In right this moment’s advanced monetary panorama, companies are drowning in a sea of financial institution statements. In 2022, a staggering 98.6% of People held transaction accounts, producing an unprecedented quantity of economic information.

For companies processing hundreds of financial institution statements every day—from insurance coverage corporations to monetary establishments, financial institution assertion processing presents a problem and a fair greater alternative for automation.

Conventional guide processing and reconciling, which consumes a median of 10-12 hours per week, is now not an possibility. It typically results in errors, delays, and missed insights, making assertion administration a logistical nightmare.

On this article, we’ll discover purposes of AI and automation for financial institution assertion processing. We’ll additionally information you thru establishing an environment friendly financial institution assertion processing system and share finest practices to rework this information flood right into a strategic asset.

What’s financial institution assertion processing?

Financial institution assertion processing is extracting and analyzing monetary information on financial institution statements.

- It includes extracting key particulars from financial institution statements, resembling transaction quantities, dates, descriptions, account balances, payee names, account numbers, and transaction varieties (e.g., debit or credit score, and many others.

- The financial institution extract data is then transformed right into a structured format for these and different accounting operations.

- The extracted information is then despatched for financial institution assertion evaluation, additional processing, and accounting.

Financial institution assertion processing is crucial for correct reconciliation, auditing, and monetary reporting.

Lately, AI-powered software program instruments utilizing pure language processing (NLP) and machine studying (ML) have revolutionized this course of.

These instruments allow companies to course of statements sooner and extra precisely by automating transaction information extraction, categorization, and evaluation. The result’s improved effectivity and scalability in monetary operations, decreasing human errors and saving time for higher-value monetary duties.

Steps in financial institution assertion processing

Let’s have a look at the steps concerned in financial institution assertion processing.

Gathering financial institution statements

Financial institution statements are available in varied codecs, resembling electronic mail attachments, PDFs, bodily copies, or spreadsheets, every requiring a special strategy.

Historically, accountants and bookkeepers manually enter information from these financial institution statements into their accounting software program.

💡

1. Use an automatic centralized platform for information standardization and extraction.

2. Guarantee all related data is accessible in a single place for environment friendly processing and evaluation.

3. Guarantee all statements are correctly scanned and readable.

4. Preserve an environment friendly audit path for future retrieval.

Information extraction instruments routinely extract pertinent data from financial institution statements utilizing machine learning-enhanced optical character recognition (OCR) expertise.

These instruments can establish key particulars resembling transaction dates, quantities, and descriptions, decreasing the effort and time spent on guide information entry.

These instruments come in several codecs, like template-based information extraction instruments, which work finest on constant financial institution assertion templates and superior AI-powered OCR software program.

💡

1. Implement automated information extraction answer with extremely correct OCR.

2. Frequently prepare the ML-powered information extraction device to enhance recognition capabilities and obtain increased accuracy.

3. Guarantee compatibility with a number of assertion codecs for seamless integration (applies to template-based information extraction instruments).

4. Monitor extraction accuracy and implement suggestions loops to enhance the method repeatedly.

5. Arrange rule-based workflows to establish and take away any duplicate entries and human evaluation for advanced or ambiguous transactions.

Reconciliation

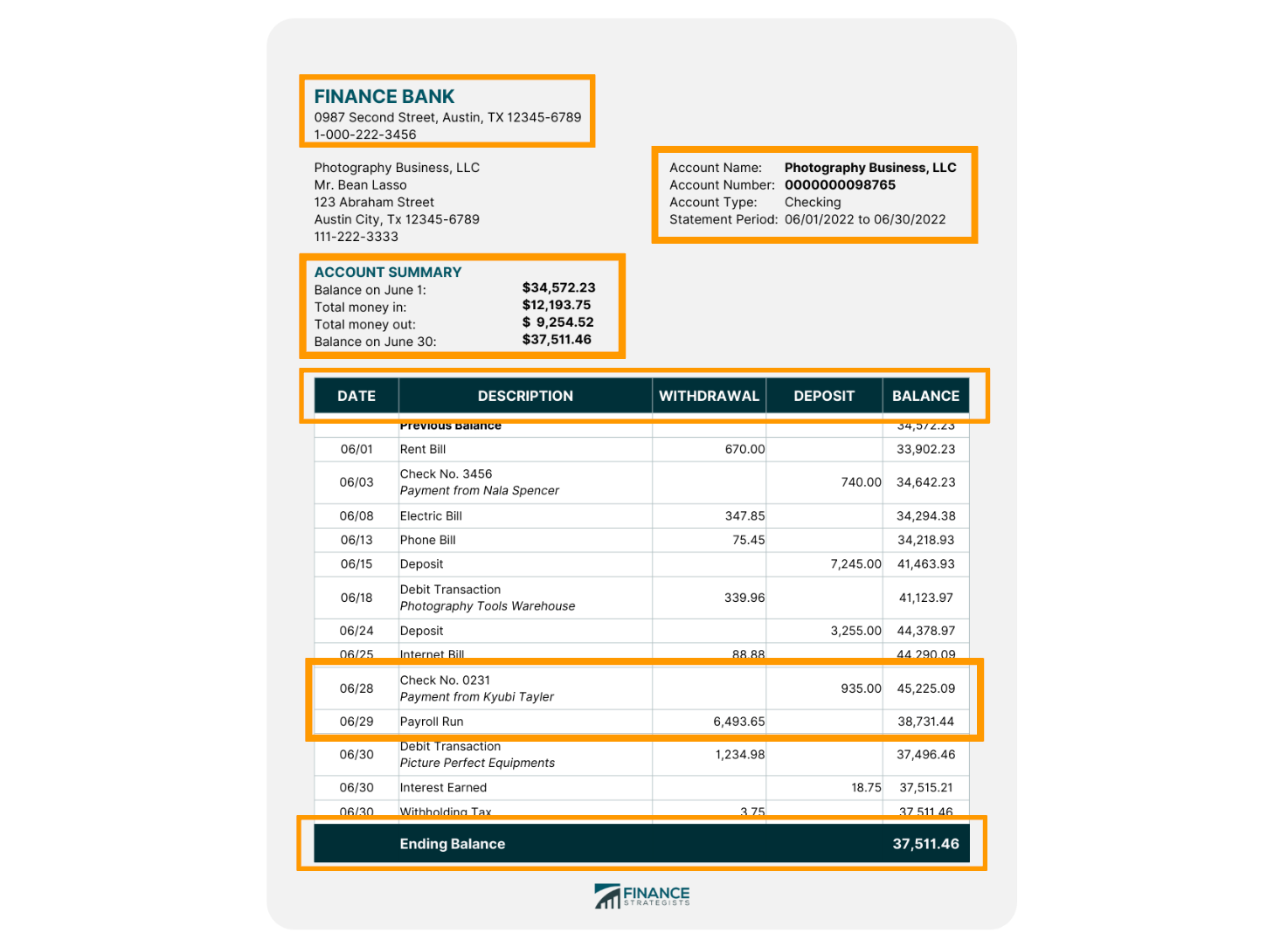

This step includes matching the extracted information with the corporate’s inside data.

As an example, if the financial institution assertion exhibits a $1,000 deposit on a particular date, it matches the corresponding entry within the accounting data. AI and machine learning-enhanced instruments can carry out these comparisons shortly and precisely.

💡

1. Totally automate the reconciliation course of, together with import and information matching.

2. Use superior matching engines to create customizable match guidelines.

3. Frequently analyze causes for variances (for eg: format variations, fraud, duplicate data)

Discrepancy identification

Throughout reconciliation, any mismatches are flagged for additional evaluation. For instance, if the financial institution assertion lists a $200 withdrawal not recorded within the firm’s books, this discrepancy have to be recognized and addressed promptly.

💡

1. Allow automated flagging alerts for discrepancies.

2. Implement reporting mechanisms to streamline the identification course of.

3. Guarantee points are resolved effectively and well timed.

Changes

As soon as the accounting group identifies and explains discrepancies, they make the mandatory changes. As an example, if an error within the recorded quantity of a transaction is found, the accountant corrects it within the accounting system to make sure accuracy.

💡

1. Set up a structured adjustment course of with thorough documentation.

2. Use accounting software program with built-in monitoring for all changes.

3. Incorporate peer critiques to boost accountability.

4. Frequently prepare employees on adjustment procedures to reduce errors.

Transaction evaluation

After reconciliation, companies typically analyze the transaction information for insights. Reviewing spending patterns can reveal constant overspending in sure classes, prompting a evaluation of buying practices.

💡

1. Use monetary analytics instruments that combine along with your financial institution assertion processing platform to investigate transaction information for traits.

2. Give attention to key efficiency indicators (KPIs) resembling spending patterns and money move.

3. Create visible experiences and dashboards for stakeholders to interpret simply.

Reporting

Lastly, the processed information is summarized into experiences highlighting the group’s monetary standing. These experiences can embrace insights on money move, expenditures, and general monetary well being, offering stakeholders with a transparent understanding of the corporate’s monetary place.

💡

1. Develop customizable experiences that spotlight key monetary metrics.

2. Automate reporting instruments for well timed and common report era.

3. Frequently evaluation reporting codecs to align with organizational objectives.

AI in financial institution assertion processing

Synthetic Intelligence (AI) has reworked financial institution assertion processing, making it sooner, extra correct, and able to dealing with massive information volumes. AI-powered techniques are revolutionizing how companies categorize transactions, detect fraud, and keep monetary accuracy.

Here is a better have a look at the AI-enhanced applied sciences that play a key position in trendy financial institution assertion processing:

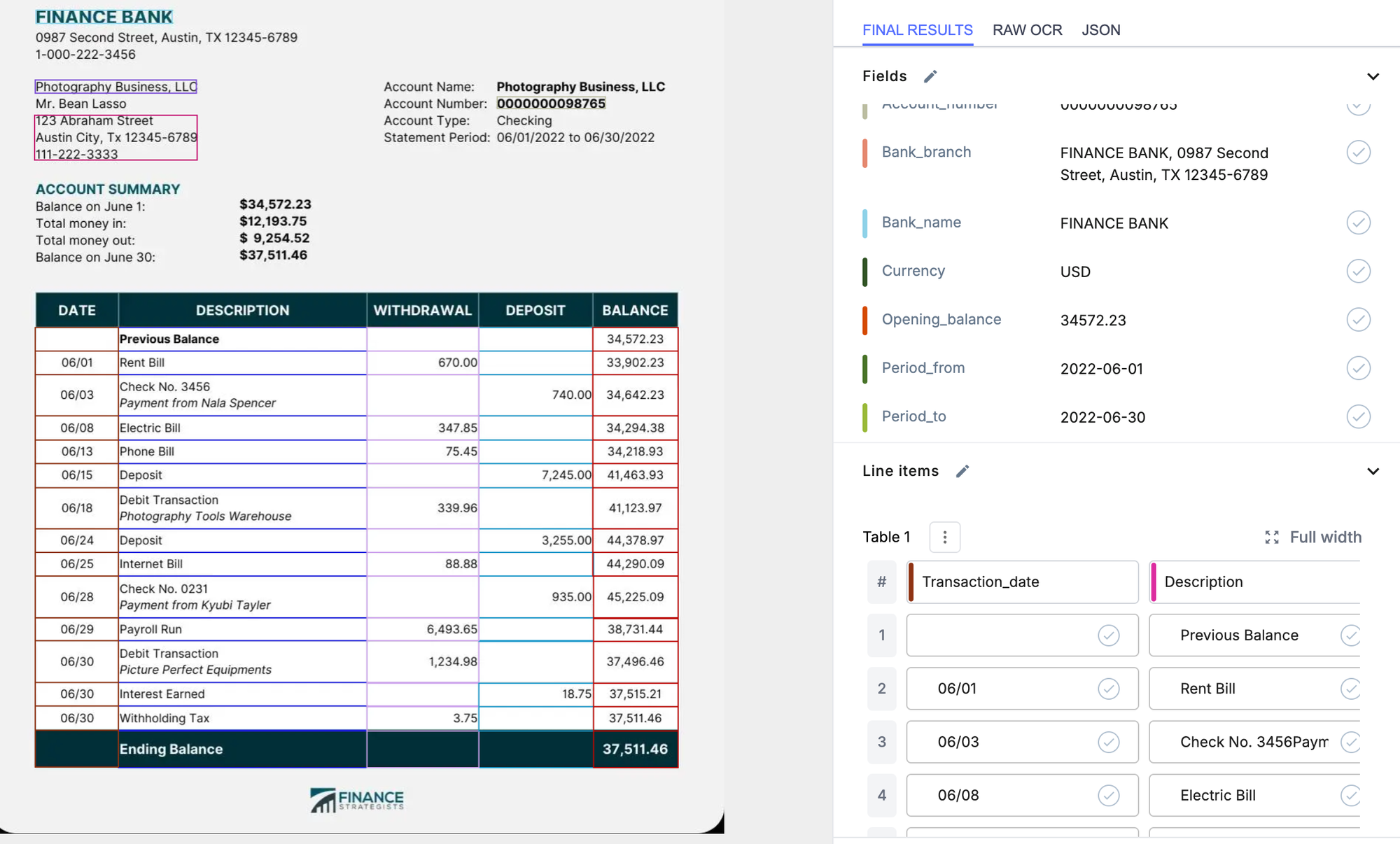

AI-powered Optical Character Recognition (OCR) instruments are indispensable in financial institution assertion processing, particularly when coping with unstructured codecs like PDFs, scanned paperwork, and handwritten textual content.

These instruments precisely extract important particulars resembling transaction quantities, dates, descriptions, and account numbers, no matter formatting complexity (tables, logos, and many others.).

AI-driven OCR is extra superior than conventional OCR. As an example, platforms like Nanonets can extract information from various codecs and languages seamlessly.

The AI engine reads and organizes information right into a structured format, serving to companies streamline reconciliation and monetary reporting. This degree of automation minimizes guide enter, reduces errors, and improves the general pace and accuracy of economic information administration.

💡

Key profit: Automating OCR processes can scale back guide reconciliation time by as much as 90%, permitting companies to give attention to strategic monetary selections.

Pure Language Processing (NLP)

Pure Language Processing (NLP) enhances financial institution assertion processing by decoding and categorizing transaction descriptions, permitting for higher transaction group.

In contrast to easy keyword-based categorization, NLP instruments perceive the context of transactions. For instance, NLP can differentiate between “AMZN*XXXX2” (an Amazon buy) and “TRANSFER TO SAVINGS” (a financial institution switch), precisely categorizing these transactions.

In follow, this enables for extra environment friendly monetary administration and correct categorization of bills, serving to companies keep correct budgets, establish spending patterns, and optimize sources.

💡

Key profit: NLP instruments can scale back the guide effort of categorizing transactions by as much as 80%, considerably bettering the accuracy of economic reporting.

Sample recognition and fraud detection utilizing ML

Machine Studying (ML) fashions analyze historic transaction information to detect fraud and acknowledge patterns in spending conduct. ML instruments repeatedly study from new transaction information, enhancing their means to flag anomalies that deviate from established patterns.

For instance, if a buyer sometimes makes small purchases from a well-recognized vendor however all of a sudden has a big transaction at an unknown vendor, the system would possibly flag it as uncommon.

ML-driven fraud detection techniques provide real-time monitoring and adaptive studying, enabling companies to guard their property from unauthorized transactions and establish potential monetary dangers early on.

💡

Key profit: ML fraud detection techniques enhance threat administration and scale back potential monetary losses by as much as 70%.

Open banking and API integrations

Environment friendly financial institution assertion processing depends closely on integrating monetary techniques resembling accounting software program, ERP platforms, and databases. With Open Banking and API integrations, companies can instantly join their financial institution assertion processing instruments with these techniques, making certain seamless information move.

Instruments like Nanonets combine with fashionable platforms like SAP, Xero, Sage, Netsuite, and QuickBooks, enabling computerized information extraction and direct import of key monetary data into accounting techniques. This eliminates information silos, reduces guide information entry, and ensures consistency throughout monetary experiences.

💡

Key profit: Companies can scale back operational prices by 30-40% by automating monetary information move between techniques via API integrations.

Automated reconciliation

AI enhances reconciliation by routinely evaluating information from financial institution statements with inside monetary data (e.g., basic ledgers). AI algorithms match transactions primarily based on particulars like dates, quantities, and payee names, flagging discrepancies for guide evaluation.

By automating reconciliation, companies save time and scale back the probability of human errors, making certain that their monetary statements are correct. This course of is vital for corporations with excessive transaction volumes, the place guide reconciliation is time-consuming and error-prone.

💡

Key profit: Automating reconciliation cuts reconciliation time by over 50%, whereas bettering accuracy and transparency in monetary reporting.

Superior analytics and predictive insights

With real-time processing, AI-enabled instruments can ship immediate insights into monetary information. Think about with the ability to spot traits as they occur—this implies you may price range extra precisely and put together for future bills with out the guesswork.

AI doesn’t simply crunch numbers; it could possibly additionally analyze buyer conduct via sentiment evaluation. By taking a look at transaction information and buyer interactions, AI helps uncover what prospects suppose and really feel. This perception means that you can tailor your companies to raised meet their wants.

💡

Key profit: AI analytics instruments improve monetary forecasting accuracy by as much as 25%, offering companies with deeper insights into their money move and monetary well being.

Contextual studying for steady enchancment

AI techniques evolve with contextual studying, adapting to the information they course of and the suggestions they obtain. For instance, if a transaction is misclassified (e.g., private expense versus enterprise expense), the person can right it, and the system will study from this correction, bettering future categorizations.

With extra information and constant suggestions, AI fashions turn into more and more correct over time, minimizing guide intervention. Companies implementing AI-powered options profit from techniques that regularly enhance, decreasing reliance on human oversight and enhancing general effectivity.

💡

Key profit: Over time, contextual studying can scale back guide changes by as much as 60%, making a extra autonomous monetary administration course of.

The way to arrange an automatic financial institution assertion processing workflow

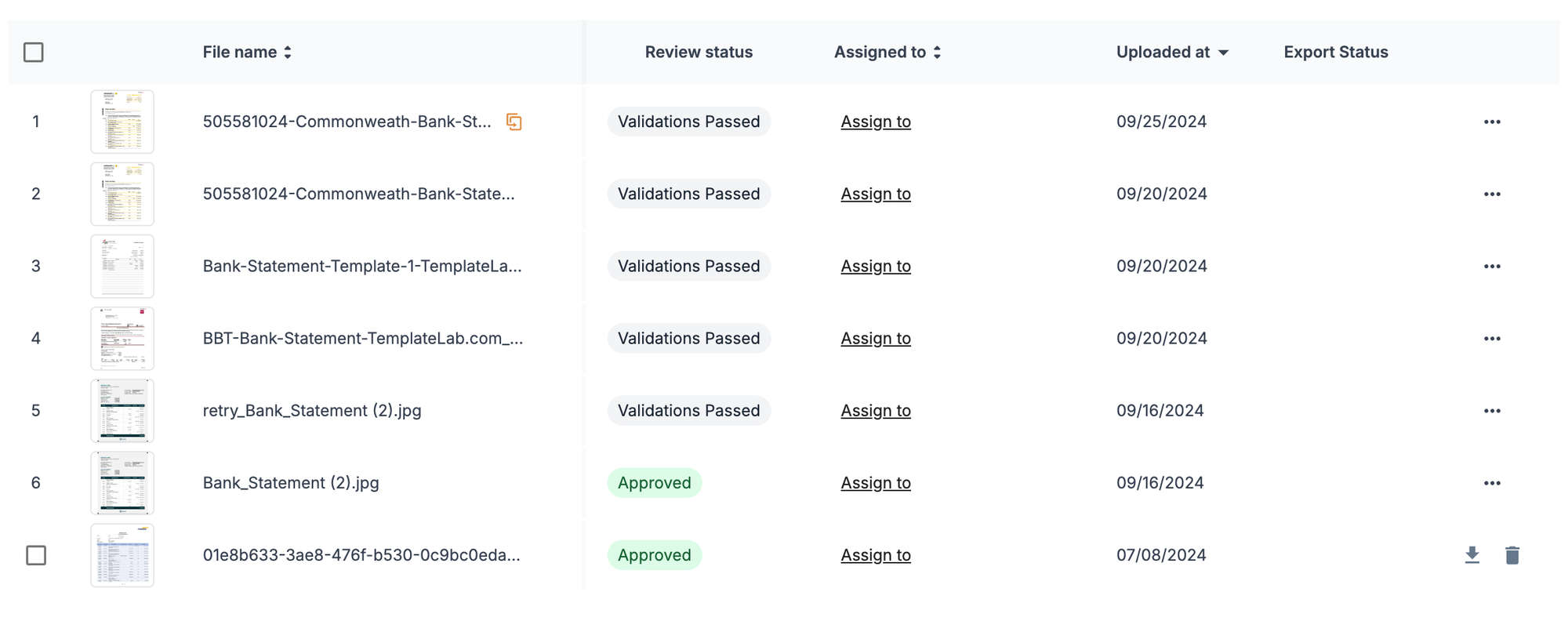

Right here’s a step-by-step information to establishing a financial institution assertion processing workflow utilizing Nanonets, an AI-powered information extraction device:

Import all financial institution statements

- Join on app.nanonets.com free of charge and choose Pre-built financial institution assertion extractor.

- Accumulate and import all of your financial institution statements from varied sources, resembling Dropbox, Google Drive, E mail, Zapier, and OneDrive.

You may also arrange an import block primarily based on particular triggers, such because the arrival of a brand new file in your cloud storage.

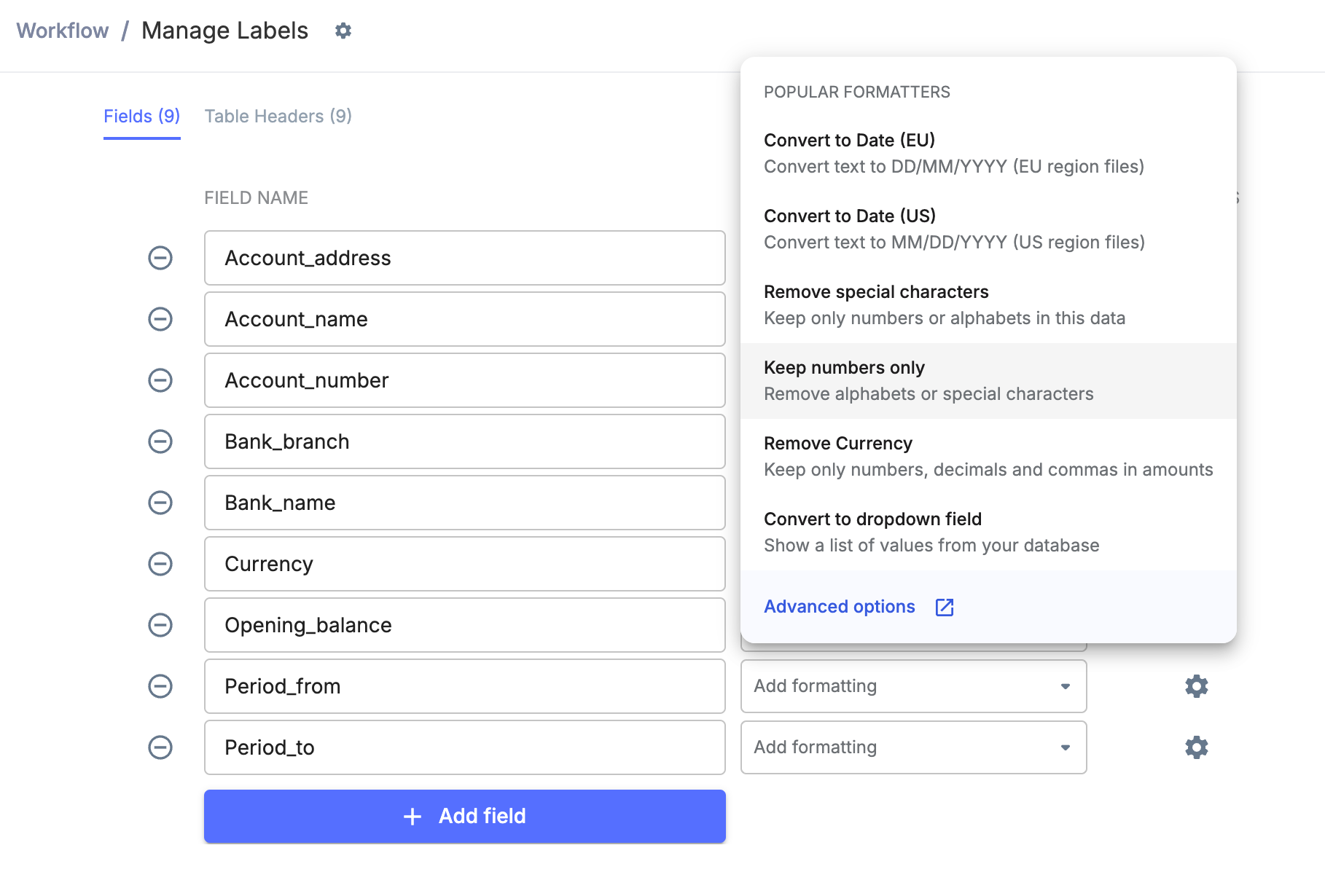

Customise information actions

- Arrange superior conditional information motion steps on your financial institution assertion processing, resembling –

- Evaluate the extracted information and customise your output by preserving solely the related fields.

- Take away pointless fields or add related missed fields to make sure a clear output.

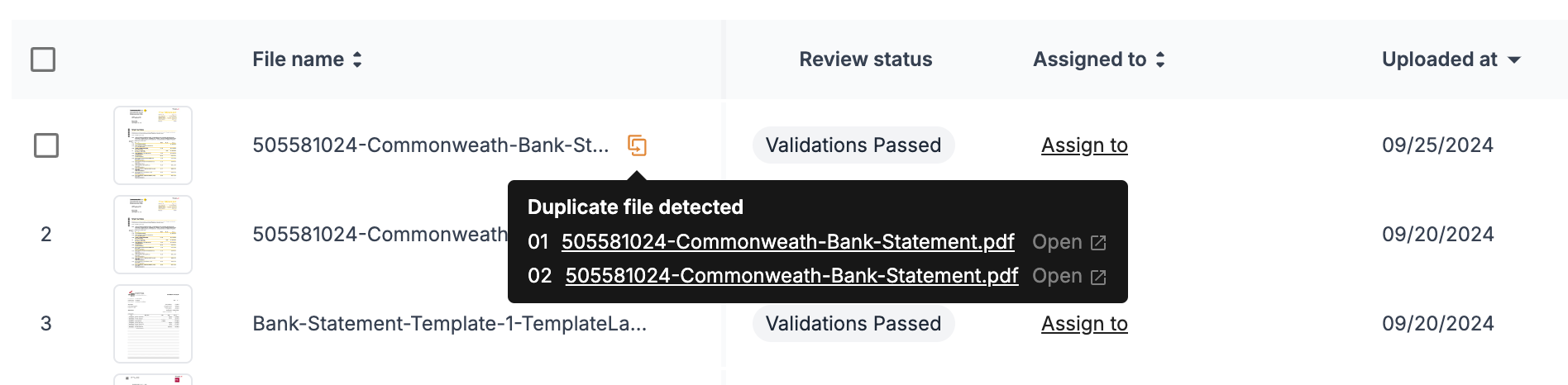

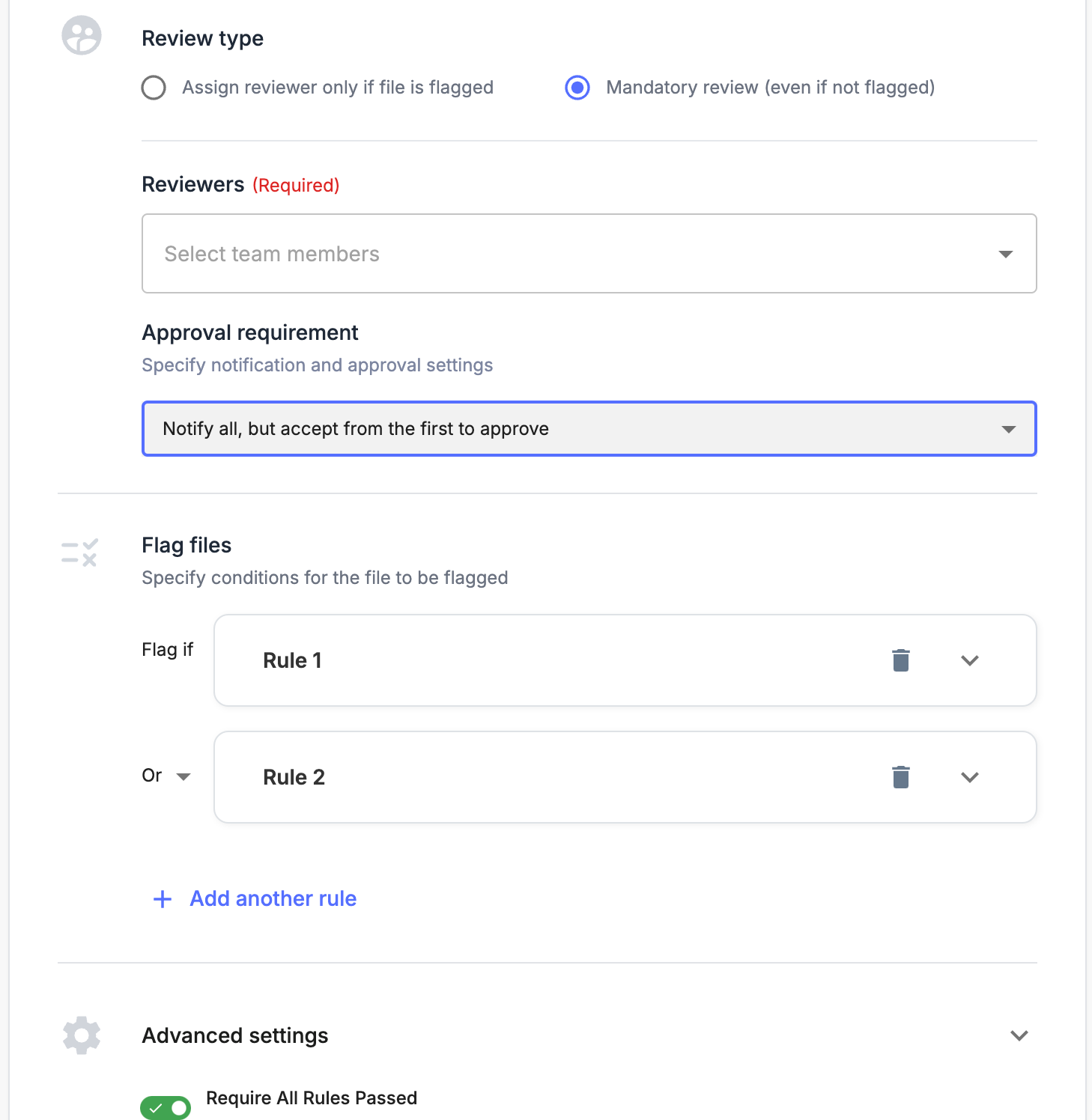

Arrange rule-based approvals

- Configure and arrange guidelines –

- Flag statements primarily based on fields like excessive transaction quantities or lacking account numbers

- Flag duplicate financial institution statements

- Organising approval course of with a number of reviewers – necessary and for flagged

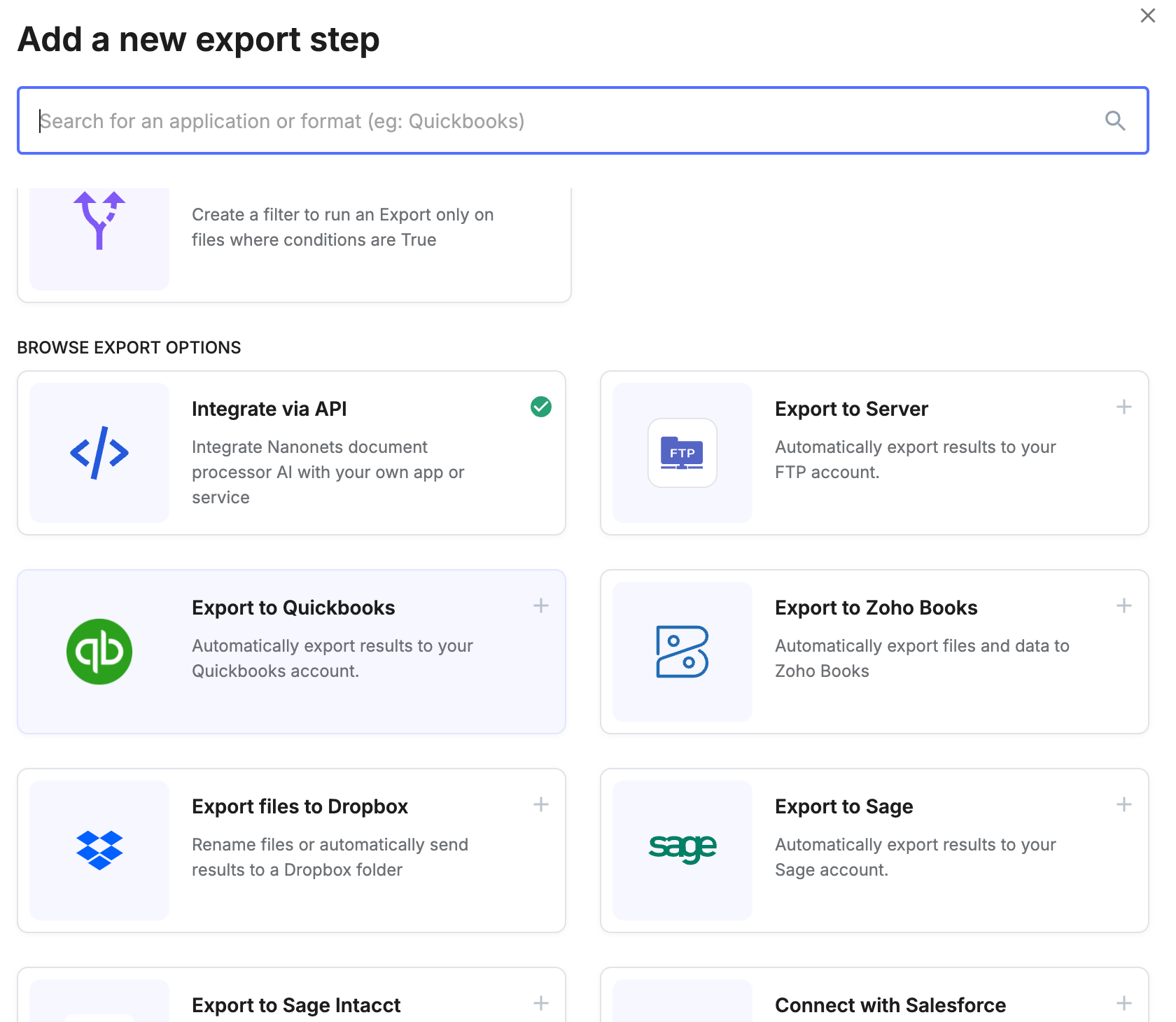

Export for processing

- You’ll be able to obtain or export the ultimate ends in totally different codecs, resembling CSV, XML, Google Sheets, or Excel, or create a shareable hyperlink to share with the group.

- For post-extraction processing, combine with third-party instruments utilizing built-in integrations –

- Combine with accounting and ERP software program like Quickbooks, Zoho Books, Sage, Xero, Netsuite

- Database export choices, resembling PostgreSQL, MySQL, and MSSQL.

- Export to customized Python scripts for specialised processing

- Or combine with any device by way of API

Greatest practices for automated financial institution assertion processing

To make sure profitable automated financial institution assertion processing, take into account the next finest practices:

Integration with current monetary techniques

Create a digital ecosystem by integrating your automated financial institution assertion processing instruments with current monetary techniques.

This integration ought to transcend easy information switch; purpose for clever interactions the place processed assertion information routinely triggers related actions in your accounting software program, resembling updating money move forecasts or flagging potential discrepancies for evaluation.

Information safety and compliance

Defending delicate monetary information must be a precedence. Encryption ensures information safety each when saved and when transmitted.

Limiting entry to solely licensed personnel, implementing Multi-Issue Authentication (MFA), and using information masking strategies scale back the danger of knowledge breaches.

To keep up information privateness and person belief, at all times keep compliant with laws like GDPR, HIPAA, and SOC.

Third-party vendor administration

When working with exterior distributors, vet their safety protocols and compliance measures to make sure they meet trade requirements.

Set up authorized agreements that define how information must be dealt with and conduct common assessments to confirm that distributors adhere to your safety and operational necessities.

Clear communication is crucial to take care of sturdy relationships and handle any points promptly.

Monitor and evaluation

Frequently auditing information high quality is significant for sustaining accuracy and compliance.

Use suggestions loops to refine AI algorithms and enhance processing accuracy. Maintain detailed logs of transactions and information modifications to make sure accountability and compliance with inside and exterior requirements.

Structured workflows, together with approval processes for information exports, can additional improve transparency and effectivity.

System upkeep and updates

Undertake a DevOps strategy to system upkeep, enabling steady updates and enhancements with out disrupting every day operations.

Implement an AI-powered documentation system that routinely updates SOPs and manuals primarily based on system modifications and person interactions.

Create a information graph of your processing system. This may permit employees to visualise interconnections between totally different elements and shortly establish the impression of any modifications.