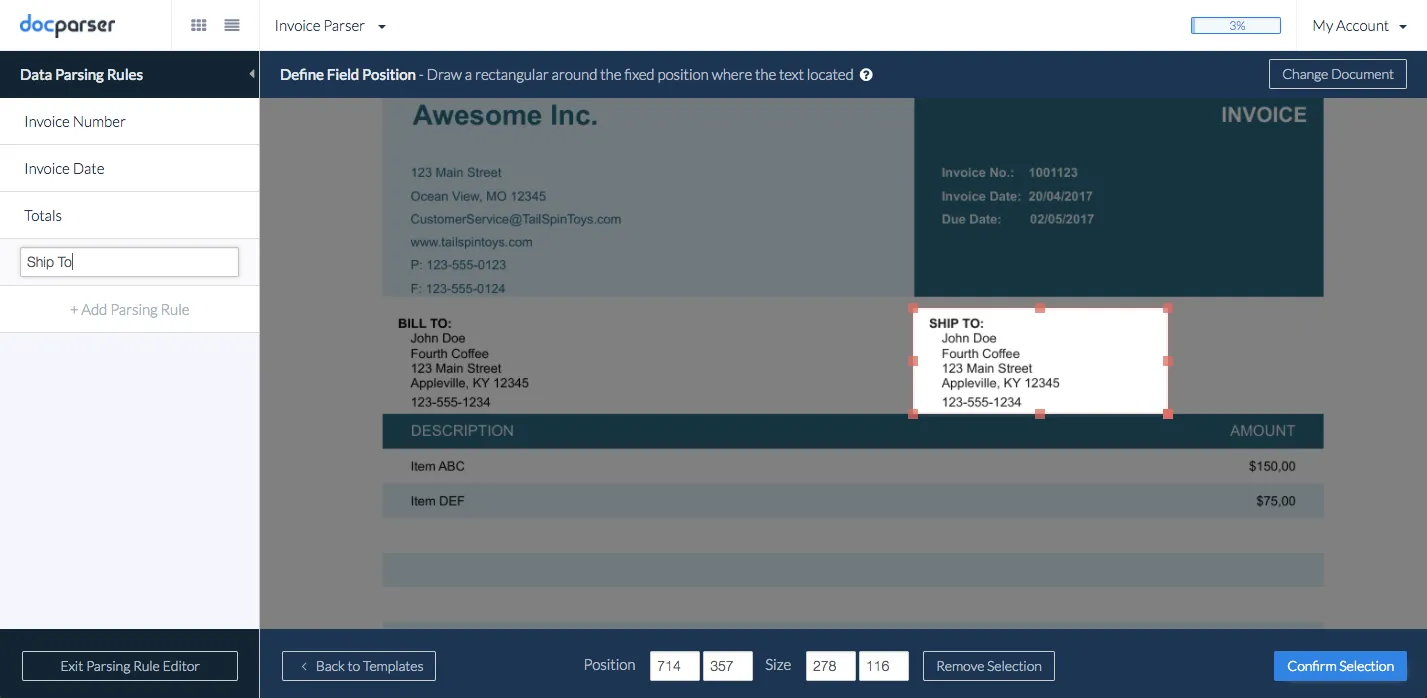

6. Docparser

Docparser is a document parsing tool that uses OCR and custom rules to extract data from various document types — bank statements, invoices, receipts, and more. It converts these documents into formats like Excel and CSV, and integrates with accounting platforms such as QuickBooks, Xero, and Sage, simplifying financial data management for businesses.

Key features:

1. Custom parsing rules using Zonal OCR

2. Supports multiple document formats (PDF, Word, images)

3. Integrations with various platforms through Zapier and other tools

4. Table data extraction capabilities

5. Document routing functionality

Pricing: Docparser offers a credit-based pricing model, with plans starting at $32.50/month for 1,200 annual parsing credits. For unlimited credits, you may need to buy the custom Enterprise plan. A 14-day free trial is available.

| Pros of Docparser | Cons of Docparser |

|---|---|

| Highly customizable parsing rules for specific needs | Significant learning curve for setting up parsing rules |

| Wide range of integration options | Manual rule creation required for each document type and layout |

| Strong customer support | Can be complex for non-technical users |

| Accurate data extraction when rules are properly configured | Limited AI/ML capabilities compared to more advanced solutions |

| Handles multiple document layouts with custom rules | Initial setup and rule configuration can be time-consuming |

| Offers time-saving automation for document processing | Credit-based pricing can be limiting for high-volume processing |

Best for: Businesses that require highly customizable document parsing solutions and have the technical resources to set up and maintain parsing rules.

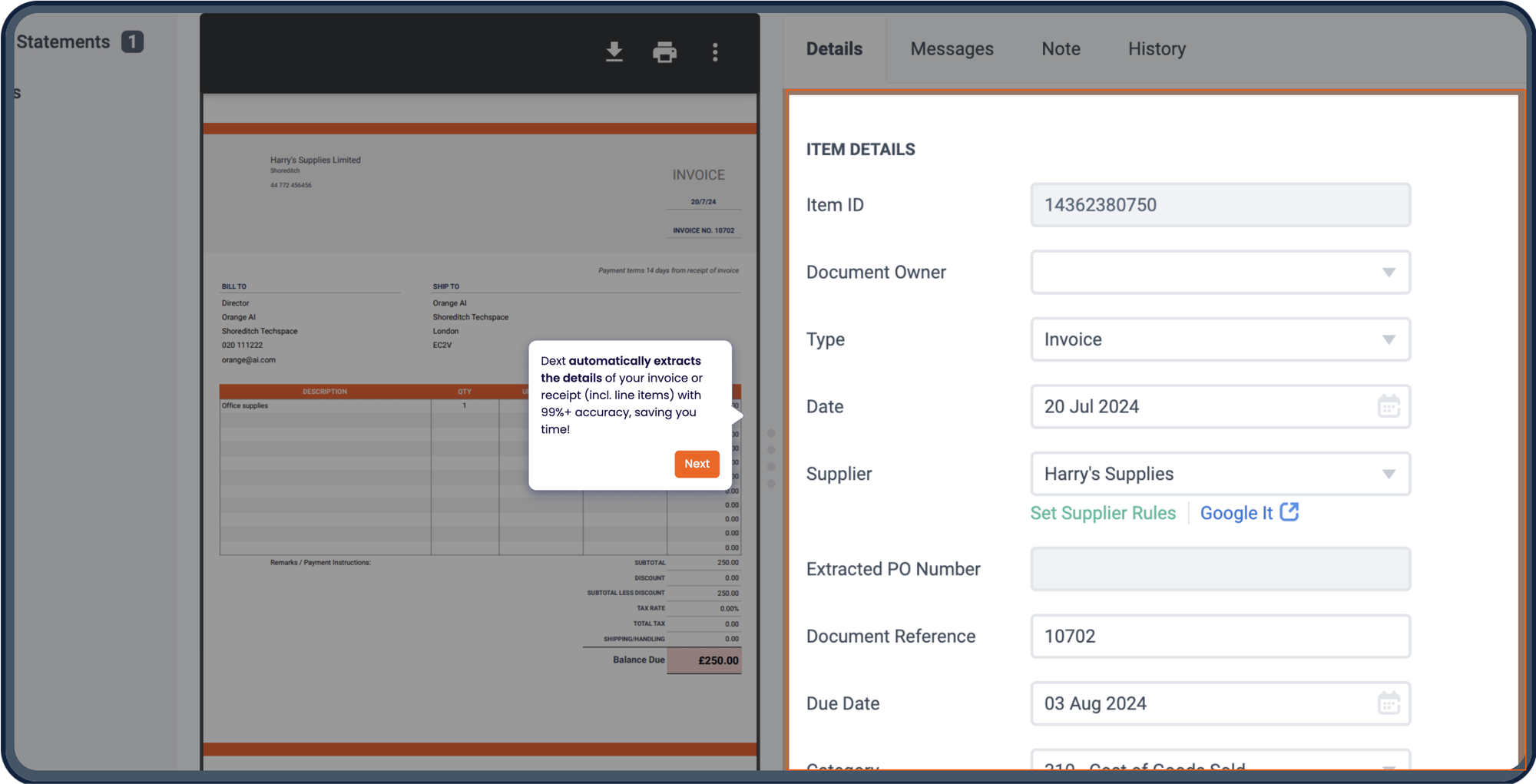

7. Dext Prepare

Dext Prepare is a cloud-based document management solution that automates financial data collection and entry. It offers a broader approach to document processing with particular strength in receipt and invoice management.

Key features:

1. Multiple capture methods (mobile app, email, upload, bank feeds, invoice fetch, bank statements)

2. Automatic data extraction

3. Integration with major accounting software (Xero, Sage, QuickBooks, IRIS)

4. Supplier rules and auto-publishing

5. Expense management tools

6. Connects with 11,500+ financial institutions

Pricing: Dext Prepare offers subscription-based pricing starting at $229.99/month (USD) for 10 clients with unlimited users. Pricing may vary by region. A free trial is available.

| Pros of Dext Prepare | Cons of Dext Prepare |

|---|---|

| Significant time savings on data entry | Bank statement processing needs improvement |

| Easy document submission through multiple channels | Duplicate detection is not very robust |

| Strong accounting software integration | Mobile app requires extra steps |

| Effective supplier rules for automation | Multi-page PDF handling can be problematic |

| Good receipt matching capabilities | |

| Helpful for audit documentation |

Best for: Businesses and accountants who need comprehensive document processing, especially those with a strong emphasis on receipt and invoice management.

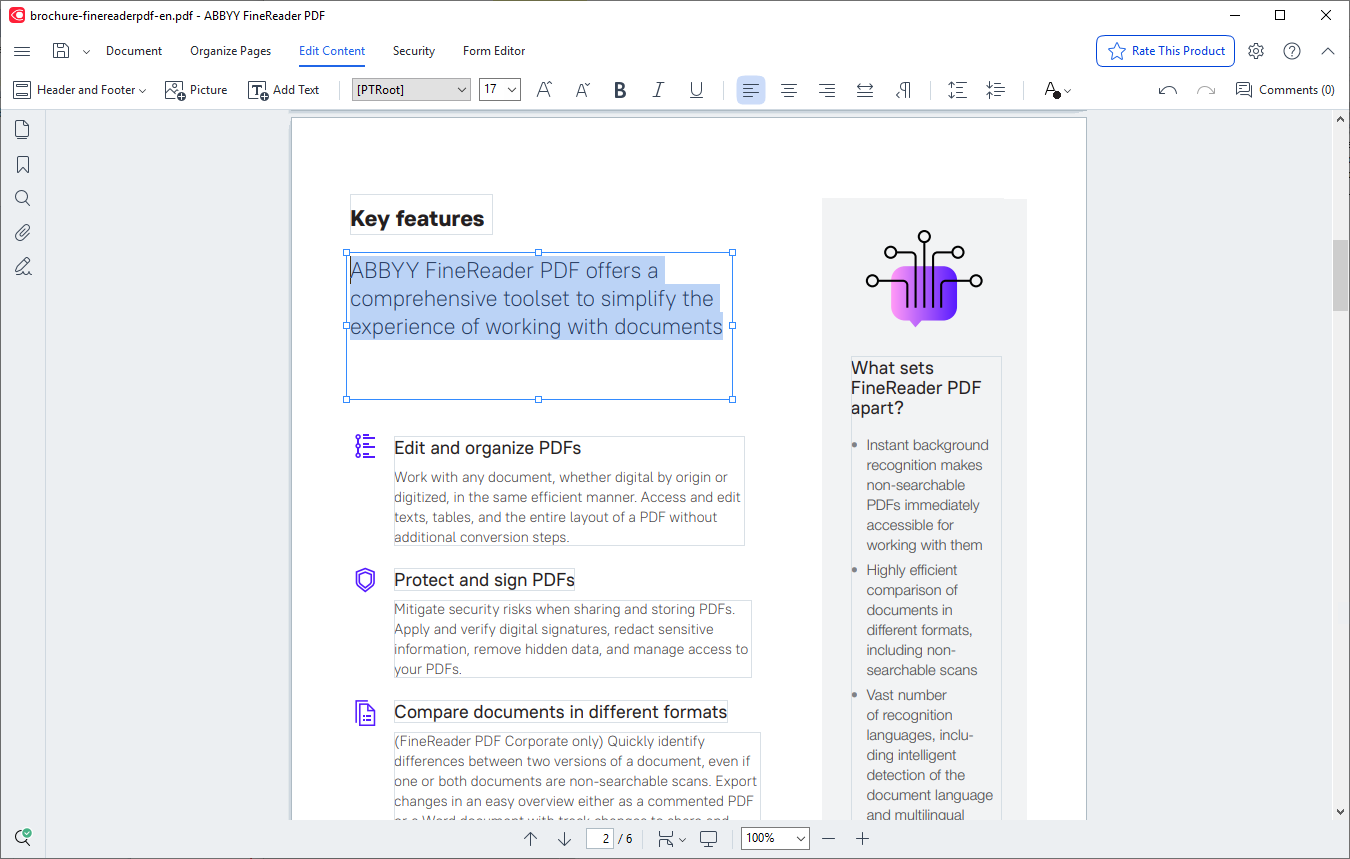

8. ABBYY FineReader PDF

ABBYY FineReader PDF is an OCR and document processing software offering a wide range of functionalities, from digitization and editing to PDF management and collaboration. It provides broader capabilities for working with various document types, including scanned documents and images.

Key features:

1. Document digitization and editing

2. Multiple language support

3. PDF management tools

4. Mobile scanning capabilities

5. Cross-platform compatibility

Pricing: FineReader offers a flexible licensing options including per workstation, per named user, and concurrent user models, available in Standard and Corporate editions. For exact prices, contact their sales team.

| Pros of ABBYY FineReader | Cons of ABBYY FineReader |

|---|---|

| High accuracy in text recognition | Not specialized for financial documents |

| Supports multiple languages | OCR issues with handwritten text |

| Good for poor quality documents | Limited accounting software integration |

| Easy document collaboration | Can be slow with large documents |

| Mobile scanning option | More expensive for business use |

| Comprehensive PDF editing | Steeper learning curve |

Best for: Large businesses needing comprehensive document digitization, OCR, and PDF editing capabilities.

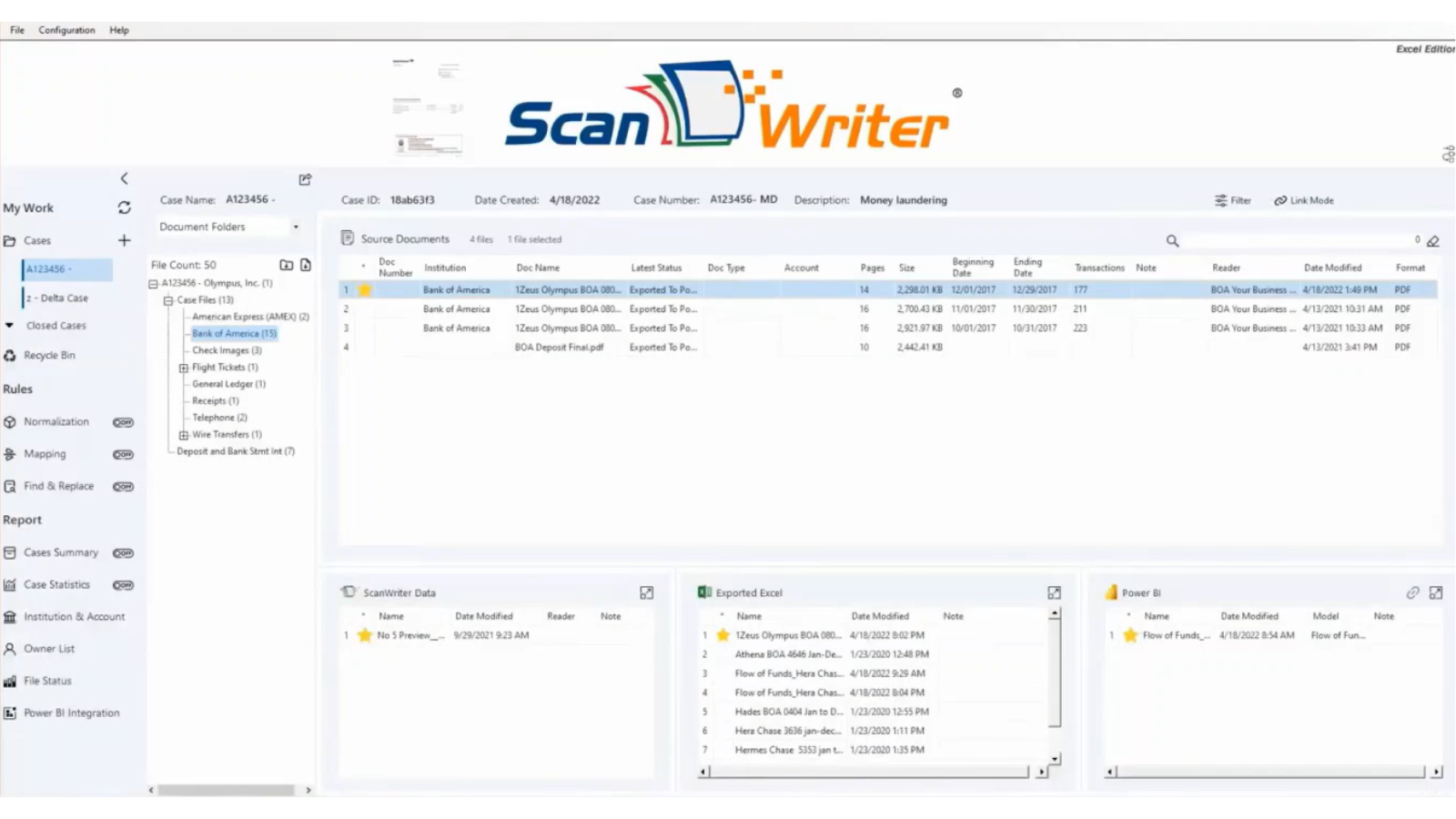

9. ScanWriter

ScanWriter is a desktop-based financial document processing tool designed specifically for forensic accountants and investigators. It focuses on local processing with a strong emphasis on audit trails and fraud detection.

Key features:

1. Converts bank statements, checks, and other financial documents to Excel

2. Built-in fraud detection tools

3. Flow of funds visualization

4. Complete audit trail tracking

5. Local file storage for security

6. QuickBooks and Excel integration

Pricing: You can get the Standard License for a one-time fee of $5,495, plus an annual maintenance fee of $3,230.

| Pros of ScanWriter | Cons of ScanWriter |

|---|---|

| High accuracy in data capture | Significant upfront investment and annual maintenance fee |

| Comprehensive audit trail capabilities | Desktop-based limitations |

| Enhanced security with local file storage | Steep learning curve |

| Extensive institution support | Some QuickBooks integration issues |

| Powerful data visualization features for analysis | Processing speed can vary depending on document complexity |

| Fast processing of large volumes of checks | Installation required |

Best for: Forensic accountants, fraud investigators, government agencies, and accounting firms handling complex financial investigations. It is best suited for medium to large organizations due to the pricing structure.

Why choose Nanonets Over DocuClipper?

| Criteria (Weightage) | DocuClipper | DocuClipper Score | Nanonets | Nanonets Score |

|---|---|---|---|---|

| AI-Powered Learning (5) | Rule-based OCR; manual setup | 0 | Deep learning; automates complex tasks | 5 |

| Handles Varied Document Types (5) | Primarily financial documents | 5 | Handles various document types | 5 |

| Cost-Effective (5) | Yes, for high volumes | 5 | Yes, for high volumes | 5 |

| Handles Unstructured Data (5) | No | 0 | Yes | 5 |

| Handles Text-Heavy Documents (5) | Yes | 5 | Yes | 5 |

| Requires Manual Intervention (4) | Yes | 0 | Yes, for custom models | 0 |

| Combines Data from Multiple Sources (3) | Yes, within documents | 3 | Yes, across systems | 3 |

| On-Platform Human QA (3) | Yes | 3 | Yes | 3 |

| Indexes & Stores Documents (3) | Yes | 3 | Yes | 3 |

| Handwriting Recognition (3) | No | 0 | Yes, limited accuracy | 3 |

| Workflows & Integrations (2) | Basic | 2 | Advanced | 2 |

| Document Classification/Routing (2) | Yes | 2 | Yes | 2 |

| TOTAL SCORE (45) | 28 | 41 |

While DocuClipper offers solid capabilities for financial document processing, Nanonets is a more versatile and powerful solution, particularly for businesses looking to scale their document processing operations. The key differentiator lies in Nanonets’ AI-driven approach versus DocuClipper’s more traditional OCR-based system.

Smarter technology, better results

DocuClipper’s rule-based OCR requires manual setup for each document type. Nanonets uses AI and deep learning to automate this process, handling unstructured data and different layouts without constant rule adjustments. This saves time and reduces manual errors, especially as your document volume grows.

Handle any document type

While DocuClipper focuses on financial documents, Nanonets can handle any document type you may get— contracts, claims, purchase orders, you name it. Got international documents? Nanonets can process in 40+ languages and even read handwriting. Your team won’t need different tools for different document types.

Scale without the headaches

Both tools handle the basics well — combining data, checking quality, and routing documents. But here’s where Nanonets pulls ahead: it gets smarter with every document you process. No need to update rules or create new templates as your business grows. The system adapts automatically. Moreover, its advanced workflows, API access, and custom model training capabilities help you scale your document processing without increasing manual effort.

FAQs

Is DocuClipper free to use?

No, DocuClipper is a subscription-based software. Pricing starts at $39/month for the Starter plan, which includes 200 pages. A free trial is available, though.

Yes, DocuClipper is a legitimate OCR software company specializing in financial document automation. It’s used by businesses of all sizes and integrates with accounting software like QuickBooks, Xero, and Sage. However, if you need more advanced features like AI-powered learning, handling of varied document types, or better scalability, exploring alternatives like Nanonets or Docparser might be beneficial.

DocuClipper is OCR software designed to automate data extraction from financial documents, including bank statements, invoices, receipts, checks, credit card statements, and brokerage statements. It converts these documents into Excel, CSV, or QBO formats for easy import into accounting platforms. Key features include bank reconciliation, transaction categorization, and flow of funds analysis.

What software converts bank statements to Excel?

Several software options automate bank statement conversion to Excel, streamlining financial data analysis. However, these tools often handle more than just conversion; for instance, Nanonets can automate bank statement retrieval from email, cloud, or your bank’s system, convert them to Excel, and send the extracted data to your accounting software or ERP — all with minimal human intervention.