Have to reconcile financial institution statements however bored with doing it manually? In search of a financial institution assertion extraction software program? Look no additional as a result of we’ve got you lined.

Now we have researched and listed the ten greatest financial institution assertion extraction software program available in the market for 2024. Not simply that, you’ll discover the professionals, cons and the pricing particulars for every, detailed within the article beneath.

Whether or not you’re a tax marketing consultant, a freelancer or a enterprise seeking to automate your financial institution assertion reconciliation workflow, our curated record will provide help to discover the precise software program for your self. However, earlier than we dive in, allow us to take a fast have a look at a comparative overview of the instruments summarised beneath:

| Software program | Execs | Cons | Pricing |

|---|---|---|---|

| Nanonets | Excessive accuracy Finish-to-end automation Safe and scalable |

Pricey Potential studying curve AI could overfit |

Pay-as-you-go: $0.3/web page Professional: $999/mo Enterprise: Customized |

| FreshBooks | Person-friendly Integrates nicely with accounting options Appropriate for small companies |

Restricted OCR Not specialised for financial institution assertion extraction Primary reconciliation |

Lite: $19/mo Plus: $33/mo Premium: $60/mo |

| ProperSoft | Helps numerous codecs Price-efficient lifetime license Offline capabilities |

Sophisticated UI Restricted accuracy Costly lifetime license |

Month-to-month: $19.99 Yearly: $119.99 Lifetime: $199.99 |

| DextPrepare | Handles advanced codecs Scalable Strong safety |

Preliminary setup required Greater pricing for small companies |

Necessities: $229.99/mo Superior: $247.23/mo Customized |

| Infrrd | Excessive accuracy Handles massive volumes Customizable Scalable |

Preliminary setup time Challenges with non-standard paperwork Ongoing prices |

Primary: Customized Enterprise: Customized Enterprise Plus: Customized |

| Docuclipper | Optimized for financial institution assertion extraction Handles advanced paperwork Integrates with instruments |

Specialised for extraction Requires setup for customized codecs |

Starter: $39/mo Skilled: $74/mo Enterprise: $159/mo |

| Parseur | Simple to make use of Helps numerous codecs Versatile template creation |

Setup time Template limitations Restricted accuracy for advanced layouts |

Micro: $39/mo Mini: $69/mo Starter: $99/mo Premium: $199/mo |

| Parsio | Versatile Handles each digital and scanned paperwork Integrates with programs |

Guide setup wanted Accuracy is dependent upon parsing guidelines Restricted monetary optimization |

Free: 100 credit/mo Starter: $49/mo Progress: $149/mo Enterprise: $249/mo |

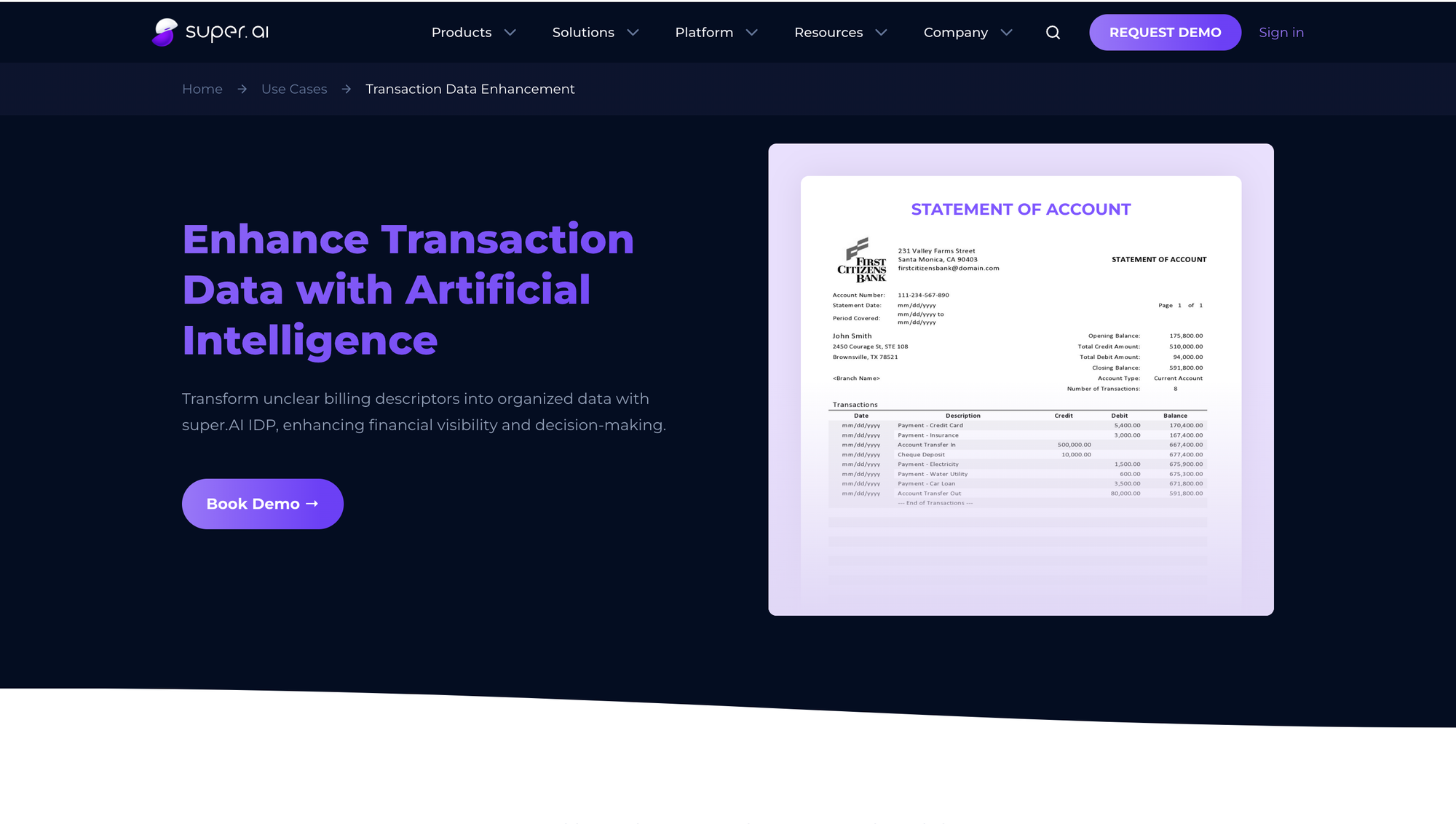

| Tremendous.AI | Customizable Excessive accuracy Scalable Human verification |

Important setup Studying curve Greater pricing |

Customized pricing primarily based on volumes and customization |

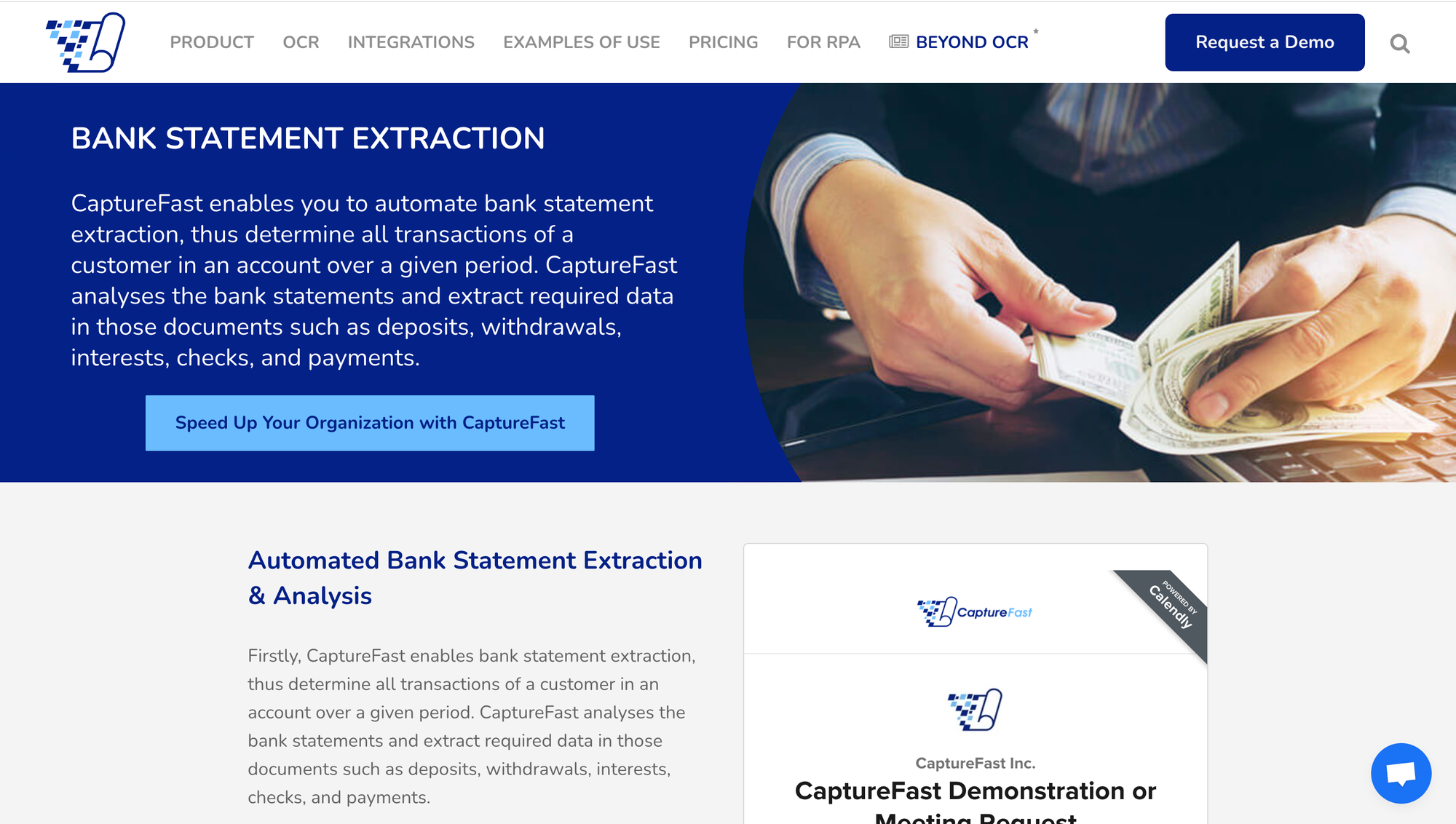

| CaptureFast | Versatile Excessive accuracy Scalable Integrates with monetary workflows |

Setup and coaching wanted Not bank-statement targeted Studying curve |

Free: 100 pages/mo Primary: $69/mo Skilled: $299/mo Enterprise: $799/mo |

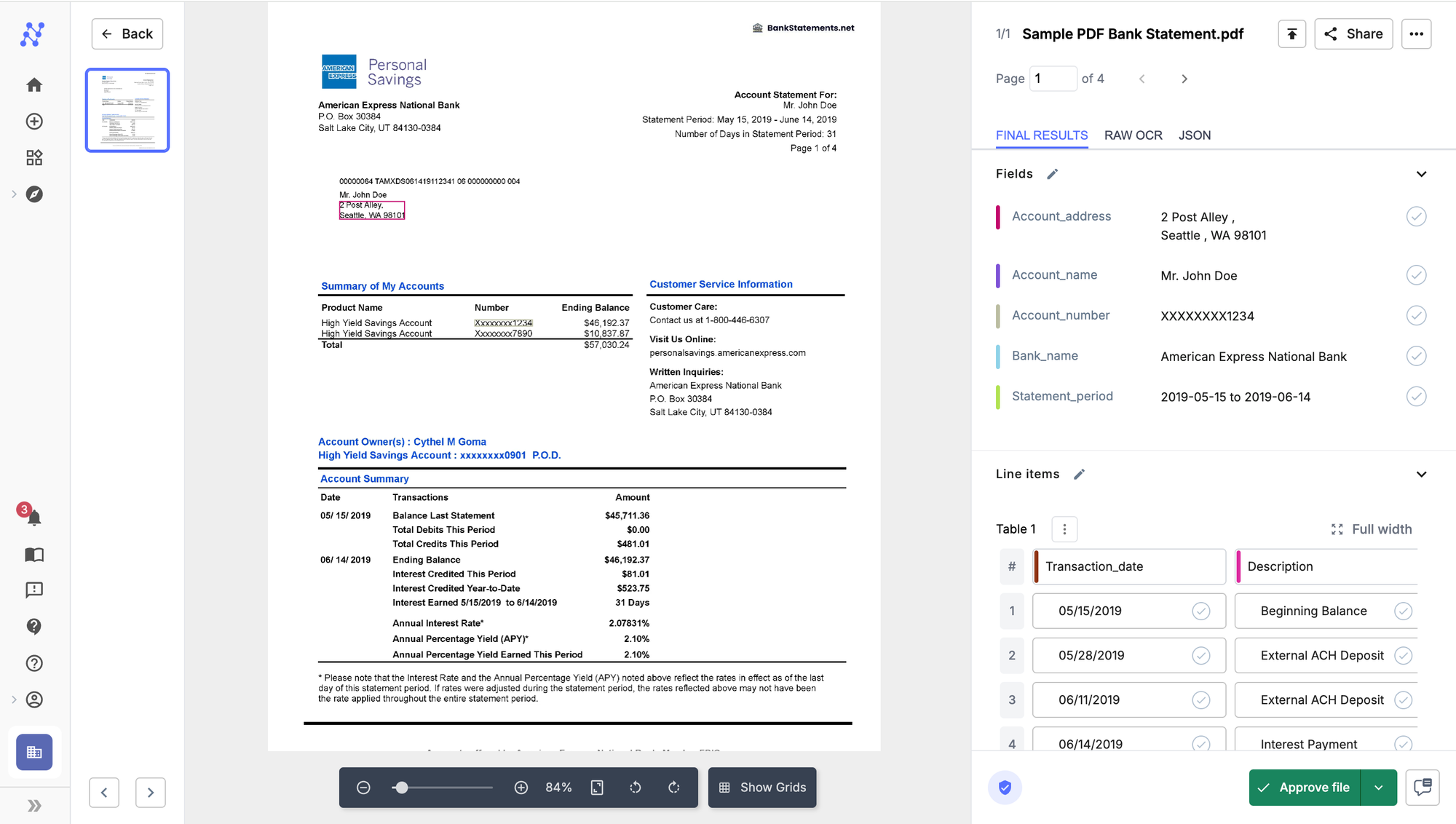

1. Nanonets

That includes on the high of the record and the very best financial institution assertion reconciliation software program in 2024, is Nanonets. Powered by generative-AI, Nanonets presents a pre-trained financial institution assertion extractor in addition to a zero-training extractor that may be arrange for financial institution statements in seconds.

It could actually deal with financial institution statements with sophisticated layouts (suppose, multi-line gadgets, nested tables, and many others.) all completely different from each other, in addition to assist 110+ languages.

It has a built-in “knowledge actions” centre which presents superior formatting capabilities, like, including/eradicating fields, fuzzy-matching fields towards exterior databases, automated categorisation, and many others. It additionally has approval workflows built-in that may flag financial institution statements with lacking fields or incorrectly extracted knowledge factors.

With its one-click integration and mapping functionality, you’ll be able to arrange automated export out of your financial institution statements straight into exterior software program, be it accounting software program like Quickbooks, Sage, Xero, and many others. or ERPs, like Salesforce. Mix that with automated import and you’ve got a whole automated workflow, end-to-end.

Key Options:

- Can reconcile financial institution statements towards different monetary paperwork like, Invoices, Receipts, Buy Orders, and many others.

- Automated import from e-mail, cloud storages, APIs, or databases

- Automated export into exterior software program, be it accounting software program like Xero, Sage, Quickbooks, Salesforce, ERPs like Salesforce or databases like MsSQL, Amazon S3, and many others.

- “LLM Actions” part to robotically categorise transactions

- Constructed-in validation workflows

✅

1. Can automate end-to-end financial institution assertion reconciliation processes

2. Simple-to-use, no-code consumer interface

3. Gives excessive accuracy for traditional paperwork like financial institution statements

4. Can deal with financial institution statements from a number of languages, having sophisticated layouts

5. Can deal with massive volumes in a safe method. We’re SoC licensed, HIPAA and GDPR compliant.

6. Supply straightforward to grasp API endpoints

❗

1. If not correctly managed, the AI fashions may turn out to be too specialised to a selected format, affecting efficiency on barely completely different layouts.

2. The price could also be greater in comparison with easier options, doubtlessly making it much less accessible for small companies or low-volume customers.

3. Regardless of the no-code interface, customers should face a studying curve in optimising the system for greatest outcomes.

Pricing:

Nanonets caters to people, freelancers, consultants and companies of all sizes with their pricing plans. They provide a one-time trial the place you’ll be able to course of as much as 500 pages without spending a dime. Past that, the pricing plans are tiered.

- Pay-as-you-go plan: Charged at USD 0.3/web page for knowledge extraction and USD 0.05/step for a workflow step.

- Professional plan: Charged at USD 999/month for extracting knowledge from as much as 10,000 pages.

- Enterprise plan: Customized-priced primarily based on variety of pages wanted, customisation steps, integrations, and many others.

2. Freshbooks

FreshBooks is a well-liked accounting software program, but it surely additionally presents options for financial institution assertion processing and knowledge extraction, though it isn’t its core focus. The platform permits customers to attach their financial institution accounts and bank cards straight, robotically importing transactions for simpler reconciliation.

FreshBooks can categorise transactions primarily based on predefined guidelines, lowering guide knowledge entry. Whereas it would not supply superior OCR for scanning bodily financial institution statements, it does present a user-friendly interface for reviewing and categorising imported transactions.

The software program’s means to generate monetary experiences primarily based on financial institution knowledge may be useful for small companies and freelancers. Nonetheless, for advanced various codecs or high-volume financial institution assertion processing, FreshBooks might not be as strong as a number of different modern-day IDP options.

Key options:

1. Computerized financial institution transaction import

2. Rule-based transaction categorisation

3. Primary reconciliation instruments

4. Monetary report era

✅

1. Person-friendly interface

2. Integrates financial institution knowledge with different accounting options

3. Appropriate for small companies and freelancers

❗

1. Restricted OCR capabilities for bodily or scanned financial institution statements

2. Is probably not in a position deal with advanced or high-volume assertion processing nicely

3. Not specialised for financial institution assertion extraction, can deal with financial institution assertion reconciliation however not different workflows

Pricing:

FreshBooks presents three customary pricing plans:

- Lite plan ranging from $19/month

- Plus plan ranging from $33/month

- Premium plan ranging from $60/month

Nonetheless, these costs are for the general accounting software program, not particularly for financial institution assertion extraction options. All plans embrace financial institution connections and transaction imports, however the variety of billable purchasers and extra options range by plan. It is value noting that FreshBooks sometimes presents reductions, particularly for annual subscriptions.

3. ParseSoft

This software program focuses on making your transaction information or financial institution statements suitable to be imported into your accounting software program, format-wise. In consequence, it presents nice flexibility in relation to the various codecs out there for conversion.

It presents options for dealing with a number of statements directly. You possibly can mix them or hold them separate. You possibly can rename these statements primarily based on predefined guidelines and assign classes to them. It additionally permits enhancing your financial institution statements throughout conversion.

Key Options:

- Helps codecs like, PDFs, Photographs, Textual content, Excel, CSV, in addition to accounting software program file codecs, like OFX, QFX, QBO, QIF/QMTF, MT940/STA.

- Gives integrations with Quickbooks, Quicken, Sage, Xero, Wave, Excel, Google Sheets amongst others.

- Gives highly effective renaming and categorizing options.

- Permits enhancing financial institution statements throughout conversion.

- Has a number of date and time formatting choices.

✅

1. Helps a number of codecs for imports and exports

2. Gives offline licenses, which means it may be put in regionally on units lowering internet-dependency.

3. Gives a lifetime license the place you pay as soon as for entry to the software program, which makes it cost-efficient

❗

1. Sophisticated and out of date consumer interface which lowers ease of use

2. Restricted accuracy which, given the delicate nature of financial institution statements, can result in monetary penalties

3. Lifetime licenses may be costly for some customers

Pricing:

Propersoft presents tiered pricing, in month-to-month, annual and lifelong license codecs, the small print to that are as follows:

- Month-to-month License: It prices $19.99 monthly and consists of entry for limitless pages/statements. It helps all converters and apps and presents free updates.

- Yearly License: It prices $119.99 per 12 months. and consists of entry for limitless pages/statements. It helps all converters and apps and presents free updates.

- Lifetime License: It prices $199.99 as a one-time cost. It consists of entry for limitless pages/statements, for all converters, codecs, apps, and presents updates each 12 months.

4. DextPrepare

DextPrepare is a complete monetary administration instrument designed to simplify expense administration, particularly for accountants and small to medium-sized companies.

One in every of its standout options is its financial institution assertion extraction functionality, which can be utilized to robotically seize and categorise knowledge from financial institution statements with excessive accuracy.

Though this isn’t a spotlight function for them, this performance streamlines the financial institution assertion reconciliation course of and reduces guide knowledge entry. The software program helps integration with numerous accounting platforms, enhancing workflow effectivity.

Key Options:

- Automated knowledge seize and categorisation from financial institution statements.

- Handles receipts, invoices, and payments alongside financial institution statements.

- Seamless integration with main accounting software program like QuickBooks, Xero, and Sage.

- Gives a cell utility to seize paperwork and handle bills on the go.

- Handles transactions in numerous currencies.

✅

Execs:1. Handles advanced and different financial institution assertion formats2. Scalable for high-volume processing3. Steady studying and enchancment of extraction accuracy4. Strong knowledge safety measures

❗

Cons:1. Might require preliminary setup and coaching for optimum performance2. Pricing could also be greater in comparison with primary accounting software program and may be vital for small companies and startups

Pricing:

DextPrepare is primarily focused at Accounting and bookkeeping corporations. It presents two plans that may be billed month-to-month or yearly. Annual plans may also help you save as much as 13% on subscription prices. Beneath are the month-to-month charges:

- Dext Necessities: USD 229.99 monthly. Lets you have upto 10 purchasers, with limitless customers every. You get entry to all options, excluding premium options, like, PDF AutoSplit, or knowledge insights.

- Dext Superior: USD 247.23 monthly. Lets you have upto 10 purchasers, with limitless customers every with entry to whole feature-suite.

Customers additionally get the choice to construct a customized plan for themselves.

5. Infrrd

Infrrd, is an AI-powered Clever Doc Processing (IDP), that provides options for knowledge extraction, together with pre-trained extractors for financial institution assertion processing. It leverages synthetic intelligence and machine studying to automate the extraction and categorisation of economic knowledge from numerous financial institution assertion codecs. It’s designed to deal with advanced, unstructured knowledge, remodeling it into actionable insights.

With the pre-trained financial institution assertion extractor, their system can extract transaction particulars, account info, and different related monetary knowledge, considerably lowering guide knowledge entry and processing time.

Key options:

1. Automated extraction of transaction particulars (dates, descriptions, quantities)

2. Clever categorisation of transactions

3. Help for a number of financial institution assertion codecs and layouts

4. Integration capabilities with monetary software program and ERPs

5. Customisable extraction guidelines to fulfill particular enterprise wants

✅

1. Excessive accuracy charges in knowledge extraction, lowering guide errors

2. Capability to course of massive volumes of statements rapidly

3. Important time financial savings in comparison with guide processing

4. Handles advanced and different assertion codecs

5. Customisable to particular enterprise necessities

❗

1. Might require preliminary setup and configuration time

2. Potential challenges with very non-standard or poorly scanned paperwork

3. Ongoing prices for software program licenses or API utilization

4. Might require human verification for ambiguous knowledge factors

Pricing:

Infrrd usually presents customized pricing primarily based on particular shopper wants and processing volumes.

They’ve 3 customary tiers:

- Primary: Customized-priced. Gives options like superior pre-processing, automated auditing and flagging of inaccurate extractions, straightforward API integrations, and many others.

- Enterprise: Customized-priced. Gives all primary options and as well as, presents devoted assist and performance-based pricing choices.

- Enterprise Plus: Customized-priced. Ensures 100% accuracy and different options, like, accelerated processing, customized dashboards, and many others.

6. Docuclipper

Docuclipper, designed particularly for doc knowledge extraction, performs nicely in financial institution assertion processing. Not like basic accounting software program, Docuclipper focuses on automating the extraction of transactions, balances, and different related monetary info from each digital and scanned financial institution statements of various codecs. It’s dependable for high-volume and complicated extractions from financial institution statements. Its means to export knowledge into common accounting software program or spreadsheets simplifies the workflow for companies.

Key options:

1. Superior OCR know-how for digital and scanned financial institution statements

2. Computerized extraction of transactions, balances, and different related monetary knowledge factors from various codecs

3. Export choices to accounting software program or spreadsheets

✅

1. Optimised for financial institution assertion extraction

2. Handles advanced and high-volume paperwork

3. Integrates with accounting instruments and knowledge codecs

Execs:

❗

1. Specialised for doc extraction, not a full financial institution assertion reconciliation resolution

2. Might require setup for some customized codecs

Pricing:

Docuclipper presents tiered pricing primarily based on the variety of pages processed, making it scalable for companies of various sizes.

- Starter: $39/month for 200 pages monthly.

- Skilled: $74/month for 500 pages monthly.

- Enterprise: $159/month for 2000 pages monthly.

- Enterprise: Customized pricing for a customized variety of pages monthly.

7. Parseur

Parseur is a flexible doc parsing instrument that may extract knowledge from financial institution statements with its template-based strategy. It additionally has an AI-powered customized extractor that may be skilled to seize transaction particulars, balances, and account info from each digital and scanned financial institution statements.

It could actually robotically extract and categorize the info, which may then be exported to numerous accounting platforms or spreadsheets. Customers can ship of their financial institution statements by way of e-mail or add them manually.

Parseur’s power lies in its flexibility and ease of use for non-technical customers, making it appropriate for companies with various doc processing wants. The accuracy for financial institution statements, particularly of various codecs is restricted, as are the out there choices for importing and exporting your financial institution statements and extracted knowledge respectively.

Key Options:

- OCR-powered knowledge extraction for financial institution statements

- Customisable templates for various codecs

- Simple export to accounting instruments, CSV, and spreadsheets

✅

1. Simple to arrange and use, even for non-technical customers

2. Helps all kinds of financial institution assertion codecs

3. Versatile template creation for particular wants

❗

1. Template creation could require preliminary setup time

2. Have to create templates for each completely different format limiting scalability

3. Not as correct for advanced layouts, like nested tables, multi-line descriptions, and many others.

4. Restricted import and export choices

Pricing:

Parseur presents two forms of plans in relation to pricing. They provide a free plan that enables customers to course of 20 paperwork monthly. Paid plans are as follows:

- Micro: USD 39/month for as much as 100 pages.

- Mini: USD 69/month for as much as 300 pages.

- Starter: USD 99/month for as much as 1,000 pages.

- Premium: USD 199/month for as much as 3,000 pages.

- Professional: USD 299/month for as much as 10,000 pages.

For volumes greater than 10,000 pages monthly, the pricing turns into customized.

8. Parsio

Parsio presents automated knowledge extraction capabilities for numerous doc sorts, together with financial institution statements. Whereas not completely targeted on financial institution assertion processing, Parsio’s platform may be configured to extract knowledge from financial institution statements utilizing customized parsing guidelines. Customers can arrange templates to determine and extract particular fields corresponding to transaction dates, descriptions, quantities, and balances from recurring assertion codecs.

The system utilises OCR know-how to course of each digital PDFs and scanned paperwork. As soon as extracted, the info may be exported to numerous codecs like CSV or JSON, or built-in with different programs by way of API. Parsio’s strategy to financial institution assertion extraction is versatile however could require extra guide setup in comparison with specialised banking extraction instruments.

Key options:

1. Customized parsing guidelines for knowledge extraction

2. OCR capabilities for scanned paperwork

3. Template creation for recurring doc codecs

4. A number of export choices (CSV, JSON, and many others.)

5. API integration for automated workflows

6. Help for numerous doc sorts past financial institution statements

✅

1. Versatile system adaptable to completely different assertion codecs

2. One-time setup for recurring assertion layouts

3. Handles each digital and scanned paperwork

4. Integrates with different enterprise programs by way of API

❗

1. Might require extra guide configuration than specialised financial institution assertion instruments

2. Accuracy is dependent upon the standard of user-created parsing guidelines

3. Not particularly optimised for monetary knowledge extraction

4. Might lack superior options like automated transaction categorisation

Pricing:

Parsio presents a tiered pricing mannequin:

1. Free plan: As much as 100 credit/month

2. Starter plan: $49/month for as much as 1,000 credit

3. Progress plan: $149/month for as much as 5,000 credit

4. Marketing strategy: $249/month for as much as 12,000 credit

A single credit score means that you can parse knowledge from a single e-mail/picture/doc. All paid plans embrace options like OCR, API entry, and integrations, with greater tiers providing extra pages monthly and extra options like precedence assist.

9. Tremendous.AI

Tremendous.AI presents a versatile AI-powered doc processing platform that may be tailored for financial institution assertion extraction, although it isn’t completely targeted on this process. The platform leverages machine studying and pc imaginative and prescient applied sciences to automate knowledge extraction from numerous doc sorts, together with financial institution statements.

Customers can prepare customized fashions to recognise and extract particular fields like transaction dates, descriptions, quantities, and balances from completely different assertion codecs. Tremendous.AI’s system can deal with each digital PDFs and scanned paperwork, utilizing OCR when mandatory. The extracted knowledge may be validated towards predefined guidelines and exported in numerous codecs or built-in with different programs by way of API.

Key options:

1. Customized AI mannequin coaching for particular doc layouts

2. OCR capabilities for dealing with scanned paperwork

3. Versatile knowledge extraction guidelines

4. Human-in-the-loop choice for high quality assurance

5. API integration for automated workflows

6. Help for numerous doc sorts past financial institution statements

7. Information validation and cleaning instruments

✅

1. Extremely customisable to suit particular financial institution assertion codecs

2. Combines AI with human verification for improved accuracy

3. Scalable for high-volume doc processing

4. Adaptable to numerous doc sorts and layouts

❗

1. Might require vital preliminary setup and coaching for optimum efficiency

2. Not a specialised resolution for financial institution assertion processing

3. Potential studying curve for non-technical customers

4. Pricing could also be greater in comparison with extra targeted options

Pricing:

Tremendous.AI doesn’t publicly disclose detailed pricing info. Their pricing mannequin is often primarily based on the next components:

1. Annual Volumes of paperwork to be processed

2. Desired knowledge fields for extraction

- Customisation or coaching necessities

10. CaptureFast

CaptureFast presents doc processing capabilities that embrace financial institution assertion extraction as a part of its broader clever doc processing platform. The system makes use of superior OCR and machine studying algorithms to automate knowledge extraction from numerous financial institution assertion codecs.

CaptureFast can determine and extract key monetary knowledge corresponding to transaction dates, descriptions, quantities, and account balances from each digital and scanned financial institution statements. The platform permits for the creation of customized templates to deal with completely different assertion layouts from numerous monetary establishments.

As soon as extracted, the info may be validated, categorised, and exported to numerous monetary programs or codecs for additional evaluation and reporting.

Key options:

1. Automated knowledge extraction from a number of financial institution assertion codecs

2. Customized template creation for various assertion layouts

3. OCR capabilities for processing scanned paperwork

4. Information validation and categorization instruments

5. Integration with monetary software program and ERP programs

6. Help for different monetary paperwork past financial institution statements

7. Cloud-based resolution with safe knowledge dealing with

✅

1. Versatile system adaptable to numerous financial institution assertion codecs

2. Excessive accuracy charges for knowledge extraction

3. Scalable for companies of various sizes

4. Reduces guide knowledge entry and related errors

5. Integrates nicely with present monetary workflows

❗

1. Might require preliminary setup and coaching for optimum efficiency

2. Not completely targeted on financial institution assertion processing

3. Potential studying curve for advanced customizations

4. Pricing could also be greater for small companies with low quantity wants

Pricing:

CaptureFast presents a tiered pricing plan:

- Free: Customers get 100 pages/month freed from value.

- Primary: USD 69/month for 1,000 pages monthly.

- Skilled: USD 299/month for 10,000 pages monthly.

- Enterprise: USD 799/month for 30,000 pages monthly.

- Customized: Customized-priced primarily based on a mixture of options and quantity of pages.

- Enterprise: Customized-priced for organisations that need on-premise deployment.

The record of options included in every plan varies.

How to decide on the precise financial institution assertion OCR software program for your self?

Selecting the best financial institution assertion extraction software program may be essential for managing funds effectively. Here is a step-by-step information that can assist you make an knowledgeable resolution:

1. Determine Your Wants

Figuring out and documenting your wants is the essential first step when deciding on a software program. It could actually range primarily based in your function. As an illustration, in case you are a bookkeeping agency or a contract tax marketing consultant, your wants would range from that of an enterprise seeking to automate their financial institution assertion reconciliation course of. This may, in flip be completely different from an insurance coverage startup seeking to automate their buyer onboarding/KYC course of.

Listed below are a number of components to think about.

- Quantity: Estimate what number of financial institution statements you’ll want to course of usually. Excessive-volume customers might have extra strong options.

- Information Accuracy: Take into account how essential accuracy is in your wants. If exact knowledge seize is crucial, search for software program with superior OCR (Optical Character Recognition) know-how.

- Integration Necessities: Decide in the event you want the software program to combine along with your present accounting or monetary administration programs, corresponding to QuickBooks, Xero, or Sage.

2. Shortlist a number of distributors and consider them

That is the place we are available. With our curated record, you’ll discover a financial institution assertion extraction software program for each want. Consult with the record above and shortlist a number of distributors who you suppose may also help you automate your course of, particular to your wants. Listed below are a number of components to think about:

- Accuracy: Is the seller specialised in financial institution assertion extraction? What’s the accuracy they supply? Can they assist a number of languages and codecs?

- Setup Course of: How lengthy after buy are you able to begin utilizing the software program? Are the options you’re in search of ready-to-use or require customisation? Are you able to make adjustments simply? Is it safe?

- Person Expertise: Is it consumer pleasant? Can the non-technical group members use the software program comfortably?

- Pricing: What’s the common market value for the feature-suite I’m in search of? What’s the billing cycle (Month-to-month/Quarterly/Yearly)? Does it match my funds?

Most of those software program have a free trial interval or choices to request a customized demo. Take a look at it totally earlier than making a purchase order. You can too attain out to some friends to assemble suggestions or have a look at assessment platforms on-line.

3. Make an Knowledgeable Choice

After you have all the data you want, it’s time to make an knowledgeable resolution.

- Weigh Execs and Cons: Examine the software program choices you’ve thought-about, specializing in how nicely they meet your wants.

- Lengthy-Time period Issues: Take into consideration how the software program will meet your wants sooner or later as your corporation grows or your doc quantity will increase.

By following these steps, you’ll be able to choose financial institution assertion extraction software program that not solely matches your present wants but additionally helps your long-term monetary administration targets.