[ad_1]

The shortage of staff has lengthy been the first labor concern for U.S. hoteliers, even earlier than the onset of the COVID-19 pandemic. Traditionally, jobs within the lodging trade have had a unfavourable notion as being too bodily demanding, requiring excessively lengthy hours, and requiring work on weekends and holidays. The scarcity of personnel was exaggerated throughout 2021 and 2022 as lots of the staff that have been laid off through the pandemic in 2020 opted to not return to the trade.

The problem of attracting employees to fill line-level positions inside accommodations lessened considerably in 2023. Reductions in resort facilities and companies, extra environment friendly use of know-how, longer lengths-of-stay, and enhanced coaching have enabled accommodations to function with fewer staff than they’ve prior to now. Alternatively, government committee-level positions are staying open for file intervals of six months or longer, in lots of circumstances negatively impacting efficiency.

Whereas accommodations have tailored to decrease ranges of candidates and staffing, new labor-related points have surfaced as a problem to house owners and operators:

- Hourly wage charges and salaries are rising at a tempo larger than income.

- The unfavourable trade perceptions are making it laborious to retain proficient staff and fill administration positions.

- The youthful workforce is looking for employers that provide versatile work hours and areas, in addition to an organization that’s delicate to environmental, social, and governance points.

- Scarcity of expertise on the government committee degree is placing upward strain on a number of the highest salaries in a resort and impacting efficiency as a result of key positions staying vacant for longer intervals.

The affect of those points was evident within the 2023 working statements of U.S. accommodations. For the 12 months, we noticed rising labor prices, declines in bonus funds, decreased use of leased labor, and implied decrease ranges of staffing.

To investigate current developments in U.S. resort labor prices, we examined the 2023 wage, wage, and worker profit expenditures of two,456 accommodations that participated in CBRE’s Tendencies within the Resort Business survey as of March 2024. In 2023, these properties averaged 221 rooms in measurement, with a mean occupancy degree of 68.8 p.c and an ADR of $220.01.

Salaries and Wages

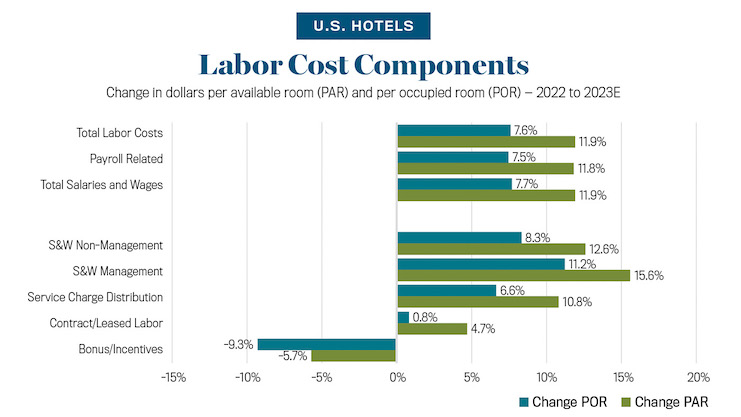

Complete labor prices for the survey pattern elevated by 11.9 p.c from 2022 to 2023. Through the 12 months, salaries and wages (11.9 p.c development) and worker advantages (11.8 p.c) grew at comparable charges.

The best proportion enhance in labor prices was seen within the meals and beverage (F&B) division (14.5 p.c). F&B income lagged in 2021 and 2022, however the return of group demand in 2023 stimulated an increase in banquet income. Elevated F&B quantity in each retailers and catering contributed to the rise in F&B labor prices.

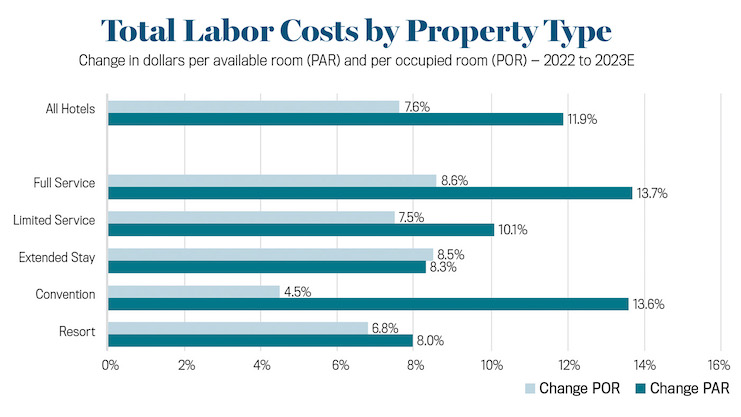

The relative restoration of property sorts additionally influenced their wants for workers. The return of group demand, together with restricted will increase in particular person enterprise vacationers, helped increase the labor prices of conference (13.6 p.c) and full-service (13.7 p.c) in 2023.

These labor value development charges are larger than the 8.6 p.c rise in whole resort revenues and the ten p.c enhance in whole working and undistributed bills throughout the identical interval. Accordingly, labor as a p.c of income elevated from 31.4 p.c in 2022 to 32.4 p.c in 2023. As a p.c of bills earlier than gross working earnings, labor prices grew from 50.9 p.c to 51.7 p.c.

From 2022 to 2023, the salaries paid to managers elevated extra (15.6 p.c) in comparison with the full wages paid to non-management staff (12.6 p.c). The rise in administration salaries could be partially attributed to the elevated problem of retaining managers.

Staffing

Whereas whole labor expenditures are rising, it seems that staffing ranges are down. Combining CBRE Tendencies information with data from the Bureau of Labor Statistics, we estimate that the common resort in our pattern operated with 5.9 p.c fewer staff in 2023 than in 2019. Over that four-year interval, whole labor prices elevated by 17.7 p.c, whereas the common hourly compensation charge for a hospitality worker grew by 29.4 p.c. This pattern of decrease staffing ranges has been verified throughout conversations with our shoppers.

Different Compensation

Moreover salaries and wages, the CBRE Tendencies survey tracks three further compensation subcategories inside every working and undistributed division of a resort. These subcategories are according to the eleventh version of the Uniform System of Accounts for the Lodging Business (USALI):

- Service Cost Distribution

- Contract, Leased, or Outsourced Labor

- Bonuses and Incentives

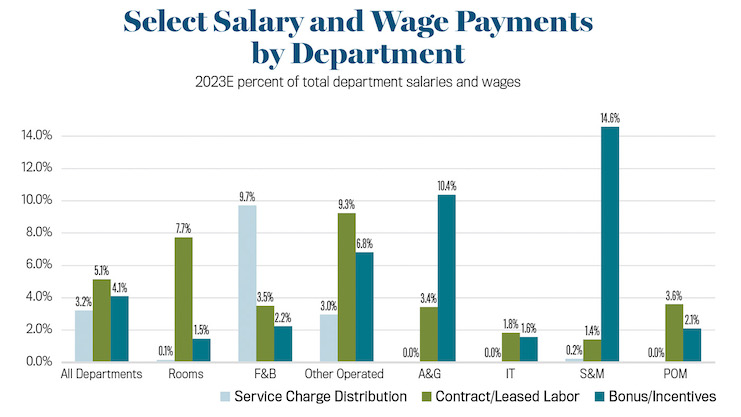

Funds made to non-management staff from necessary service-charges elevated probably the most (10.8 p.c) amongst these three subcategories throughout 2023. To spice up revenues and worker pay through the trade restoration, accommodations have elevated the usage of necessary service-charges within the F&B and different operated departments (spa, golf, and many others.).

Whereas the funds made to contract and leased staff elevated by 4.7 p.c in 2023, this value as a p.c of whole salaries and wages declined through the 12 months. This means much less of a dependence on the usage of this costly supply of staffing. Nonetheless, this assertion doesn’t maintain true for sure markets the place company labor continues to be predominant and dear.

As anticipated, bonus and incentive funds are most often discovered within the administrative & common and gross sales & advertising and marketing departments. The slowdown in tempo of income and revenue development from 2022 to 2023 resulted in a decline of 5.7 p.c in bonus/incentive funds.

Not Only a Price

Staff are usually not simply the best expense for accommodations, however they’re additionally an integral a part of the product and repair providing. Rising labor prices are usually not simply influenced by rising wage charges, but in addition adjustments in resort facilities and companies, the usage of know-how, visitor preferences, and worker wants and wishes. Accordingly, managing labor expense isn’t just a operate of controlling prices. It additionally requires a holistic understanding of operational and societal elements.

[ad_2]