[ad_1]

Seven Finest Practices for Efficient Account Reconciliations

From Mesopotamia’s rudimentary ledgers monitoring livestock and crops to the second-century BCE Indian treatise “Arthashastra“, accounting has been a cornerstone of financial administration in any civilized society. Right now, amidst burgeoning world commerce and quickly increasing enterprise operations, the significance of accounting operations endures. On the core of accounts administration lies account reconciliation, the method of evaluating varied monetary paperwork to make sure accuracy and accountability.

On this article, we will discover the fundamentals of accounts reconciliation, discussing its significance, processes, and finest practices.

What’s Account Reconciliation

Account reconciliation is a vital course of in monetary administration that ensures accuracy and consistency in monetary operations. It supplies vital insights into an organization’s monetary well being and efficiency. There are numerous sorts of account reconciliation, every providing distinct advantages: Financial institution Account Reconciliation aligns money balances, Accounts Payable Reconciliation matches vendor quantities, Accounts Receivable Reconciliation confirms buyer funds, Stock Reconciliation validates stock valuation, Payroll Reconciliation ensures correct worker wage recording, Credit score Card Reconciliation verifies transactions and Fastened Asset Reconciliation tracks asset actions and values, aiding in monetary planning and administration.

Want for Account Reconciliation

Account Reconciliation ensures the accuracy and integrity of monetary information by figuring out discrepancies and errors, thus fostering belief amongst stakeholders and facilitating knowledgeable decision-making. It aids within the detection and prevention of fraud, safeguarding in opposition to monetary losses and reputational injury. Efficient Account Reconciliation promotes compliance with regulatory necessities and accounting requirements, mitigating the chance of penalties and authorized penalties. By offering a transparent and clear image of a corporation’s monetary well being, account reconciliation empowers companies to optimize useful resource allocation, streamline operations, and drive sustainable progress.

The way to conduct Account Reconciliation

The method of Account Reconciliation entails a number of key steps to make sure accuracy and completeness:

- Collect Paperwork: Acquire monetary information like financial institution statements, invoices, and ledger entries.

- Determine Accounts: Decide accounts needing reconciliation, together with financial institution, payables, receivables, stock, payroll, and belongings.

- Examine Data: Match inside information with exterior sources like financial institution statements and invoices.

- Examine Discrepancies: Analyze variations, hint transactions and rectify errors.

- Make Changes: Document lacking transactions and proper errors for correct balances.

- Doc Course of: Keep detailed information of steps, findings, and changes.

- Assessment and Approve: Validate reconciled accounts for accuracy, searching for approval from stakeholders.

- Implement Controls: Introduce measures to stop future discrepancies and guarantee accuracy.

Frequent Challenges and Discrepancies within the Account Reconciliation Course of

The Account Reconciliation course of comes with its personal set of challenges and potential discrepancies. Listed here are some widespread ones:

- Information Entry Errors: Human errors throughout knowledge entry can result in discrepancies between inside information and exterior sources. Transposing numbers, omitting transactions, or recording incorrect quantities can distort the accuracy of reconciled accounts.

- Timing Variations: Variations in timing between when transactions are recorded internally and once they seem in exterior statements, equivalent to financial institution statements, can create challenges in reconciliation. For instance, checks could also be issued however not but cashed, resulting in timing discrepancies.

- Financial institution Errors: Banks could make errors in processing transactions, equivalent to posting incorrect quantities or duplicating entries. Figuring out and rectifying these errors will be time-consuming and require coordination with the financial institution.

- Unrecorded Transactions: Failure to report all transactions, equivalent to excellent checks or pending deposits, can result in discrepancies in reconciled accounts. It is important to make sure that all transactions are precisely recorded and accounted for.

- Fraudulent Actions: Fraudulent actions, equivalent to unauthorized transactions or embezzlement, can go undetected throughout the reconciliation course of, resulting in important monetary losses for the corporate.

- Complicated Transactions: Complicated transactions, equivalent to international foreign money exchanges or mergers and acquisitions, can pose challenges in reconciliation as a result of their intricate nature and a number of accounting implications.

- System Errors: Errors or glitches in accounting software program or programs may end up in discrepancies in reconciled accounts. Common upkeep and updates are essential to mitigate the chance of system-related errors.

- Lack of Documentation: Inadequate documentation or lacking supporting paperwork for transactions can hinder the reconciliation course of, making it tough to confirm the accuracy of recorded transactions.

- Incomplete Data: Incomplete or outdated information can complicate the reconciliation course of, as it could be difficult to hint transactions or confirm balances with out full data.

- Employees Turnover: Excessive employees turnover or insufficient coaching of accounting personnel can affect the standard and consistency of the reconciliation course of, growing the probability of errors and discrepancies.

Finest Practices in Account Reconciliation

Listed here are some finest practices in account reconciliation that assist in sustaining correct monetary information and making certain the integrity of the monetary reporting course of:

- Common Reconciliation Schedule: Set up a daily schedule for conducting account reconciliations, equivalent to month-to-month or quarterly. Constant reconciliation helps determine discrepancies promptly and prevents the buildup of errors over time. For instance, an organization might reconcile its financial institution accounts on the finish of every month to make sure accuracy in money balances.

- Segregation of Duties: Implement segregation of duties to stop errors and fraud. Assign completely different people to carry out reconciliations, approve transactions, and report accounting entries. This separation of duties helps guarantee checks and balances within the reconciliation course of. As an example, one individual might reconcile financial institution statements whereas one other evaluations and approves the reconciled balances.

- Documentation and Document-Preserving: Keep thorough documentation of the reconciliation course of, together with supporting paperwork, audit trails, and explanations for any changes made. Correct documentation supplies a transparent audit path and facilitates transparency and accountability. For instance, hold copies of financial institution statements, invoices, and receipts as proof of reconciled transactions.

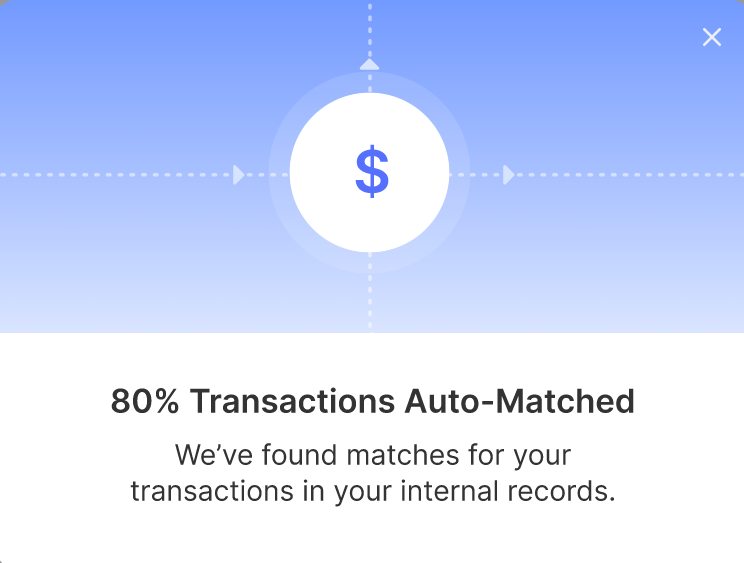

- Use of Reconciliation Instruments: Make the most of accounting software program and reconciliation instruments to streamline the reconciliation course of and reduce guide errors. Automated reconciliation software program can match transactions, determine discrepancies, and generate stories effectively. As an example, reconciliation software program can mechanically examine financial institution transactions with accounting information and spotlight any discrepancies for additional investigation.

- Assessment and Approval Procedures: Set up evaluation and approval procedures for reconciled accounts to make sure accuracy and completeness. Assign duty to designated personnel for reviewing reconciled balances and approving changes earlier than finalizing the reconciliation. For instance, a monetary supervisor might evaluation and approve financial institution reconciliations earlier than they’re submitted for audit.

- Steady Monitoring and Evaluation: Constantly monitor account balances and traits to determine anomalies or irregularities that will require additional investigation. Common evaluation of reconciled accounts helps detect errors, fraud, or inefficiencies early on, permitting for well timed corrective motion. As an example, carry out pattern evaluation on accounts receivable balances to determine overdue funds or potential dangerous money owed.

- Coaching and Training: Present ongoing coaching and schooling to accounting employees on reconciliation finest practices, accounting requirements, and regulatory necessities. Make sure that employees are outfitted with the mandatory expertise and information to carry out correct and efficient reconciliations. For instance, conduct common coaching periods on reconciliation procedures, software program utilization, and fraud detection methods.

By implementing these finest practices, companies can improve the accuracy, reliability, and effectivity of the account reconciliation course of, in the end enhancing monetary reporting and decision-making capabilities.

Automate the Reconciliation Course of with Nanonets

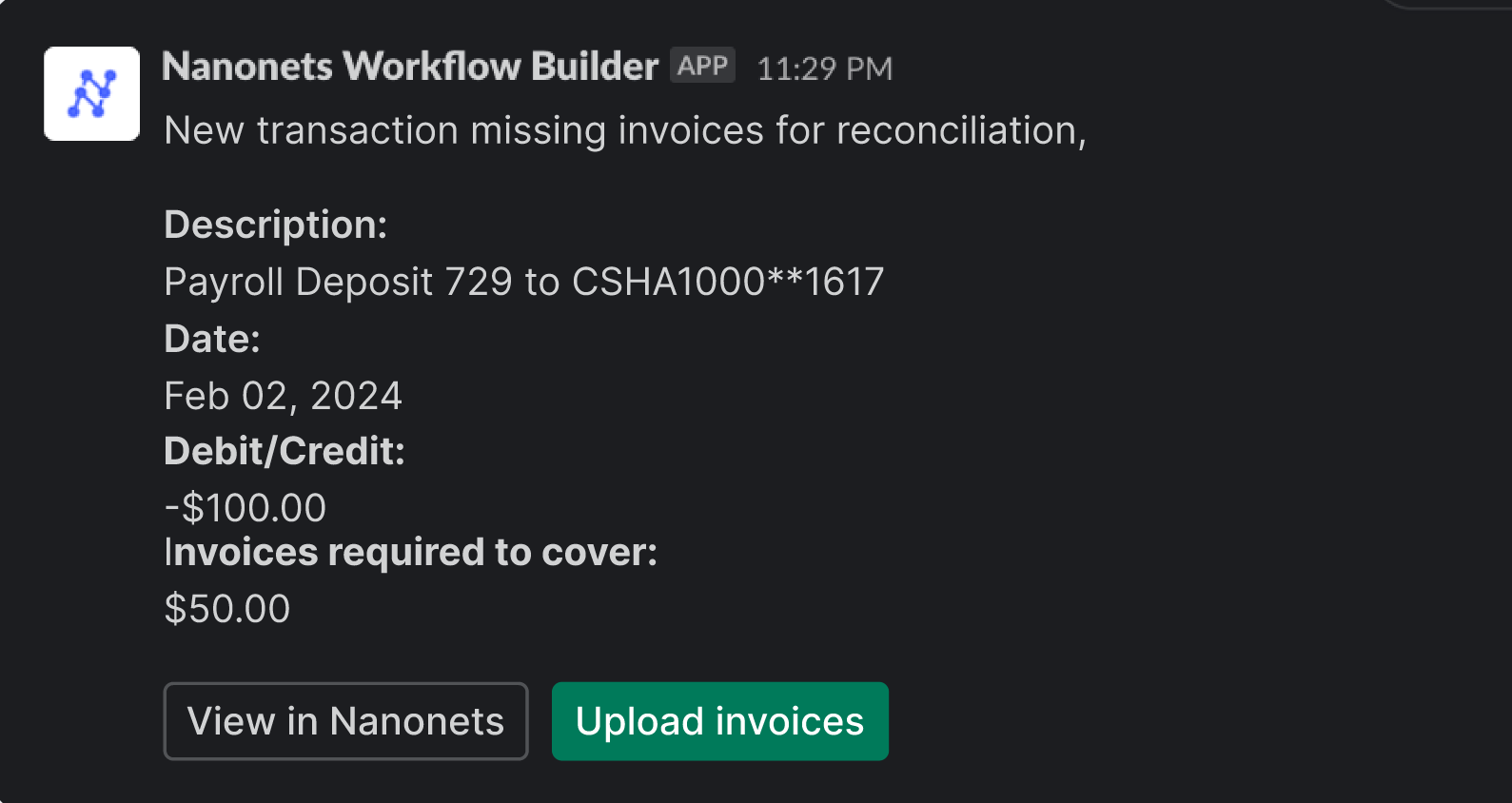

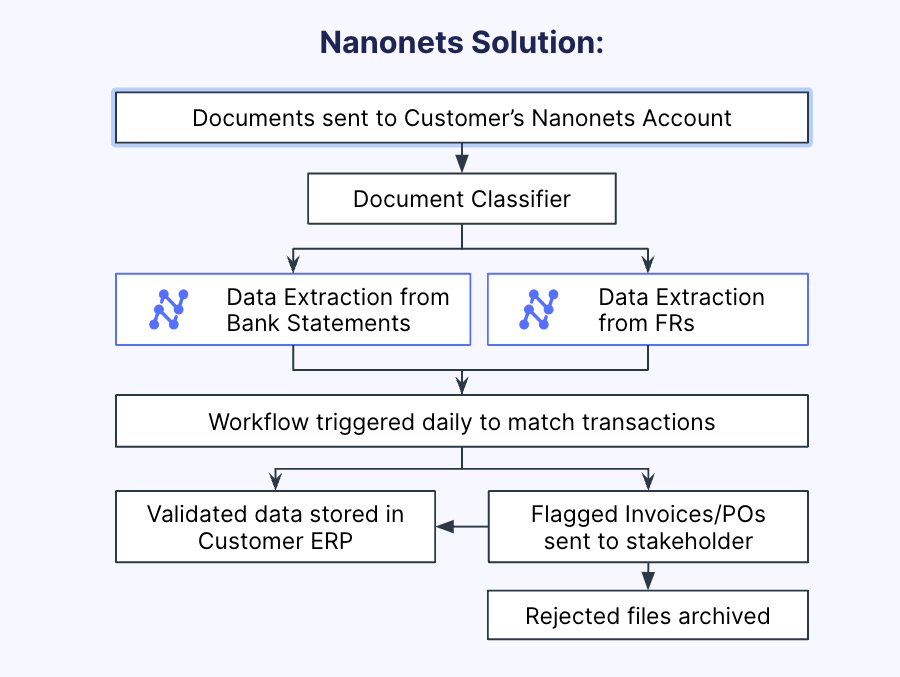

Relating to automating reconciliation duties, Nanonets stands out as one of many premier software program options available on the market. Nanonets gives a number of options that make it well-suited for automating account reconciliation processes:

- Customizable Fashions: Nanonets supplies instruments to create customized OCRmodels tailor-made to particular reconciliation wants. This customization permits organizations to coach fashions primarily based on their distinctive knowledge units and reconciliation necessities, making certain optimum efficiency and accuracy.

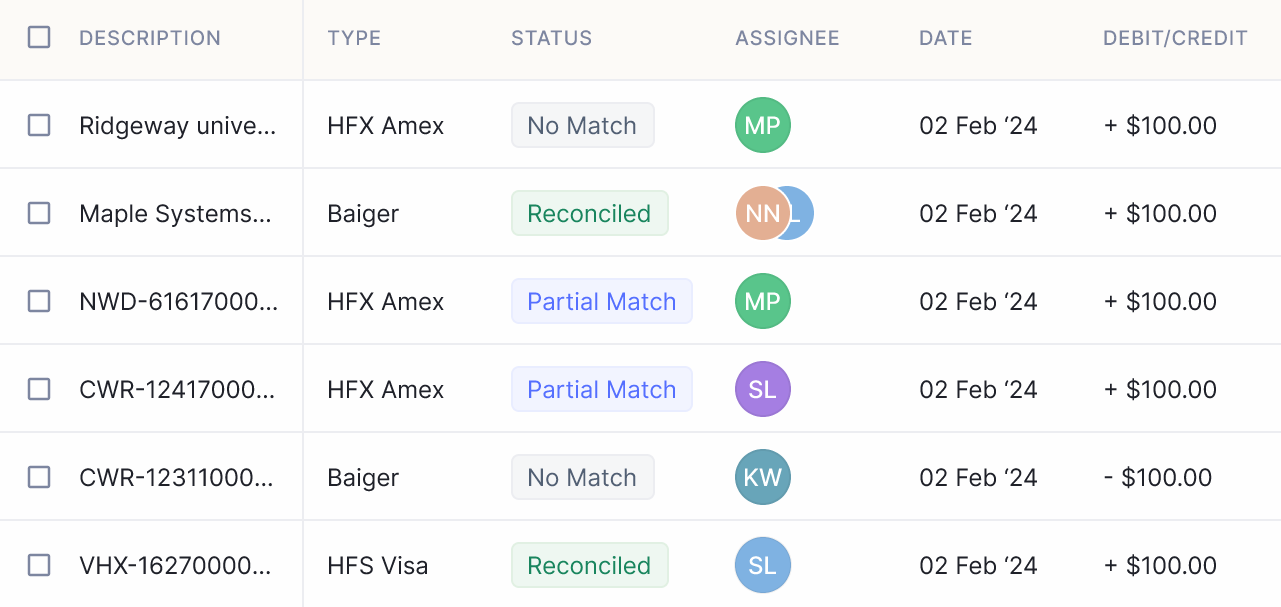

- Information Extraction Capabilities: Nanonets consists of options for extracting knowledge from varied sources, together with scanned paperwork, PDFs, pictures, and structured knowledge codecs like CSV or Excel. This flexibility in knowledge extraction permits organizations to reconcile transactions from numerous sources, equivalent to invoices, receipts, financial institution statements, and buy orders.

- API Integration and Workflow Automation: Nanonets gives APIs and integration capabilities that permit seamless integration with current programs and workflows. Organizations can incorporate Nanonets’ reconciliation performance into their current accounting or ERP programs, streamlining the reconciliation course of and eliminating guide knowledge entry duties.

- Actual-time Reconciliation: With Nanonets, organizations can carry out real-time reconciliation, permitting for quick detection and determination of discrepancies as transactions happen. This real-time functionality enhances monetary visibility and management, enabling organizations to make knowledgeable selections primarily based on up-to-date monetary knowledge.

- Accuracy and Confidence Scoring: Nanonets supplies confidence scoring mechanisms that assess the accuracy of reconciliation outcomes and supply insights into the reliability of match outcomes. This function permits customers to prioritize and evaluation reconciliation outcomes primarily based on confidence ranges, making certain high-quality outcomes and minimizing the chance of errors.

Take Away

Efficient account reconciliation is important for monetary accuracy and integrity. Implementing finest practices like common evaluations and segregation of duties mitigates errors and ensures compliance. But, guide processes are time-consuming and error-prone. Software program options like Nanonets use superior algorithms to automate the account reconciliation course of, thereby empowering finance groups to give attention to strategic initiatives, enhancing effectivity and transparency.

[ad_2]