[ad_1]

Introduction

Accounts Payable (AP) are short-term obligations that an organization owes to its collectors or suppliers, however firm has not but paid for them. On an organization’s steadiness sheet, payables are recorded as a present legal responsibility.

Understanding Accounts Payable: Is it a debit or a credit score?

To raised perceive AP, we should first know the fundamental idea of debits and credit.

What are debits and credit?

Debit and credit score are the 2 important accounting phrases it’s essential to know to grasp the double-entry accounting system. A double-entry accounting system information every transaction as a debit or a credit score. This ensures that the books are all the time balanced.

In easy phrases, debits are quantities owed to somebody and credit are quantities somebody owes you.

Debit and credit score are phrases utilized in finance to point adjustments in account balances. Debiting an account entails recording an quantity owed or subtracted, which decreases the account steadiness.

Conversely, crediting an account entails recording an quantity added or deposited, which will increase the account steadiness. In essence, debiting reduces the steadiness whereas crediting will increase it.

Journal Entries for Debits and Credit

Journal entries are created in accounting methods to file monetary transactions. Debits and credit should be recorded in a sure order in an accounting journal entry. Debits and credit in an accounting journal will all the time seem in columns subsequent to 1 one other. As ordinary, debits shall be proven on the left and credit on the precise. When recording a transaction, it’s all the time essential to place knowledge within the correct column.

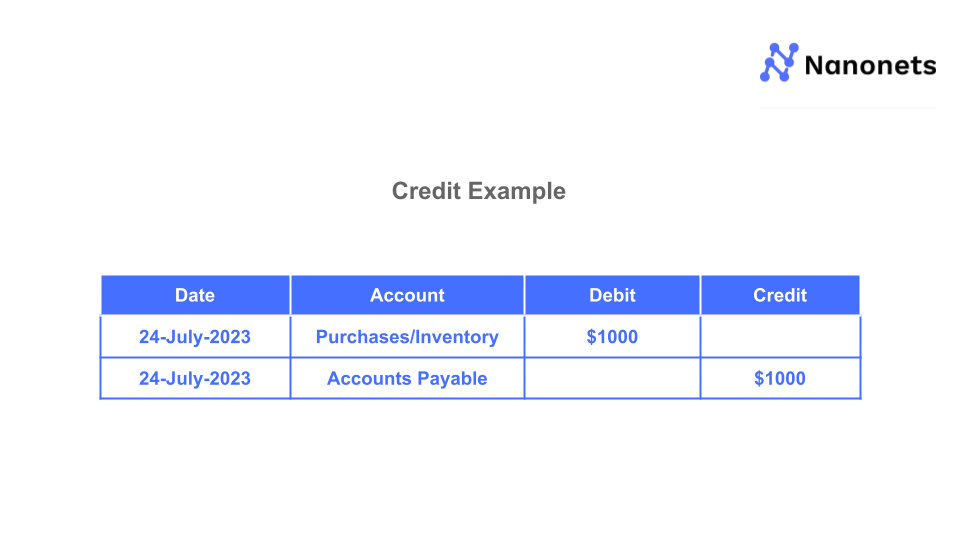

Credit score Instance:

If the corporate buys a laptop computer for its staff for $1000, following is how it will likely be recorded:

1. Purchases or Stock account shall be debited by $1000

2. Accounts Payable shall be credited with $1000

Right here is the double entry for purchasing something on credit score:

Firms usually discuss with the identify of the seller from whom they’ve made purchases fairly than the “Account payable” account when recording monetary transactions. As a substitute of holding all of the balances underneath a single account, it allows them to handle their Accounts Payable balances extra effectively.

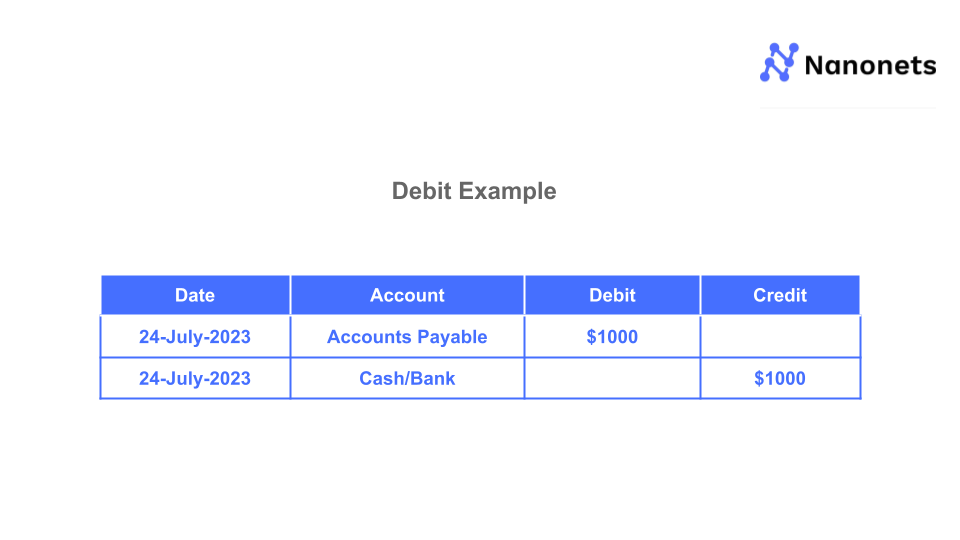

Debit Instance:

After the enterprise has settled its debt of $1000 to the seller, it’s required to file the transaction as follows:

1. Accounts Payable account shall be debited by $1000

- Money or financial institution transfers are the 2 most typical strategies that companies use to make a debit to Accounts Payable. That account shall be credited with $1000

Consequently, the double entry for the payback of Accounts Payable ought to seem like this.

What’s Account Payable?

Merely put, An organization’s Accounts Payable consists of any excellent payments for buy of products or companies from its distributors. Accounts Payable is a legal responsibility since it’s a debt.

A credit score steadiness in a payable account implies that the corporate owes cash, whereas a debit steadiness signifies that the corporate has settled its money owed to a specific vendor. Subsequently, the traditional steadiness of Accounts Payable is destructive.

Is Accounts Payable debit or credit score?

To reply the query, Accounts Payable are thought-about to be a kind of legal responsibility account. Because of this when cash is owed to somebody, it’s thought-about to be credit score. However, when somebody owes you cash, it’s thought-about to be a debit. On this case, Accounts Payable could be categorised as a debit.

Relying on the character of the transaction, Accounts Payable could also be recorded as a debit or a credit score. Accounts Payable is a legal responsibility; therefore any progress in that quantity is usually credited. Accounts Payable are sometimes credited when an entity receives fee however debited when the corporate is launched from its authorized obligation to pay the debt.

Accounts Payable are a kind of legal responsibility, that means they’re a debt your organization owes. Liabilities are often recorded as a credit score in your steadiness sheet. Nevertheless, Accounts Payable will also be thought-about a debit, relying on the way you construction your chart of accounts.

Credit score purchases are essentially the most frequent supply of credit score in AP. When a enterprise makes use of credit score to purchase provides, the transaction is recorded in Accounts Payable.

Conversely, a debit in Accounts Payable usually outcomes from money being refunded to suppliers, lowering liabilities. Debits in Accounts Payable may also outcome from reductions or product returns.

Accounts Payable are thought-about a legal responsibility, which suggests they’re sometimes recorded as a debit on an organization’s steadiness sheet. Nevertheless, the account could also be recorded as a credit score if an organization makes early funds or pays greater than is owed.

Automate knowledge seize, construct workflows and streamline the Accounts Payable course of in seconds. No code is required. Ebook a 30-min stay demo now. Automate bill funds with AI.

Recording Account Payable – Examples

The next examples ought to make it clearer how the entries within the journal are to be made for the Account Payable.

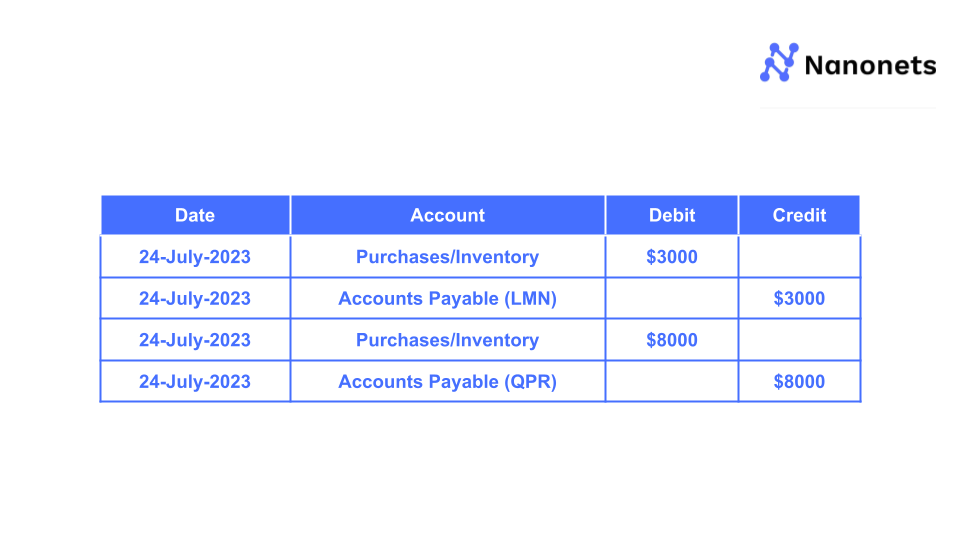

Instance 1:

One enterprise, XYZ Firm, purchases from one other firm, LMN Co., for a complete of $3000 price of merchandise. Moreover, it purchases from a unique provider, QPR Co., totalling $8,000 price of things. These two purchases are being made utilizing credit score for one month. The next are the double entries that should be accomplished for the acquisition that was constructed from LMN and QPR Firm:

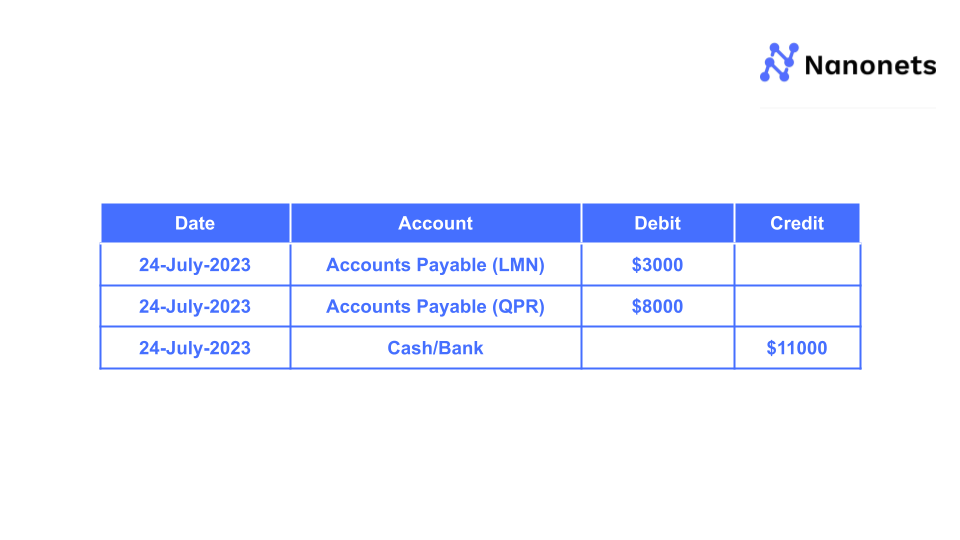

After a month has handed, XYZ Firm makes a compensation to LMN and QPR Firms for the acquisition made above. The financial institution or money supply of XYZ Firm is used to make a debit to Accounts Payable. The next is the compound accounting entry that ought to be made to each Accounts Payable ledgers.

This entry nullifies the steadiness in suppliers’ ledgers, i.e., Accounts Payable (LMN) and Accounts Payable (QPR). The closing steadiness on the finish of the monetary yr shall be zero per these two transactions.

While you pay your lease, you debit your account with the cash you owe. So, when monitoring transactions in a double-entry accounting system, consider debits as cash flowing out of an account and credit as cash flowing into an account. This may initially appear complicated, however it should develop into clear when you begin working with examples. Let’s take a better take a look at what these phrases imply and the way they work collectively within the accounting system.

Instance 2:

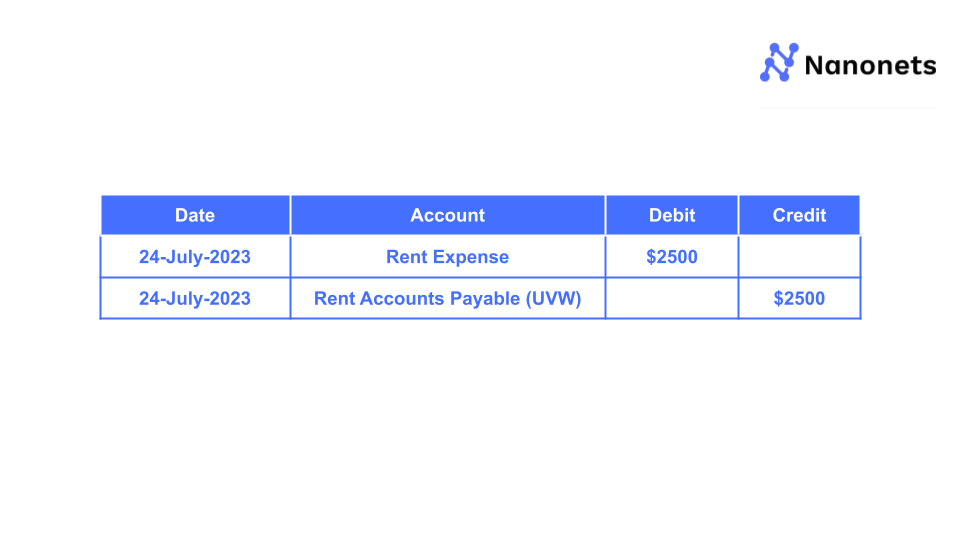

XYZ agency has moved its day-to-day enterprise actions right into a location rented from UVW firm at the price of $2,500 monthly for the house. XYZ Firm is paying lease to UVW Firm.

On an accrual foundation, the fee of the overdue quantity takes place after the rental service has been accomplished. This means that first, the service is loved, after which the fee for it’s made after it has been supplied for a month.

The next is how the double entry for the rental service seems for the corporate that was purchased from UVW:

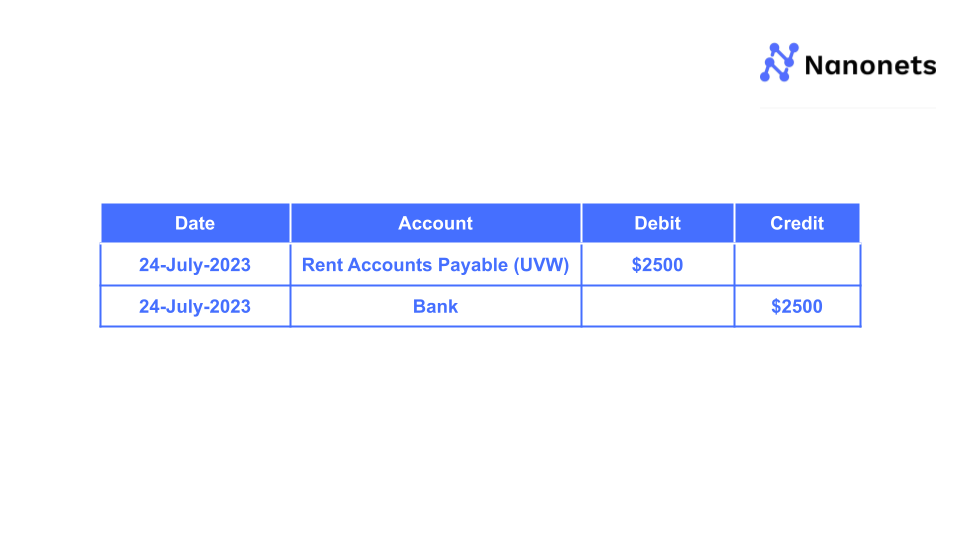

After a month, UVW will obtain the overdue sum of $2,500 in fee. The submission should be made within the following format:

What is supposed by a “Turnover Ratio” for Accounts Payable?

An organization’s short-term liquidity could also be evaluated by calculating a ratio referred to as Accounts Payable turnover. This ratio represents the typical tempo at which a enterprise pays again its suppliers. The Accounts Payable turnover ratio is a statistic companies use to gauge how effectively they’re clearing off their short-term debt.

The next is the system that ought to be used to calculate the Accounts Payable turnover ratio:

AP Turnover Ratio = Web Credit score Purchases/Common Accounts Payable

In sure calculations, the numerator is not going to embody internet credit score purchases; fairly, it should utilise the price of items bought. The overall Accounts Payable firstly of an accounting interval and Accounts Payable after the interval are added collectively after which divided by 2.

gauge the monetary well being based mostly on Turnover Ratio?

Collectors can gauge the corporate’s short-term liquidity and, by extension, its creditworthiness based mostly on the Accounts Payable turnover ratio. If the share is excessive, consumers pay their bank card distributors on time. Suppliers could also be pushing for quicker funds, or the agency could also be attempting to make the most of early fee incentives or elevate its creditworthiness if the determine is excessive.

A low proportion suggests a sample of late or nonpayment to distributors for credit score transactions. This is perhaps due to good lending situations or a sign of money move points and a deteriorating monetary state of affairs. Though a falling ratio might counsel monetary hassle, that isn’t all the time the case. The enterprise could have negotiated extra beneficial fee situations that can allow it to delay funds with out incurring any further charges.

Suppliers’ credit score phrases usually decide an organization’s Accounts Payable turnover ratio. Firms that may negotiate extra beneficial lending preparations usually report a decrease ratio. Massive firms’ Accounts Payable turnover ratios could be decrease as a result of they’re higher positioned to barter beneficial credit score phrases (supply).

Firms ought to use the credit score phrases prolonged by suppliers to their benefit to obtain reductions on purchases, although a excessive Accounts Payable turnover ratio is usually fascinating to collectors as signaling creditworthiness.

When analyzing an organization’s turnover ratio, you will need to accomplish that within the context of its friends in the identical business. If, as an example, nearly all of an organization’s rivals have a payables turnover ratio of no less than four-figure, the two-figure determine for the hypothetical firm turns into extra worrisome.

Arrange touchless AP workflows and streamline the Accounts Payable course of in seconds. Ebook a 30-min stay demo now.

Automating the Accounts Payable course of

Automating the Accounts Payable course of could be a good way to save lots of time and scale back errors. By automating the method, companies can keep away from manually inputting knowledge and be certain that all invoices are paid on time. Moreover, AP automation will help companies preserve monitor of spending, as all transactions shall be recorded in a single place.

As a enterprise proprietor, you recognize that some of the essential — and time-consuming — job is paying your payments on time. However what if there have been a option to automate this course of?

Enter Nanonets. Nanonets is an AI-powered Accounts Payable resolution that makes it straightforward to automate your invoicing and funds. With Nanonets, you’ll be able to take a photograph of your invoice and have it mechanically processed — from extraction of crucial knowledge to scheduling funds and updating your accounting software program — that means you’ll be able to spend much less time on paperwork and extra time operating your corporation.

Nanonets on-line OCR & OCR API have many fascinating use circumstances that might optimize your corporation efficiency, save prices and enhance progress. Discover out how Nanonets’ use circumstances can apply to your product.

[ad_2]